Stripe Account Frozen or Closed? What It Means and What to Do Next

Few things are more frustrating than waking up to find your Stripe account frozen or closed. Your payouts are stuck, new payments can’t go through, and Stripe’s emails don’t exactly explain what went wrong.

Stripe is a great platform for many startups and eCommerce brands. However, if your business could be considered “high risk”, you’re bound to face freezes and shutdowns.

In this article, we’ll break down why Stripe does this, what you can do about it, and where to go next if your business needs a payment processor that won’t leave you hanging.

What happens when Stripe freezes or closes your account?

When Stripe limits, freezes, or terminates your account, it can feel like the rug’s been pulled out from under you. Here’s what’s actually happening behind the scenes.

If your account is frozen, Stripe temporarily pauses payouts and may prevent you from accepting new payments while they review your account activity. You’ll usually get an email or see a notification in your Stripe Dashboard asking for more details or documentation.

If your account is closed, that’s a different story. Stripe will immediately suspend all payouts, freeze any remaining funds, and disable your ability to process transactions. You’ll also receive an email explaining the decision — though often, it’s a short and generic message that doesn’t give much detail.

According to Stripe’s own Terms of Service:

“Stripe may terminate this Agreement (or any part of it) or close your Stripe Account at any time for any or no reason (including if any event listed in Sections 6.2(a)-(i) of these General Terms occurs).”

In other words, Stripe reserves the right to shut down your account at any time — even if you haven’t technically violated their policies.

Once your account is closed, it’s usually final. Appeals rarely work, especially if your business has been labeled “high risk.”

There are edge cases where merchants have managed to get reinstated — typically smaller accounts that can prove an error or provide strong documentation showing their transactions are legitimate.

