8 Best US High-Risk Merchant Service Providers in 2026

As banks and card networks continue to tighten underwriting rules and chargeback thresholds, more businesses than ever are being labeled “high-risk.”

When you end up in that category, opening — and keeping — a merchant account with a standard bank or a payment aggregator like PayPal or Stripe becomes extremely difficult. Even if you are approved, account freezes, sudden fund holds, or full shutdowns are often just a matter of time.

To operate reliably, you need to work with merchant service providers that specialize in high-risk industries. These providers understand elevated risk profiles, work with flexible acquiring banks, and build systems designed to keep your account stable long term.

This article aims to provide a practical comparison of the most reputable high-risk merchant service providers in the United States. You will learn what each provider offers, where they excel, and what limitations to consider — based on real-world use cases and merchant feedback.

Things to look for in a high-risk merchant services provider

Nearly every high-risk merchant account provider promises fast approvals and low rates. In reality, those claims are impossible to verify upfront — and often depend on your business model, processing history, and risk profile.

Instead of focusing on marketing promises, evaluate providers based on concrete factors you can confirm (at least to some degree) before applying:

- Specialization in high-risk verticals: High-risk processing is not a one-size-fits-all approach. You want a provider with some experience in your specific industry because underwriting standards and risk tolerance vary by vertical.

- Simple online merchant application: A streamlined, online application process saves time and reduces back-and-forth. The best providers clearly explain what documents are required and guide you through underwriting without unnecessary friction.

- Risk management tools: Look for built-in tools such as AI-supported fraud detection, chargeback monitoring, and transaction risk analysis. These features help you stay within card network thresholds and reduce the chances of reserves, holds, or account termination.

- Transparency in fees, reserves, and terms: High-risk accounts often involve higher fees or rolling reserves, but nothing should come as a surprise. Reputable providers explain pricing structures, reserve requirements, and contract terms upfront — in plain language.

- Access to multiple payment methods: Your provider should support the payment methods your customers expect, including credit and debit cards, eCheck, ACH, MOTO, digital wallets, and alternative payments like Apple Pay & Google Pay.

- Support for a variety of business models: Subscription billing, recurring payments, high-ticket sales, and international transactions all carry different risk profiles. Choose a provider that explicitly supports your business model.

- Experienced and responsive customer support: When issues arise — and they will — you need fast access to expert support. Look for dedicated account managers and US-based support teams.

