How To Open an Adult Merchant Account

Opening and running an adult business inevitably comes with a set of payment processing challenges. Whether you operate an adult content site or an online toy store, you’ve probably noticed that many banks and traditional processors shy away from adult transactions.

The industry is labeled “high risk” due to higher chargeback rates, strict compliance rules, and reputational concerns — making it tough to find reliable and affordable payment options.

Many adult merchants deal with issues like sudden account terminations, withheld funds, or sky-high processing fees. That’s just frustrating.

The good news? With the right merchant services provider, you can start accepting payments quickly and keep your account in good standing long-term.

Here at SecureGlobalPay, we specialize in helping adult merchants get approved fast — even if you’ve been declined elsewhere.

QUICK AND EASY ONLINE APPLICATION

We specialize in approving high risk merchants!

If you are interested in the steps and documentation required to open an adult merchant account, just keep scrolling down.

What is an adult merchant account?

An adult merchant account is a special type of payment processing account that allows businesses in the adult industry to accept credit cards, debit cards, and digital payments securely. It functions much like a standard merchant account, but comes with slightly higher fees and access to more advanced chargeback and fraud prevention tools.

Being labeled high risk doesn’t mean your business is illegitimate — it simply means there’s a greater chance of chargebacks, higher transaction volumes, or regulatory scrutiny. Because of this, adult businesses need processors that understand the industry and can protect them from sudden interruptions.

Examples of businesses that typically require an adult merchant account include:

- Adult content websites and subscription platforms

- Webcam or camming sites

- Adult novelty or toy stores (online or retail)

- Online dating sites, apps, and membership services

- Adult magazines, clubs, and lifestyle brands

With the right adult merchant account and gateway, you can process payments smoothly, protect customer data, and ensure steady revenue flow — without worrying about account shutdowns.

What do you need to apply?

Before you can open a high-risk merchant account, you’ll need to prepare a few standard documents. These help processors verify your business and ensure you meet the necessary compliance requirements.

Most providers will ask for:

- A valid business license and government-issued photo ID

- Proof of domain ownership or a live website

- Estimated monthly processing volume

- Recent bank statements (usually from the past 3–6 months)

- Processing history, if you’ve accepted payments before

- Refund policy, terms of service, and privacy policy pages on your website

- Proof of age verification compliance, showing your business prevents underage access.

Some processors may ask for additional documentation depending on your business type or where you’re located. For example, international merchants might need incorporation records, supplier agreements, or compliance certificates.

Having everything ready will speed up the approval process.