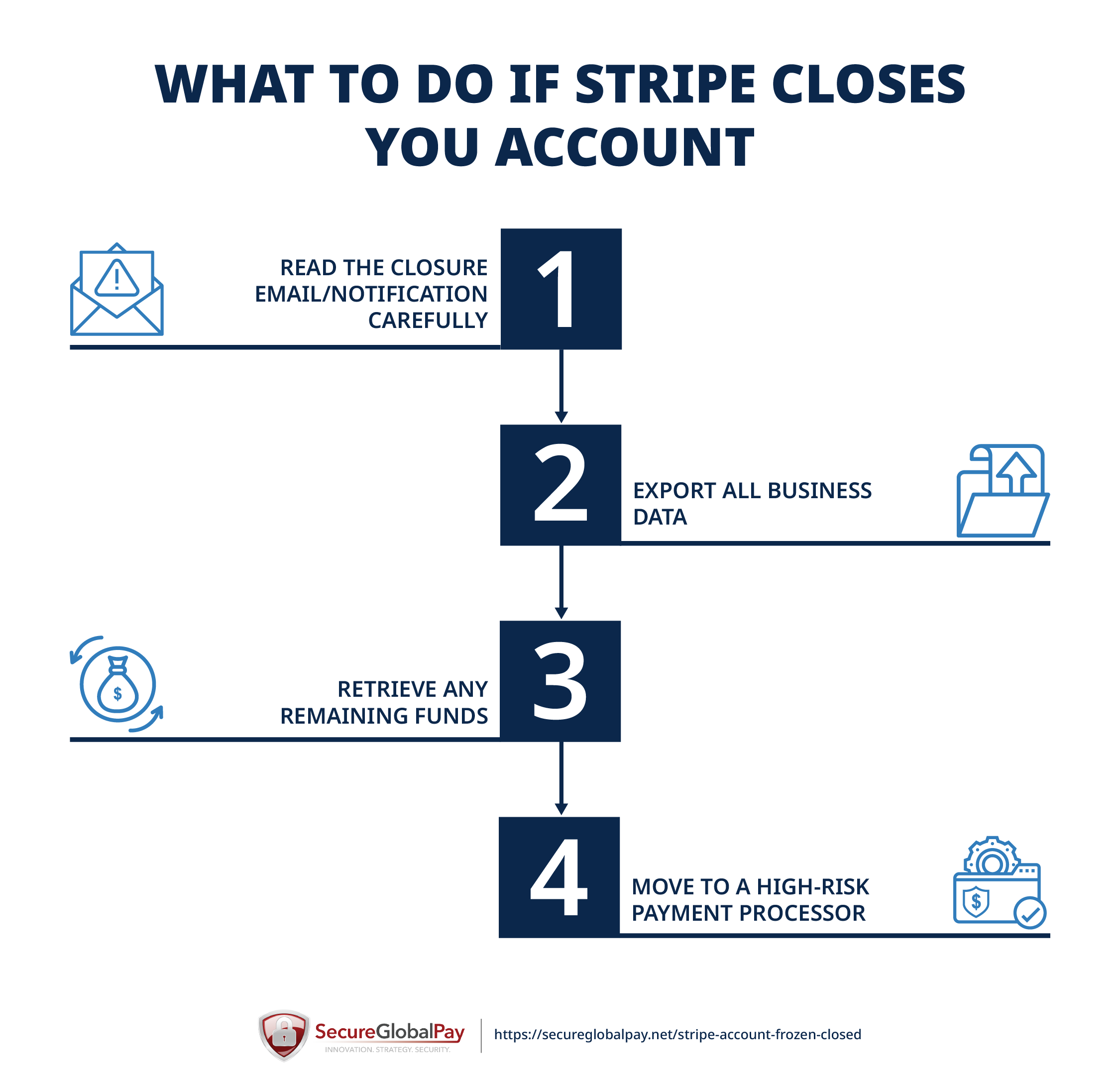

Steps to take if Stripe shuts down your account

First, it’s important to know whether your account is frozen or closed.

If it’s frozen, there’s still a chance to get it back by contacting Stripe support and providing any documents or explanations they ask for. But if it’s closed, Stripe has made a final decision — and your best move is to secure your funds, gather your data, and switch to a processor that supports your business type.

Step 1: Read the closure email/notification carefully

Open Stripe’s notification email and check the exact wording. Does it say your account is temporarily restricted, under review, or permanently closed? This determines your next steps.

Stripe usually provides a short reason — for example, “high dispute rates” or “prohibited business type.” Keep that email for your records. You’ll need it when applying for a new processor or if you decide to appeal later.

In most cases, contacting Stripe support won’t change the outcome if the account is labeled high risk. Many merchants receive the same canned response: “This decision is final.”

Step 2: Export all business data

Before your access is limited, download reports, customer lists, payout history, and invoices from your Stripe Dashboard.

You’ll need these for accounting, tax records, and applying to new merchant accounts. Stripe can remove access after some time, so don’t put this off for too long.

Step 3: Retrieve any remaining funds

Stripe generally holds your funds for a risk period — usually around 90 days — to cover potential chargebacks or refunds.

Now, there’s no legal limit that forces Stripe to release your funds after exactly 90 days. That timeframe is a guideline, not a guarantee. In reality, some merchants report getting their money sooner (within 60 days), while others — especially those labeled high-risk — have waited up to 180 days or more.

In most cases, Stripe does release the funds once the hold period ends. However, there are a few situations where you might not get all your money back:

- Active or pending chargebacks: Stripe will deduct these amounts from your balance.

- Violations of Stripe’s Terms of Service: If your business sold prohibited items or is flagged for fraud, Stripe can permanently withhold funds to cover liabilities.

Step 4: Move to a high-risk payment processor

If your business model consistently triggers Stripe’s risk filters, it’s time to look for a high-risk-friendly payment processor.

High-risk merchant service providers — like SecureGlobalPay — are built for businesses that deal with higher chargebacks, regulated products, or unconventional business models. They provide higher approval rates for restricted industries, more stable long-term processing, and tailored risk management tools like chargeback and fraud protection.

SWITCH FROM STRIPE TO SECUREGLOBALPAY

Reliable Processing for High-Risk Merchants!