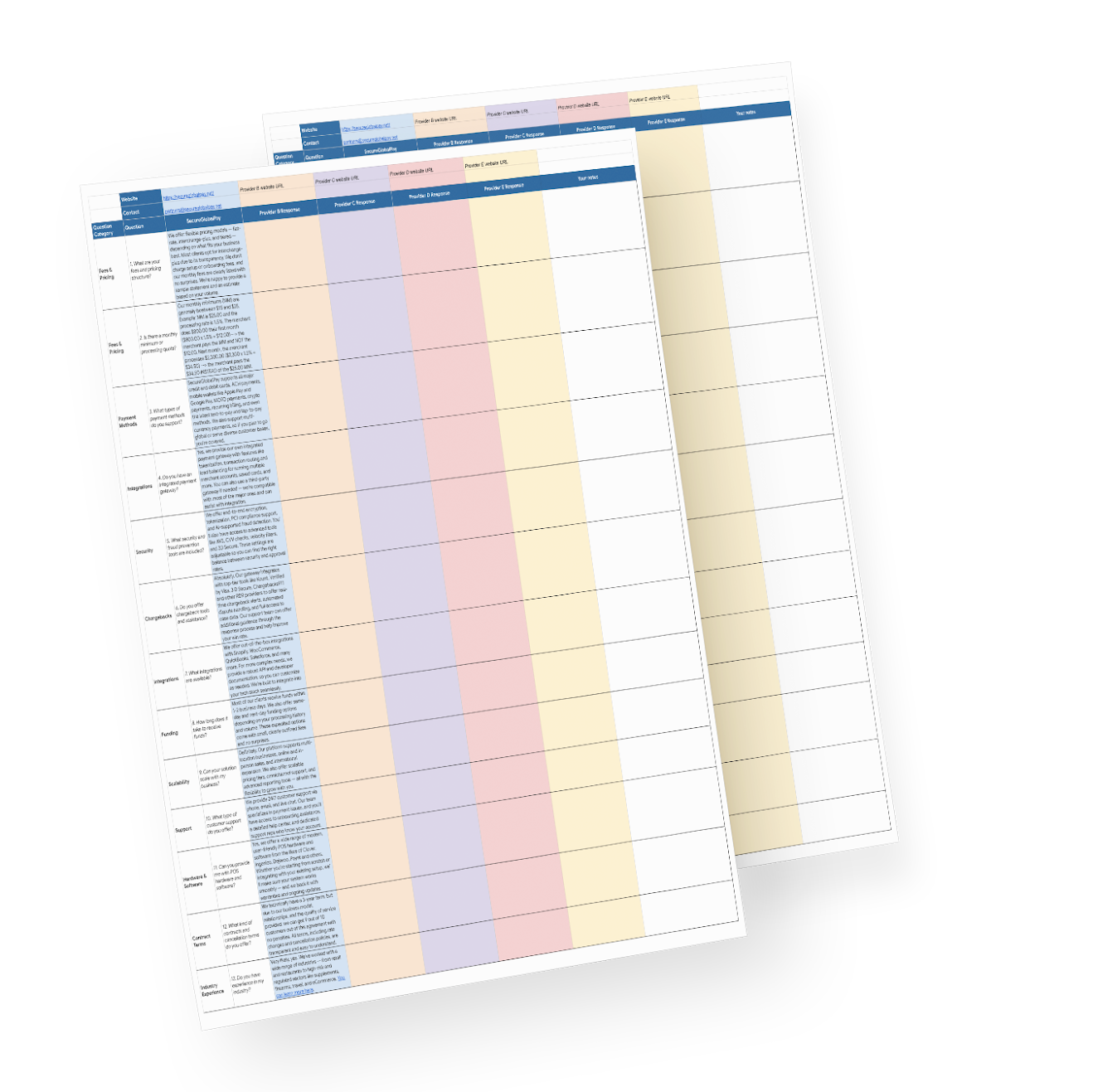

Free Template for Comparing Merchant Service Providers

Our Google Sheet template arms you with 13 critical questions you should ask each provider to catch red flags and cut through the sales talk — with SecureGlobalPay’s answers already filled in for comparison.

When evaluating providers, prioritize transparency and realistic expectations. Be cautious of companies that guarantee instant approval, zero reserves, or unusually low rates. In high-risk processing, overpromising inevitably leads to underdelivering.

Best high-risk merchant service providers in the USA

One of the big challenges in comparing high-risk merchant service providers is that the solutions they offer and the advantages they advertise are extremely similar.

We highly recommend using this comparison and looking at other user reviews to shortlist a few providers — then jump on a call with each of their representatives before making a final decision.

1. SecureGlobalPay

SecureGlobalPay provides comprehensive payment processing solutions for high-risk and high-volume merchants in the US, Canada, the EU, and the UK. They work with both first-time merchants and brands that have experienced shutdowns with traditional processors and payment aggregators like Stripe or PayPal.

Services and technology offered:

- High-risk merchant accounts: Accounts are structured to match your industry, volume, and risk profile so you can process consistently without unexpected shutdowns

- Integrated payment gateway: A modern, PCI-compliant payment gateway that handles transactions, security, and reporting in one system. Plus, it offers hundreds of integrations with shopping carts, ecommerce platforms, CRMs, billing software, and other solutions.

- Numerous payment methods: Debit & credit card processing, online payment processing, recurring billing, mobile & wireless payments, ACH & echeck, digital wallets, Apple Pay and Google Pay, MOTO payments — whichever way your clients want to pay, SecurGlobalPay can set it up.

- Fraud and chargeback protections: The integrated payment gateway offers AI-fraud detection, dispute visibility, chargeback threshold alerts, and integrations with third-party chargeback management tools.

- Dedicated account management: You get a direct point of contact for onboarding, support, gateway setup, and ongoing monitoring.

What SecureGlobalPay does well:

- Deep experience with high-risk and hard-to-place merchants, including complex business models.

- All-in-one payment solution that includes both domestic and offshore merchant accounts, a robust payment gateway with support for multiple MID, Level 2 & 3 processing, zero-fee programs, and proactive risk management.

- Clear communication during underwriting, including realistic limits and expectations.

- Doesn’t treat small merchants as just another number in a spreadsheet.

- Hands-on customer support from experienced account managers who know and anticipate processing challenges high-risk businesses could encounter.