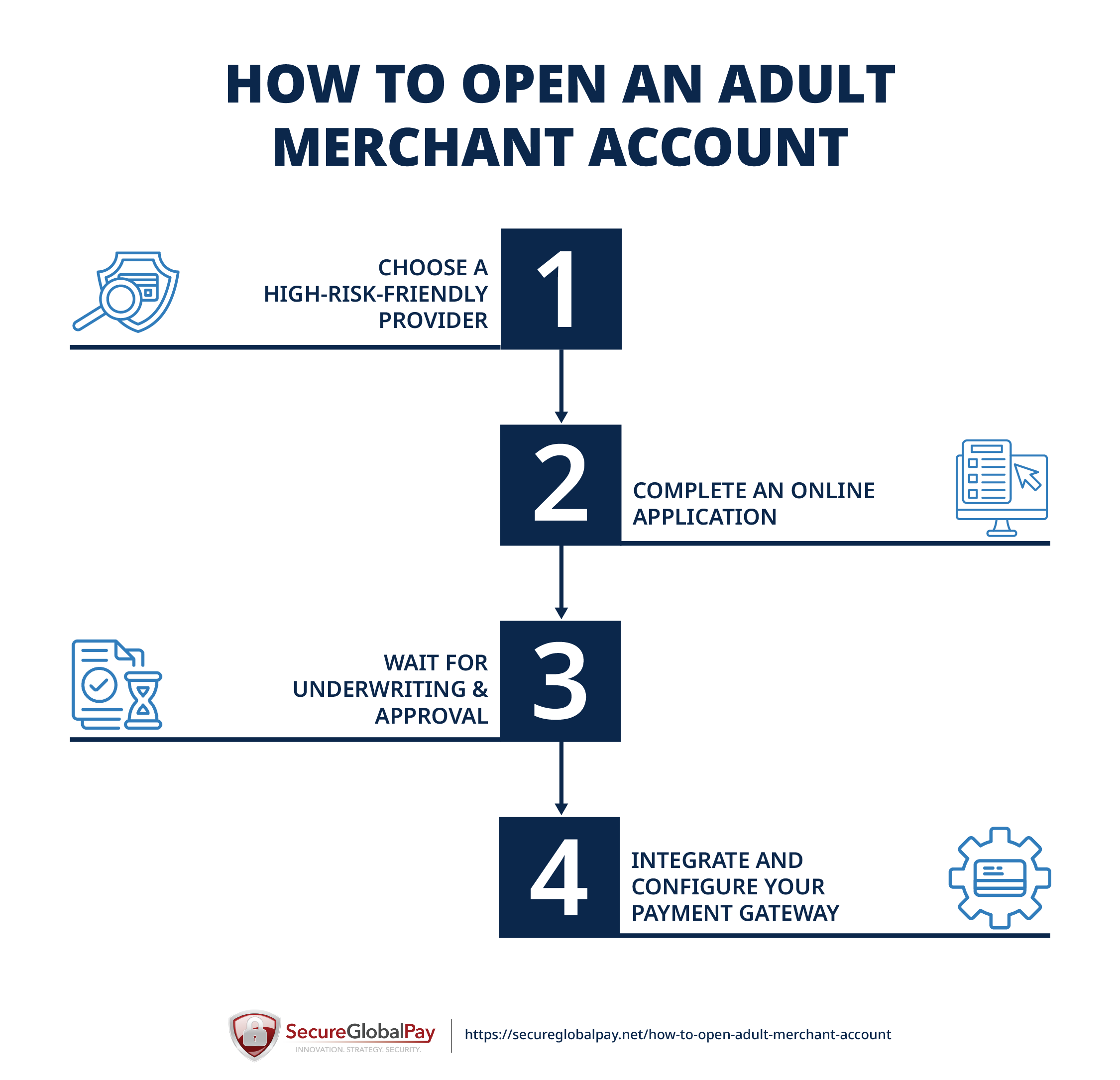

Steps to open an adult merchant account

The process is straightforward, but choosing the right partner makes all the difference. Here’s how to go from application to accepting payments with minimal hassle.

Step 1: Choose a high-risk-friendly provider

Not every payment processor works with adult businesses. Many traditional banks and mainstream providers automatically reject applications from industries they consider “high risk.” That’s why your first step is to find a provider that welcomes adult merchants — not one that will flag or freeze your account later down the line.

SecureGlobalPay specializes in high-risk payment processing and offers domestic, international, and offshore solutions specifically for adult businesses. Whether you’re running a small niche site or a large subscription platform, we understand the compliance and risk management requirements unique to this industry.

In short: Working with a high-risk provider from the start saves you time, avoids unnecessary rejections, and ensures your business can scale without interruptions.

Free Template for Comparing Merchant Service Providers

Our Google Sheet template arms you with 13 critical questions you should ask each provider to catch red flags and cut through the sales talk — with SecureGlobalPay’s answers already filled in for comparison.

Step 2: Complete an online application

Once you’ve chosen a high-risk-friendly provider, the next step is to fill out a simple online application. This form gives the processor a snapshot of your business — who you are, what you sell, and how you plan to handle payments.

When applying, be honest about your business type and what products or services you offer. Trying to hide the adult nature of your business or using vague descriptions will just slow down the process (and lower approval chances).

Reputable providers like SecureGlobalPay won’t judge or penalize you for your niche. Transparency upfront helps ensure a long-lasting partnership.

Step 3: Wait for underwriting & approval

After you submit your application, it moves into underwriting. Don’t let that word scare you; it’s simply a process to confirm your information and assess potential chargeback or fraud risk.

During underwriting, the processor may review your website, financial history, and business documentation. They’ll check that your content complies with laws and that your billing and refund policies are clear and transparent.

Approval times can vary depending on the provider and how complete your application is. Most adult merchant accounts are reviewed and approved within 2-5 business days. For better or worse, there is no instant approval for high-risk businesses.

Step 4: Integrate and configure your payment gateway

After approval, the final step is setting up your payment gateway — the secure payment bridge that connects your website or platform to your merchant account.

Integration is usually straightforward. We give you the necessary API keys or plugins to connect the gateway to your website, app, or shopping cart system. Then, we help you configure payment settings like currency options, billing descriptors, and recurring payment schedules (if applicable).

Our support team guides merchants through the entire integration process, ensuring everything runs smoothly from day one. We also offer a wide range of payment options — including credit and debit cards, ACH and eCheck processing, recurring billing, and even crypto payments for added flexibility.

Once this is done, you’re ready to start accepting and processing payments.

Tips to get (and stay) approved as an adult business

Getting approved for an adult merchant account is one thing — keeping it active and problem-free is another.

Here are some proven ways to avoid unexpected issues down the road:

- Be realistic about your processing volume: Don’t overstate your expected sales. Start with reasonable numbers and scale gradually once you establish a track record.

- Make sure your website is secure and compliant: Use standard SSL encryption (HTTPS) and clearly display your refund, terms of service, and privacy policy pages. These are basic requirements for most acquiring banks.

- Maintain clean financials and transparent operations: Keep accurate records, pay taxes on time, and make sure your business information matches your application details.

- Keep chargebacks under control: High chargeback rates are the fastest way to lose a merchant account. Use a secure payment gateway that offers fraud prevention tools, age verification systems, and chargeback management integrations.

- Set up multiple merchant accounts: If you are a high-volume merchant or expect huge sales spikes, set up multiple merchant accounts. For that, you’ll want a gateway that supports multiple MIDs.

- Use clear billing descriptors and customer support info: When customers recognize charges on their statements and can easily reach your support team, disputes and chargebacks drop significantly.

Following these steps shows acquiring banks that you’re running a professional, compliant business.

Benefits of opening an adult merchant account with SecureGlobalPay

Having the right partner at your side is crucial. With SecureGlobalPay, you’re not just getting a payment processor — you’re gaining a long-term partner that understands your industry and helps your business scale securely.

Here’s why adult merchants around the world trust SecureGlobalPay:

- High approval rates for adult and other high-risk businesses.

- Competitive processing rates — even for high-risk categories.

- Global coverage with multi-currency and international payment options.

- Access to a powerful payment gateway with AI-supported fraud and chargeback protections.

- Dedicated customer support with deep experience in adult industries.

- Fast setup and seamless integration with your site or platform.

Apply today with SecureGlobalPay and make payment processing one less thing you have to worry about.