Recommended reading #1: How to Choose a Merchant Service Provider? 13 Key Evaluation Questions

Recommended reading #2: How to Cancel Merchant Services and Switch to a New Provider

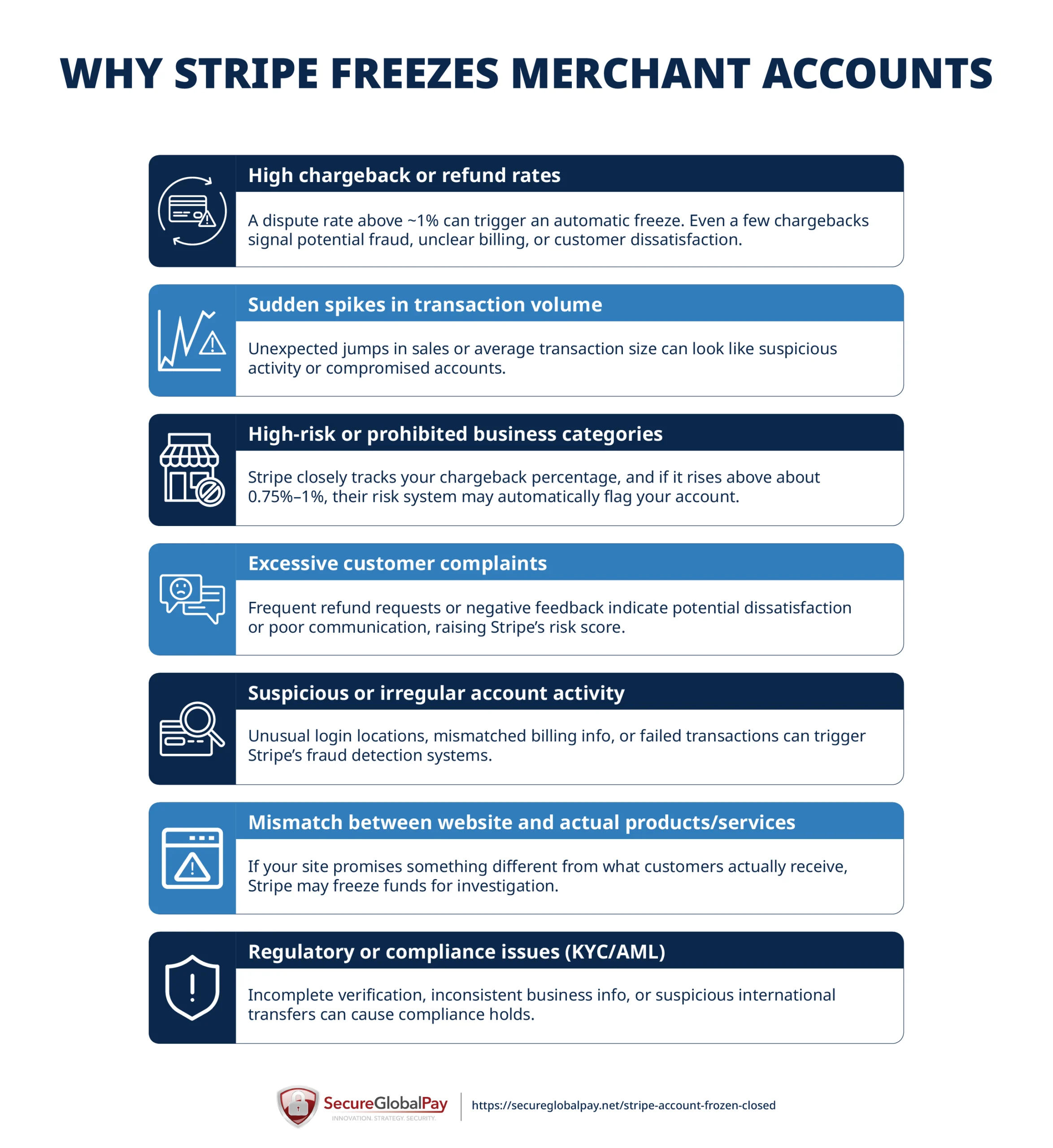

Common reasons why Stripe freezes accounts

Stripe uses automated risk monitoring systems to protect buyers, sellers, and itself from fraud or regulatory problems. These systems scan every transaction in real time, flagging anything that looks unusual — a sudden spike in volume, repeated disputes, or products that fall into a “gray area.”.

