High-Risk Merchant Account Instant Approval – Myth or Reality?

When choosing a payment processing provider, do not be swayed by claims that they can instantly approve your high-risk merchant account. Simply put, a high-risk merchant account instant approval does not exist — at least not in the true sense of that word. To help expedite things, you’ll need a well-seasoned and reputable payment service provider like SecureGlobalPay to help guide you through the approval process.

This doesn’t mean that a high-risk business can’t get a fast approval or that there aren’t some things you can do to speed up the process.

Let’s see how “instant approval” works in practice, how to improve your chances of getting approved, things you can do to expedite the process, and how to apply.

The myth behind instant approval for high-risk merchant accounts

Instant approval implies that you can submit your application and get automatically approved. In reality, there’s no such thing as a legitimate instant approval for any form of high-risk merchant services account.

The approval of a high-risk business requires extensive research into the credit history, location, dealings, and business owners. You’ll always be required to submit more documents and wait longer for the underwriting processes compared to a low-risk business.

Larger payment processing platforms like Stripe, Paypal, or Square might allow you to instantly sign up and create an account, but as soon as they realize you are high-risk, they will terminate it and freeze your funds.

All high-risk merchants must undergo a series of compliance checks before being approved for a high-risk merchant account. To speed things up, you need an experienced and reputable payment service provider like SecureGlobalPay that will guide you throughout the approval process.

How long does it really take to get approval for a high-risk merchant account?

In our experience, the approval for high-risk merchant accounts usually takes 3 to 7 business days. Once that happens, your payment processor (i.e. SecureGlobalPay) needs to configure the payment gateway. A few hours after that, you are ready to accept credit card payments.

One way to ensure fast approval is to go through a pre-vetting process with the chosen high-risk payment processing provider. For example, you can send over basic business details to partners@secureglobalpay.net. We can look it over, ask for more info if needed, and discuss it with our acquiring banks.

If all looks good, you can be sure that your high-risk merchant account will be quickly approved once you officially apply. And even if there are issues, our account representatives will help you quickly sort them out.

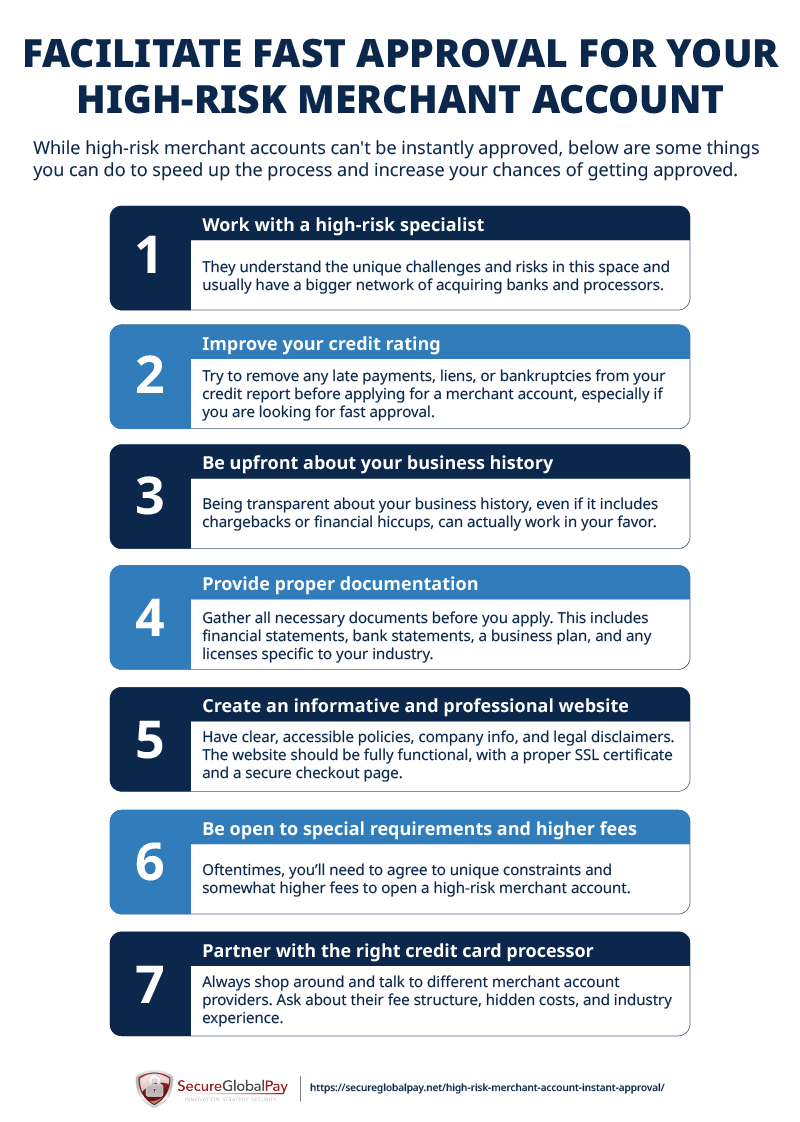

How to increase your chances and facilitate fast approval for your high-risk merchant account

Navigating the waters of high-risk merchant account approval doesn’t have to feel like you’re steering through a storm. There are clear, proactive steps you can take to not just increase your chances of approval but speed up the process as well.

