Terminated Merchant Account: What to Do If Your Merchant Account Gets Closed

Having your merchant account suddenly shut down can feel like the rug’s been pulled out from under your business. Payments stop, cash flow takes a hit, and the clock starts ticking to find a fix before your operations grind to a halt.

Accounts get closed for a handful of reasons — from your processor deciding your industry has become “too risky,” to excessive chargebacks and compliance violations.

It’s stressful, but it’s not the end of the road. In this article, we’ll walk you through why accounts get shut down, what each scenario means for you, and the practical steps you can take to get up and running as fast as possible.

Why was your merchant account shut down?

When a merchant account gets closed, it usually falls into one of two main scenarios. Neither is fun, but the fallout — and how quickly you can get back to processing payments — depends on which one you’re dealing with.

Scenario 1: Closed simply for being considered too risky

Sometimes, an acquiring bank or payment processor decides they no longer want to work with your business because the perceived risk is too high. This can happen if your chargeback rate climbs, if your industry introduces new regulations, or if the processor changes its risk policies.

This often happens to high-risk merchants who initially sign up with payment aggregators like PayPal and Stripe. They might approve your account at first, but once they realize you’re in a high-risk category — like travel, firearms, CBD, tobacco, and similiar — they will freeze or close your merchant account without any warning.

If this is your situation, the good news is that you did not do anything wrong and you’re not blacklisted.

However, make sure you do not end up in the same position again. Switch to a provider that specializes in high-risk merchant accounts, such as SecureGlobalPay. We are set up to work with higher-risk industries and understand the unique challenges you face.

QUICK AND EASY ONLINE APPLICATION

Start Accepting High Risk Payments Now!

Scenario 2: Terminated merchant account (+ added to the MATCH/TMF list)

This is a much tougher scenario. If your account is shut down for serious reasons like:

- Repeated violations of card network rules

- Processing prohibited products or services

- Fraudulent activity

- Serious compliance breaches

- Excessive chargebacks

…your processor may report you to the MATCH (Member Alert to Control High-Risk Merchants) list, also known as the Terminated Merchant File (TMF).

The consequences are big: you can’t open a new merchant account until you’re removed, and in many cases, that won’t happen for five years. You can learn more on Mastercard’s official page.

That said, there are exceptions — if the listing was made in error or if you resolve the issue to the processor’s satisfaction, they can request your removal. But in reality, getting off the MATCH list is rare.

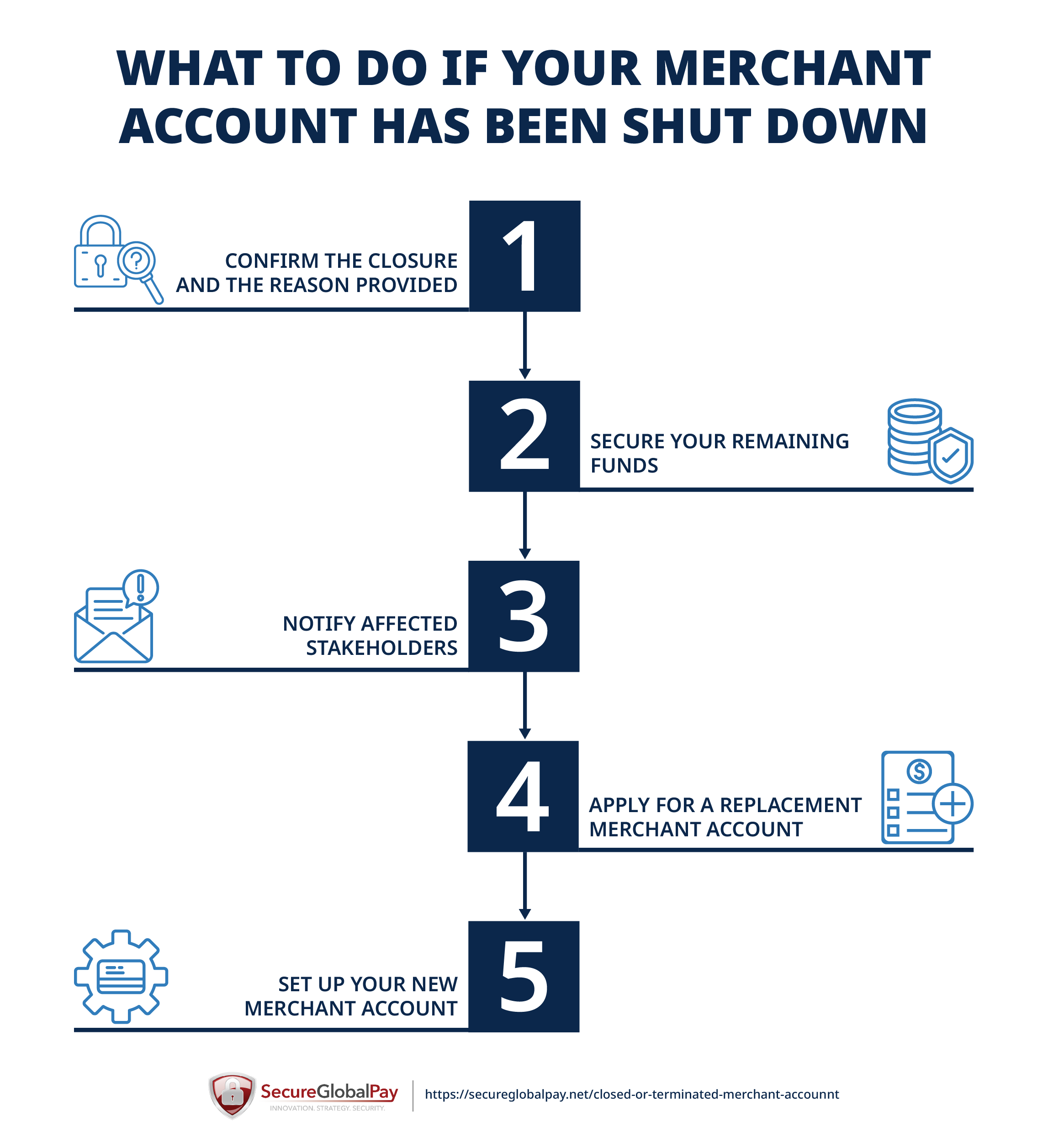

Steps to take if your merchant account has been shut down

While trying to understand what happened, in parallel, you should work on securing your funds and lining up a replacement processor. Here’s the order we recommend.