While this automation helps Stripe manage millions of users efficiently, it can also mean honest merchants get caught in the net.

Unfortunately, getting a clear answer from Stripe support isn’t easy. Most replies are automated, and human reviews can take days or weeks. Understanding what triggers these freezes can help you prevent them (or at least prepare for them).

High chargeback or refund rates

Stripe closely tracks your dispute percentage, and if it rises above about 0.75%–1%, their risk system may automatically flag your account. Even a handful of chargebacks in a short period can set off alarms if your transaction volume is low.

High refund or chargeback rates signal to Stripe that something might be wrong — whether it’s fraud, unclear billing descriptions, or customer dissatisfaction.

Review and update your chargeback management strategy to implement best practices and keep those disputes under the said thresholds.

Sudden spikes in transaction volume

A sudden jump in your transaction volume or average ticket size is one of the fastest ways to trigger a review. Even a single large or out-of-pattern sale can prompt Stripe to pause payouts until they verify what’s going on.

Suppose you normally process $5,000 a week. Suddenly, you do $25,000 in a couple of days. Stripe’s algorithm may assume your account has been compromised or that you’ve started selling a new type of product/service.

A seasonal store launching a big holiday sale. A crowdfunding campaign reaching its funding goal overnight. A new marketing campaign suddenly boosting orders. These reviews can happen to completely legitimate businesses.

To reduce your chances of being flagged:

- Scale gradually — try to ramp up transaction volume over time.

- Notify Stripe in advance if you expect a spike (e.g., product launches, promotions, or major events).

- Keep documentation ready — invoices, product pages, or campaign links can help prove your activity is legitimate if Stripe asks.