1. Work with a high-risk specialist

First off, team up with a payment processor that specializes in high-risk businesses and has a proven track record. There are three major reasons for that:

- They understand the unique challenges and risks associated with your business model and are better equipped to guide you through the approval maze.

- Competent high-risk providers will ensure a merchant’s paperwork is in order. This avoids unnecessary delays in the underwriting process.

- Established high-risk merchant account providers will often have a bigger network of acquiring banks and processors. This makes it easier to find the ideal one that is in the best position to approve your business.

Take it from someone with over 20 years of experience in high-risk space — we’ve seen it all and know how to position your application for success.

2. Improve your credit rating

It’s crucial to remove any late payments, liens, or bankruptcies from your credit report before applying for a merchant account, especially if you are looking for fast approval.

Contact a reputable credit reporting bureau to get your credit report. If possible, ask them to remove these issues from your report. Try to eliminate any bad credit to help ensure a satisfying and lasting effect on your following application process.

3. Be upfront about your business history

Honesty is your best policy here. Being transparent about your business history, even if it includes chargebacks or financial hiccups, can actually work in your favor. Processors appreciate transparency and are more willing to work with merchants who are upfront about their past, as it helps in assessing risk accurately and setting up measures to mitigate it.

4. Provide proper documentation

Gather all necessary documents before you apply. This includes financial statements, bank statements, a business plan, and any licenses specific to your industry. Having your paperwork in order shows you’re serious and prepared, making it easier for the processor to evaluate your application quickly and favorably.

5. Maintain an informative and professional website

To ensure a good first impression, your website should be professional, easy to navigate, and informative. Have clear, accessible policies and company information, alongside any necessary legal disclaimers. The website should be fully functional, with a proper SSL certificate and a secure checkout page.

Payment processors will look at those features, and if they are missing, it could raise red flags and potentially hinder your approval process.

6. Be open to special account requirements and paying higher fees

Occasionally, you’ll need to agree to some unique constraints or part with somewhat higher fees to open a high-risk merchant account. If it makes sense, do it! It is always worth giving your clients as many non-cash payment options as possible.

Once your merchant account starts establishing a positive track record, you can regularly renegotiate fees and reserve requirements.

7. Partner with the right credit card processor

Always shop around and talk to different merchant account providers. As a high-risk business, before making a commitment, you should have a clear idea about their:

- Discount rates

- Transaction fee

- Equipment costs

- Reserve fees

- Monthly minimum fees

- Chargeback fees

All of these costs can pile up and ruin your profit margins. Do your due diligence to find a high-risk merchant services provider that can match your needs.

Set up your high-risk merchant account with SecureGlobalPay

SecureGlobalPay is an all-in-one payment processing provider that specializes in working with high-risk merchants. We offer fair and customizable pricing options that help businesses accept and process credit card payments quickly and effectively.

If you decide to work with use, you can get access to:

- ACH Processing

- Business Funding

- Chargeback Dispute Resolution and Prevention Programs

- Instant Check Processing Solutions

- High-Volume Payment Solutions

- Merchant Cash Advances

- Mail Order/ Telephone Order (MOTO) Processing

- Online Payment Gateways

- Point-Of-Sale (POS) Solutions

We are especially proud of our customer support. Each customer gets a dedicated, experienced account manager to guide you through the approval process and solve any operational issues as soon as they come up.

Learn more by sending a question to partners@secureglobalpay.net, or by contacting one of our sales reps at +1 800-419-1772, or simply fill out our online application form:

FAQ

Can I get a high-risk merchant account with instant approval and no credit check?

The prospect of obtaining a high-risk merchant account with instant approval and no credit check is unrealistic. Credit evaluations are a crucial step for merchant account providers to assess the risk level of partnering with a business, especially for those considered high-risk.

That said, transparency about your business and financial standing can facilitate the process, and working with providers who specialize in high-risk accounts may offer more accommodating terms despite the necessary checks.

Why is my business considered high-risk?

Businesses can be labeled as high-risk for multiple reasons. Key factors include the industry’s typical chargeback rates, transaction sizes, and the likelihood of financial instability or fraud. Additionally, if a business operates internationally, offers subscription-based services, or has a history of financial discrepancies, it might also be classified as high-risk.

Is there a high-risk merchant account instant approval in the UK?

In the UK, the concept of “instant approval” for high-risk merchant accounts is much like in the US: more myth than reality. Due to the stringent regulations governing financial transactions and the need to thoroughly assess risk, UK merchant account providers conduct detailed reviews of applicants, especially those considered high-risk.

Can startups and new businesses get approved?

Startups and new businesses can indeed get approved for merchant accounts, including high-risk ones. However, the approval process might come with more scrutiny and potentially stricter conditions compared to established businesses.

Providers assess the risk associated with new ventures without a proven financial track record or credit history. To enhance their chances, new businesses should be prepared to provide detailed business plans, forecasts, and potentially personal financial information.