1. Confirm the closure and the reason provided

Not all account closures are permanent. Sometimes processors freeze or suspend accounts during a review — which means you might still get reinstated. Before you panic, confirm with your provider whether the termination is final:

- Check for official notice: Find the email, letter, or dashboard message confirming the closure.

- Ask for details: If the notice is vague, contact the processor and request a written breakdown of the violations, metrics, or incidents that led to the decision.

- Identify the cause: Common reasons include excessive chargebacks, lesser-known policy violations, or even sudden spikes in volume.

Knowing the exact cause will help you choose the right next step and the right replacement provider. For example, if spikes in volume are the issue, you’ll want to partner with a merchant service provider who can set you up with a high-volume merchant account and offers a payment gateway that can handle multiple MIDs.

2. Secure your remaining funds

When a merchant account is shut down, processors often hold onto your remaining balance for a set period — sometimes months — to cover potential refunds and chargebacks. That money is still yours, but you need to know when (and if) you’ll get it back.

- Review the reserve/hold policy: Check your contract or the processor’s terms to see how long funds can be held. Common timelines are 90–180 days.

- Request a settlement schedule: Ask for a final transaction report and the exact dates they plan to release your money.

- Negotiate if possible: If your account history shows low disputes and clean transactions, you may be able to push for an early or partial release of funds.

3. Notify affected stakeholders

In emergency situations, proactive communication is crucial. The sooner the right people know, the faster they can adapt. You should:

- Alert your finance team or person: You might need to sit down with them and figure out how the delay in funds will affect bills, payroll, and day-to-day expenses.

- Inform customers if refunds are affected: If you can’t process refunds through your old account, let customers know how and when they’ll receive them. Clear communication can prevent complaints and new disputes.

- Coordinate with vendors and partners: Any third parties relying on your payment processing — such as subscription platforms, fulfillment centers, or affiliates — should be informed of the issue.

These are not fun conversations to have. You don’t need to share details, but you should explain how you plan to move forward.

4. Apply for a replacement merchant account

You can wait to get a confirmation that your old account is gone for good. However, keep in mind that, on average, it takes between 2 and 5 working days to open a high-risk merchant account.

So the smart thing is to start lining up a new one immediately. You’ll want to:

- Target trusted high-risk providers: If your business is in a category traditional processors shy away from, go straight to high-risk merchant service providers instead of wasting time with banks that will likely decline you.

- Have your documents ready: This usually includes your business license, recent bank statements, chargeback rates, and processing history.

- Be upfront about your history: Hiding your closure can backfire. Processors will find out during their checks. Being honest up front can actually speed up approval.

5. Set up your new merchant account

Once you’ve been approved by a new provider, your merchant service provider should help you with your setup process. Key steps to take include:

- Integrate your gateway: This may involve updating your checkout software, e-commerce platform, or POS system to connect with the new processor.

- Tell customers about payment changes: If your payment methods or checkout process look different, a quick heads-up can prevent confusion or abandoned carts.

- Consider redundancy: If you process high volumes, ask your merchant services providers to set you up with multiple merchant accounts.

- Address past issues: If your last account closed due to high chargebacks, work with your new processor to implement better chargeback management strategies.

Getting this step right not only gets your sales flowing again but also helps prevent the same nightmare from happening twice.

Avoid account freezes and closures with SecureGlobalPay

SecureGlobalPay offers ultimate payment processing solutions for hard-to-place merchants. You get:

- High-risk merchant accounts tailored to your business type.

- Fast approvals — even if you’ve been turned down before.

- Chargeback management tools to keep your dispute rate under control.

- Advanced fraud prevention tools to minimize fraud.

- Multiple processing options to reduce your risk of downtime.

- State-of-the-art payment gateway that allows customers to pay using virtually any payment method.

- Global payment capabilities if you sell internationally.

Learn more by sending a question to partners@secureglobalpay.net or jumpstart the process by filling out our online application form.

FAQs about closed or terminated merchant accounts

First, find a provider that’s a good fit for your business type — if you’re in a high-risk category, skip the mainstream processors and go to a high-risk merchant account provider. Gather your paperwork (business license, bank statements, processing history) and apply — many processors now offer easy online applications.

On a statement or account notice, “merchant closed” usually means your payment processor or acquiring bank has shut down your account. This can be due to excessive chargebacks, compliance violations, high-risk classification, or inactivity. It’s not a temporary freeze — it means you can’t process payments until you open a new account.

If you want to close your own account, contact your provider’s merchant support department and request closure in writing. Make sure all pending transactions have settled, refund any outstanding orders, and confirm the final date the account will remain active. Get a closure confirmation email or letter for your records.

This phrase usually appears on a customer’s bank statement when you, the merchant, have cancelled a transaction or recurring billing subscription. It can also mean you proactively closed your own merchant account with the processor.