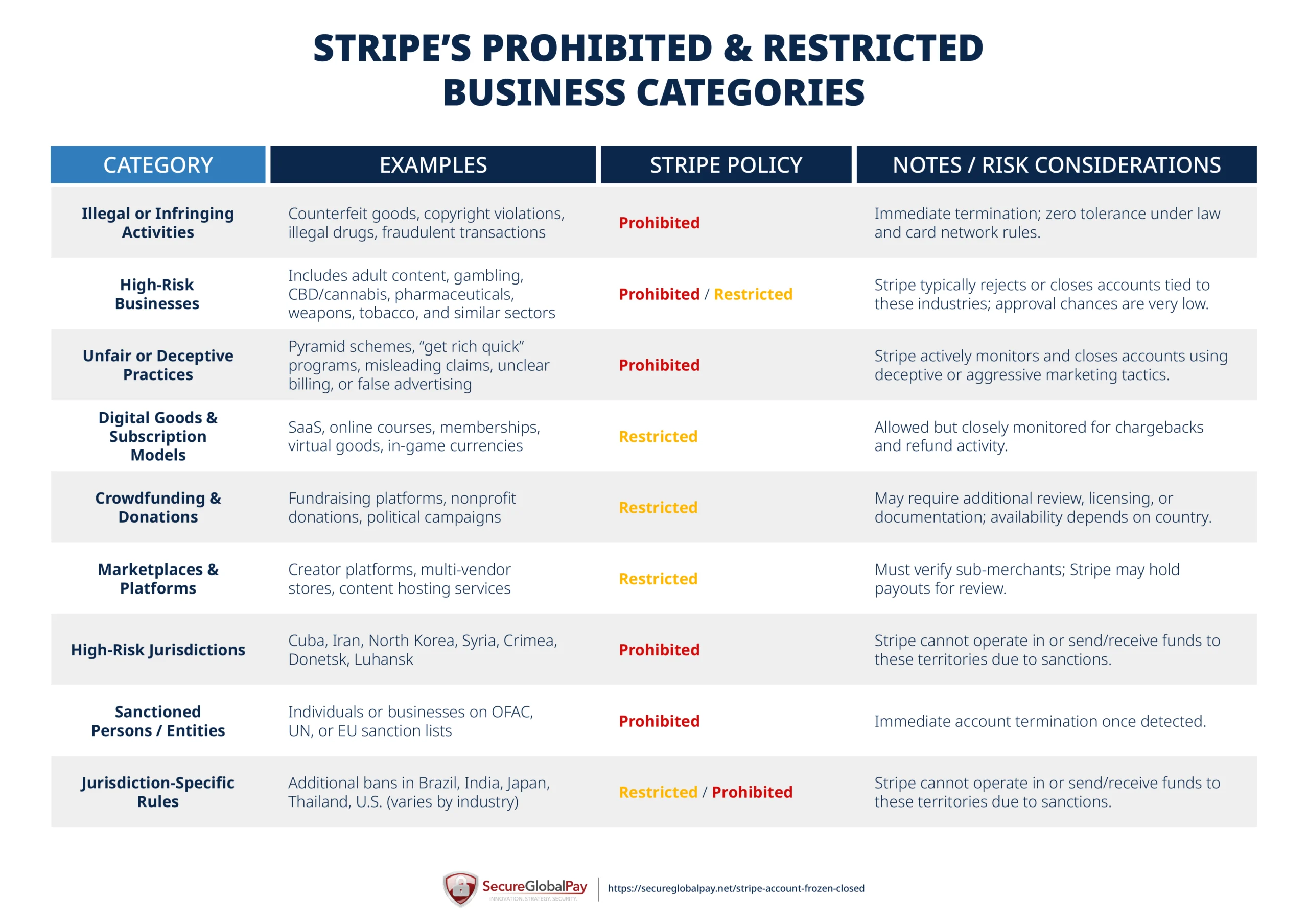

High-risk businesses selling restricted or prohibited products

Stripe maintains a long list of restricted and prohibited businesses, and selling anything on that list can instantly trigger an account freeze or permanent closure.

Examples of high-risk industries that often raise red flags include:

- CBD and hemp-derived products

- Nutraceuticals, CBD, supplements, and weight-loss products

- Adult content or services

- Travel, ticketing, and event promotion

- Gambling, gaming, and contests

- Cryptocurrency, forex, or investment schemes

- Firearms, tactical gear, or self-defense products

Stripe’s underwriting team uses data from card networks and internal risk models to decide which sectors carry higher dispute or regulatory exposure. Unfortunately, that means even you can be penalized simply for operating in one of these categories.

If you fall into one of these industries, it’s often better to skip Stripe altogether and work with a specialized high-risk merchant processor. Check the industries SecureGlobalPay supports here.

Excessive disputes or customer complaints

Even if your chargeback rate is low, a steady stream of customer complaints or refund requests can still raise Stripe’s risk flags.

From Stripe’s perspective, consistent complaints suggest issues with product quality, delivery, or transparency, which can quickly turn into chargebacks. The algorithm doesn’t distinguish between a business with poor customer service and one that simply has a demanding customer base — both look “risky” on paper.

Here’s how to stay off Stripe’s radar:

- Respond quickly to customer inquiries and offer refunds before disputes escalate.

- Keep your billing descriptors clear and recognizable — so customers know what the charge was for.

- Use order tracking and confirmation emails to reduce “item not received” claims.

- Gather and document feedback — having records of satisfied customers can help your case if Stripe questions your legitimacy.

Suspicious account activity or fraud detection flags

Stripe’s fraud prevention tools — like Radar — constantly scan transactions for anything that looks out of the ordinary. While this protects buyers, it can also cause legitimate merchants to get flagged if their activity doesn’t match typical patterns.

Common triggers include:

- Mismatched IP addresses or locations: For example, logging in from a different country than usual or processing transactions from unfamiliar regions.

- Multiple failed payment attempts: A high number of declines or retries can resemble card testing or fraud.

- Inconsistent billing information: If customer names, emails, or addresses don’t match card details, transactions can get flagged automatically.

- Unusual refund behavior: Frequent partial refunds or repeated refund requests can look like potential money-laundering or scam activity.

When Stripe’s system detects enough of these red flags, it may freeze payouts or disable new payments until a manual review is complete.