What real merchants say about SecureGlobalPay high-risk merchant services:

- “Top notch broker. Worked my high risk application the fastest I’ve ever had one worked. Got a placement in just over a week. Smooth, professional operation.” — C.R. W. [Firearms Industry]

- “Our business grew 10X in a month and our merchant provider was holding back all of our funds. Roland and his team at SecureGlobalPay got us up and running again, saved us money, and began working with us to improve our invoicing and billing processes. If you have a fast-growing business or a high-risk account, this team stands head and shoulders above the rest (and I’ve worked with many others). A+++ rating.” — G. B. [Ecommerce]

- “SecureGlobalPay has gone beyond meeting my expectations when it comes to how quickly my questions were answered, the level of professionalism this company has exuded, and the all-around care they have provided. You will be in great hands if you choose to work with them — especially if you are a high-risk merchant or have a merchant situation that requires a little more expertise.” — L. B. [Adult Industry]

- “From the start, they took the time to understand our unique payment processing needs and provided insightful solutions tailored to our business. Their support was crucial in navigating the technical setup seamlessly, ensuring everything was in place for our operations.” — A. J. [Travel Industry]

2. PaymentCloud

PaymentCloud is a strong option for high-risk merchants who want fast approvals without sacrificing account stability. It works especially well for ecommerce businesses, subscription brands, and merchants that have been declined by traditional processors.

Services and technology offered:

- High-risk merchant accounts: PaymentCloud specializes in placing merchants with acquiring banks that already support high-risk verticals, improving approval odds.

- Third-party payment gateway: Merchants can choose from multiple leading gateways, allowing you to keep existing integrations or select a setup that best fits your checkout flow.

- Wide range of payment methods: Credit and debit cards, ACH, and alternative payment options are supported to meet customer expectations and reduce reliance on a single payment rail.

- Chargeback and fraud tools: PaymentCloud integrates with chargeback monitoring and fraud prevention solutions to help merchants stay below card network thresholds.

What PaymentCloud does well:

- High approval rates for hard-to-place and previously declined merchants.

- Flexible gateway options that work with existing e-commerce stacks.

- Strong educational support during the application process.

Potential limitations and considerations:

- Advanced fraud and chargeback tools often require third-party services.

- Some merchants complain of unexpected fees that were not communicated during sign-up.

- Several merchants report that their set up process can be overly lengthy and confusing.

- They have a fairly large team, so the speed and quality of onboarding and support vary; they can be excellent or poor, depending on the customer representative you get.

3. Soar Payments

Soar Payments is a great option for high-risk merchants who want hands-on support and clear guidance through underwriting. It is a good fit for businesses in regulated or reputation-sensitive industries that need help navigating bank requirements.

Services and technology offered:

- High-risk merchant accounts: Soar Payments works with a wide network of domestic and offshore banks to place merchants that have complex risk profiles or prior processing issues.

- Third-party payment gateway: Merchants can choose from several PCI-compliant gateways, making it easier to integrate with existing ecommerce platforms or billing systems.

- Chargeback and risk monitoring support: Soar Payments helps merchants understand chargeback drivers and connects them with tools to monitor dispute ratios and fraud trends.

- Dedicated merchant support: Each account includes personalized guidance during setup and continued access to support as your processing volume grows.

What Soar Payments does well:

- Strong experience with regulated and difficult-to-place industries.

- They advertise industry minimum pricing, but that is very hard to confirm upfront.

- Supportive, consultative onboarding process.

Potential limitations and considerations:

- Some risk management tools have to rely on third-party integrations.

- According to their FAQ page, there are many high-risk industries that SoarPayments doesn’t work with. These include Adult, Debt Collection, Kratom, Marijuana, Pharmaceuticals, and more.

- They do not offer offshore merchant accounts and do not work with non-USA businesses.

- They do not provide as many payment methods as some other competitors on this list.

4. EMB (eMerchantBroker)

EMB (eMerchantBroker) is best known for working with very high-risk and high-volume merchants, including businesses that have been declined multiple times or have complex processing needs. It is a better fit for established companies that need to scale volume, rather than those starting out.

Services and technology offered:

- High-risk merchant accounts: EMB specializes in placing merchants with domestic and offshore acquiring banks that support high volumes, elevated chargeback risk, and complex verticals.

- Multiple payment gateways: Merchants can choose their proprietary payment gateway or a third-party gateway, allowing EMB to tailor setups based on volume, fraud exposure, and geographic reach.

- Broad payment method support: Credit and debit cards, recurring billing, ACH, and many alternative payment methods are available depending on the acquiring bank.

- Chargeback management support: EMB provides a chargeback protection service to help dispute unauthorized or fraudulent charges and support to get your money back.

- Dedicated account representatives: Merchants work with assigned representatives who assist with underwriting, setup, and scaling decisions.

What EMB does well:

- Strong ability to place merchants that other providers cannot; they advertise 99% approval rates, but there is no way to confirm that.

- Experience with high-volume and international processing setups.

Potential limitations and considerations:

- Contracts may include longer terms or stricter conditions. You should carefully review them before signing anything.

- Many clients complain that the customer service is slow and unresponsive.

- Better suited for established merchants rather than early-stage startups.

5. PayKings

PayKings is a good fit for high-risk merchants in heavily regulated or compliance-sensitive industries, such as CBD, firearms, supplements, and adult. The provider emphasizes regulatory alignment and risk controls, making it appealing to businesses that need extra support staying compliant while processing payments.

Services and technology offered:

- High-risk merchant accounts: PayKings focuses on placing merchants in regulated verticals with acquiring banks that understand industry-specific compliance requirements.

- Integrated and third-party payment gateways: Gateway options are selected to support compliance, security, and stable processing.

- Multiple payment methods: Credit and debit cards, ACH, and recurring billing are supported, along with many alternative payment methods.

- Compliance-focused risk management tools: PayKings emphasizes fraud prevention, transaction monitoring, and dispute visibility to help merchants stay within acceptable risk levels.

- Dedicated account support: Merchants receive guided onboarding and ongoing assistance tailored to regulatory-heavy business models.

What PayKings does well:

- Strong experience with regulated and restricted industries.

- Works with businesses of all sizes.

- Users praise the smooth onboarding process and helpful customer support.

Potential limitations and considerations:

- Pricing can be on the higher side compared to other high-risk merchant service providers; but it still depends on perceived risk and vertical.

- While the post-approval setup seems quick and efficient, some users do complain about their pre-approval workflows.

6. Corepay

Corepay is a full-service payment processor with flexible payment solutions across multiple sales channels. It works with both low-risk and high-risk merchants. Works great for ecommerce, mobile, and MOTO-based businesses that want broad payment coverage without being locked into a single gateway or processing setup.

Services and technology offered:

- High-risk merchant accounts: Corepay places merchants with acquiring banks that support elevated risk profiles while accommodating different sales channels and transaction types.

- Gateway-agnostic processing: Merchants can use their proprietary gateway or integrate with a wide range of PCI-compliant gateways, such as Authorize.net or NMI.

- Multiple payment methods: Credit and debit cards, ACH, mobile payments, and recurring billing are supported to meet diverse customer preferences.

- Risk and chargeback support: Corepay offers access to monitoring tools and guidance to help merchants manage fraud exposure and dispute ratios.

What Corepay does well:

- Corepay’s own gateway is built to handle high transaction volumes and integrations for high-risk ecommerce merchants.

- Serves clients across the USA, Canada, the UK, and Europe, which is great for businesses that need an international/offshore merchant account.

- Merchants seem to be broadly satisfied with their onboarding and customer support.

Potential limitations and considerations:

- Better suited for merchants who already understand their technical needs.

- They are a newer provider on the market, and while they advertise great coverage across high-risk industries, they might lack experience in specific verticals.

- Again, as a smaller provider, there are only a handful of customer reviews, which makes it hard to confirm various claims they feature on their website.

7. Zen Payments

Zen Payments is one of the larger and more established high-risk payment providers. It is a solid choice for high-risk merchants that value flexibility and personalized support, especially those operating in ecommerce, subscription billing, and digital services.

Services and technology offered:

- High-risk merchant accounts: Zen Payments works with numerous acquiring banks to place merchants based on their specific industry, processing history, and risk tolerance.

- Gateway flexibility: Merchants can choose from several PCI-compliant gateways, allowing you to align processing with your existing ecommerce or billing infrastructure.

- Multiple payment methods: Credit and debit cards, recurring billing, ACH, and alternative payment methods are supported depending on the acquiring bank.

- Dedicated account management: Merchants receive hands-on assistance during onboarding and continued support as their business evolves.

What Zen Payments does well:

- Flexible underwriting and high-approval rates for a wide range of high-risk verticals.

- Many merchants praise their customers support.

- Willingness to work with startups and growing businesses.

Potential limitations and considerations:

- No proprietary, all-in-one gateway solution.