Mismatch between website promises and actual products/services

The Stripe team might review your website, checkout process, and marketing materials to ensure they accurately reflect what you’re selling. If there’s a gap between what’s advertised and what customers actually receive, Stripe may freeze your account while they investigate.

This mismatch can happen in a few ways:

- Your website advertises one type of product, but your transactions suggest you’re selling something else.

- You use ambiguous pricing or subscription terms that make it unclear how customers are charged.

- Your site includes claims that seem exaggerated or misleading (“guaranteed results,” “no refunds,” etc.).

- Your checkout process doesn’t match your site — for example, customers buy through a third-party funnel that looks different from your main site.

To Stripe, these inconsistencies suggest a higher risk of customer dissatisfaction or disputes. And they take them seriously.

Regulatory or compliance issues (e.g., KYC/AML concerns)

Stripe is legally required to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. That means they must verify who you are, what your business does, and where your funds are coming from.

Here are common triggers for compliance-related holds:

- Unverified business information: Missing or outdated legal names, addresses, or tax details.

- Identity verification failures: If your uploaded ID doesn’t match account data or can’t be verified.

- Bank account mismatches: If funds are routed to an account not owned by the same legal entity.

- Transactions involving high-risk countries or restricted regions.

- Large or frequent international transfers: Anything that may resemble money-laundering behavior.

Considered high risk? Switch from Stripe to SecureGlobalPay

If Stripe has shut down your account and labeled your business as too risky, it’s usually not worth trying to fight it. Even if you manage to get reinstated, it is only a matter of time before the same thing happens again.

Here are just some of the benefits of working with SecureGlobalPay:

- Higher approval rates: We work with industries that Stripe, PayPal, or Square often reject (e.g., supplements, travel, digital goods, adult, gaming, subscription boxes).

- Stable, long-term processing: Once approved, you’re less likely to face sudden shutdowns because your risk level is understood and priced into the account.

- Advanced risk management: You’ll get access to modern chargeback prevention tools, AI fraud detection, and guidance tailored to your specific business model.

- Flexible account structures: We can set you up with backup, multi-MID, or offshore merchant accounts to ensure you can still accept payment, even if one account experiences issues or you have sudden spikes in processing volume.

- Transparent pricing and direct support: You get a dedicated account manager and clear fee breakdowns.

SecureGlobalPay has helped hundreds of high-risk merchants continue processing payments without interruptions. Many Clients have came to us after Stripe shut them down over “elevated chargeback risk or prohibited business type.” Within a few days, they were fully approved, connected, and back to accepting payments — with zero downtime since.

If you’re ready to move forward, you can fill out our simple online application — or reach out to partners@secureglobalpay.net if you have any questions.

FAQ about Stripe account closures

Usually not. Once Stripe permanently closes an account, that decision is final — especially if your business is labeled “high risk.” You can try appealing by replying to the closure email, but most merchants receive a short “final decision” response. It’s better to apply with a provider that accepts your business type.

The exception might be if your account is closed due to inactivity or an error on Stripe’s side. In those situations, you have a reasonable chance to reopen your account.

If your account is only frozen (not closed), you may be able to recover it by verifying your business, providing the requested documents, or explaining specific transactions. If it’s closed, recovery isn’t realistic — consider exporting your data and switching to a new processor.

Technically, you can, but the same thing will likely happen again. Stripe tracks users through business names, tax IDs, owner information, and banking details. You’d need to form an entirely separate legal entity — and even then, success isn’t guaranteed.

Yes. Stripe can legally debit your linked bank account for refunds, chargebacks, or fees that occur after your account is closed. This is stated in their Terms of Service. It’s another reason to monitor your bank account closely during the 90-day risk period.

There’s no legal limit, but most merchants see funds released after 60–90 days. If Stripe believes your account carries ongoing risk (e.g., refunds or prohibited products), they can hold funds for up to 180 days or longer.

Keep chargeback rates below 1%, do not sell restricted products, maintain consistent transaction volumes, and make sure your website accurately reflects what you sell. If you run a high-risk business, consider applying with a high-risk payment processor from the start — it’s more stable and saves you future headaches.