- While this might be due to merchants not reading their contract carefully, there have been multiple complaints about lack of transparency and unexpected fees.

8. Durango Merchant Services

Durango Merchant Services is best suited for high-risk and hard-to-place merchants that have been declined multiple times or operate in restricted industries. It is often a go-to option for businesses that need creative placement strategies and are willing to work through a more rigorous underwriting process.

Services and technology offered:

- High-risk merchant accounts: Durango specializes in placing merchants with domestic and offshore banks that accept elevated risk, complex histories, or restricted verticals.

- Integrated payment gateway:Their Durango Pay Gateway offers all of the security aand features you would expect from a modern payment gateway.

- Multiple payment methods: Credit and debit cards, recurring billing, ACH, and alternative payments are supported based on bank approval and industry constraints

- Dedicated account management: Merchants work directly with experienced representatives who stay involved throughout underwriting and ongoing processing

What Durango Merchant Services does well:

- Strong track record with very high-risk and previously declined merchants.

- Access to both US-based and offshore acquiring relationships.

- Experienced team familiar with complex underwriting scenarios and technical integrations.

Potential limitations and considerations:

- Pricing and reserve requirements are often higher than average

- Less emphasis on bundled or proprietary technology solutions

- Businesses with lower processing volume might get a better service and more attention elsewhere.

Why high-risk merchants trust SecureGlobalPay to handle their accounts and payment processing

High-risk merchants need a partner that understands their industry, proactively manages risk, and treats their business as a long-term relationship — not a disposable account.

SecureGlobalPay has earned that trust by helping hard-to-place merchants get approved and processing. Here’s what makes SecureGlobalPay stand out:

- Nearly 30 years of high-risk processing experience: We worked through multiple card network rule changes, regulatory shifts, and fraud trends. That experience translates into fewer surprises and more durable merchant accounts.

- Full-service payment processing: You get everything in one place — a high-risk merchant account, payment gateway, and risk management tools. The fewer tools and vendors you need to use, the less room for hiccups, complexity, and unexpected fees.

- Proactive account management: We actively help you manage chargebacks, fraud exposure, and transaction risk. This proactive approach reduces the likelihood of reserves, freezes, or sudden account termination.

- Highly positive merchant sentiment: Many merchants highlight clear communication, fast responses, and hands-on support. Instead of generic support responses, we take the time to explain everything and answer your questions.

Want to sign up with SecureGlobalPay? Here’s how the process works:

- Step 1: Complete this online application to provide basic business details, processing history, and required documentation.

- Step 2: We review your business model, risk profile, and volume expectations, then match you with the right acquiring bank.

- Step 3: Once approved, you receive clear terms outlining pricing, reserves, and processing limits — so you know exactly what to expect.

- Step 4: We help you configure and test your merchant account, gateway, and integrations.

- Step 5: Off you go — you can start taking payments without fear of freezes or shutdowns.

If you operate in a high-risk industry and want long-term account stability with a trusted partner, SecureGlobalPay is the way to go.

FAQs

A business is considered high-risk when banks and card networks view it as more likely to generate chargebacks, fraud, or regulatory exposure. Common factors include your industry, business model, processing history, chargeback rate, average transaction size, and geographic reach. Even legitimate, fast-growing businesses can be labeled high-risk.

Most high-risk merchant accounts use tiered pricing or interchange-plus pricing. You can expect a combination of processing rates, per-transaction fees, monthly account fees, and sometimes setup or annual fees. Here is the complete breakdown of high-risk payment processing fees.

High-risk accounts carry more financial exposure for acquiring banks. To offset that risk, providers may require rolling reserves, higher processing rates, or volume caps. These safeguards help protect all parties in the event of disputes or chargebacks and are standard across the high-risk payments industry.

Approval timelines vary based on your risk profile and documentation. Many specialized providers complete underwriting in 2 to 5 business days.

You reduce risk by using clear billing descriptors, transparent refund policies, fraud detection tools, and proactive chargeback monitoring. Working with a provider that actively helps manage disputes — not just reports them — can significantly improve account longevity.

Unless you have a very complex setup, switching merchant services is easier than you think. The SecureGlobalPay team helps you coordinate underwriting, gateway setup, and account activation so you can transition without interrupting cash flow.

In many cases, you can run SecureGlobalPay in parallel with your existing processor during the transition period. This reduces risk, allows you to validate performance, and ensures continuity before fully migrating your processing volume.