OnlyFans Payment Processing (And Why Stripe Fails Adult Merchants)

OnlyFans is a subscription-based platform best known for adult content, where creators charge fans monthly fees and sell pay-per-view content. While it hosts fitness trainers, musicians, and influencers, its explosive growth has come from adult creators who want direct access to their audience — and reliable payouts.

From a payments perspective, OnlyFans works differently than a typical adult website. Creators don’t set up their own merchant accounts. Instead, they sign up under OnlyFans’s master merchant account, and OnlyFans handles card processing, payouts, chargebacks, and compliance on their behalf. Creators get paid; OnlyFans absorbs the payment risk.

Let’s take a closer look at their payment processing setup.

What payment processor does OnlyFans use?

OnlyFans doesn’t rely on just one payment processor — it uses several high-risk merchant services providers at the same time to handle the huge volume of transactions across subscriptions, tips, and pay-per-view content.

While we can’t know for sure, multiple industry resources list the processors currently involved as: Stripe (as the primary payment processor), CCBill, Merrick, and Harris.

The general idea is that OnlyFans routes and balances payments across these processors to manage risk and keep chargeback ratios within acceptable limits for each provider. Smaller platforms can’t easily negotiate such a setup, but OnlyFans’ high transaction volume gives it strong leverage.

How Stripe works with OnlyFans

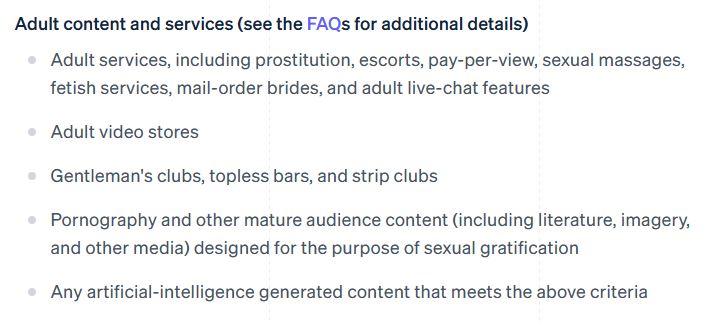

What’s peculiar in all of this is that Stripe continues to work with OnlyFans despite having adult content and services listed as restricted businesses (see screenshot below).

In general, Stripe’s acceptable use policies restrict content that it deems sexually explicit or associated with prostitution, escort services, or pornography — which makes adult content sites a high-risk or prohibited category in most of Stripe’s standard documentation.

Yet Stripe continues to process a significant portion of OnlyFans transactions. Most likely, this is because:

- OnlyFans is technically a platform with mixed content (some of it SFW), not purely an adult site — which puts it into the grey area and gives it some wiggle room when it comes to classifications and compliance.

- OnlyFans is large enough to negotiate custom agreements regarding how payments are stored, routed, and reviewed — including additional risk and anti-fraud controls on Stripe’s side.

- OnlyFans’ volume and compliance infrastructure might give Stripe enough confidence (and fees) to keep the relationship alive, even if Stripe broadly avoids smaller adult merchants.

In other words: Stripe is involved, but not in the same way it works with a low-risk e-commerce merchant. OnlyFans benefits from bespoke arrangements and risk management that most adult merchants won’t be able to access on their own.

Why Stripe is not a good solution for adult merchants

For adult merchants, payment facilitators like Stripe and PayPal are a bad long-term bet.

We have worked with multiple founders who described the same pattern:

- Account is approved initially.

- The processing volume grows.

- Stripe reviews the business more closely.

- Stripe freezes the funds or terminates the account with little to no warning (and limited appeal options).

- Merchants scramble to find a high-risk payment processor ASAP.

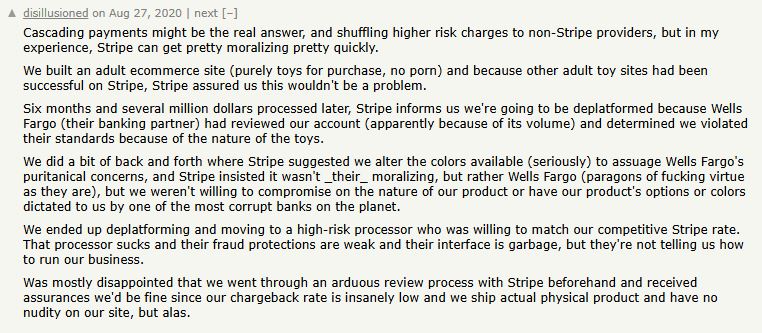

You can find a real-life example in this thread:

TL;DR: An eCommerce business selling physical sex toys was approved by Stripe and processed millions in transactions with a low chargeback rate before being suddenly deplatformed. The shutdown happened after Stripe’s acquiring bank, Wells Fargo, reviewed the account due to its volume and decided the products violated its internal standards. Ultimately, the business was forced to move to a high-risk processor.

How to set up payment processing for an OnlyFans-style platform?

If you’re building an OnlyFans-style platform, the biggest mistake you can make is starting with mainstream processors and hoping they’ll “make an exception.”

Subscription platforms with user-generated adult content are automatically classified as high-risk. That’s true even if you have moderation, age verification, and spotless chargeback metrics. Planning for high-risk processing from day one saves you from painful migrations.

When evaluating processors, prioritize:

- Marketplace or sub-merchant support: If you plan to remain the merchant of record, your merchant service provider must be able to configure this payment setup.

- Clear adult content policies: If a processor won’t say “yes, we support adult platforms” in writing, walk away.

- Strong chargeback and fraud tools: Adult platforms are judged harshly on dispute ratios, so prevention matters even more than refunds. Use a processor that offers proper fraud and chargeback management tools.

- Multiple acquiring banks: If one bank exits the space, your processor should be able to reroute traffic without shutting you down.

Build redundancy early. OnlyFans doesn’t rely on one processor — and neither should you. Even at launch, plan for backup processing by using multiple processors or merchant accounts. This ensures you’re not one policy change away from losing revenue overnight.

Here’s why you should work with SecureGlobalPay instead

Adult merchants and adult platforms struggle with payment processing for one simple reason: most banks and mainstream processors don’t actually want this business.

High-risk merchant services providers exist to resolve exactly this kind of challenge. Here are just some of the benefits of partnering with SecureGlobalPay:

- Adult merchant account: Your business is underwritten upfront with banks that knowingly support adult content, so there are no surprises later. We can help you set up both domestic and offshore merchant accounts.

- Secure payment gateway: A powerful gateway designed for high-risk traffic, recurring billing, and adult-friendly MCCs. It includes AI-fraud detection, chargeback management tools, multi-merchant account setup, and numerous payment options.

- Quick approval: Clear requirements, realistic timelines, and approvals based on what you actually sell.

- Global payments: Accept payments from international customers in dozens of currencies and support creators worldwide.

- Fair and transparent pricing: Our rates are explained clearly, with no bait-and-switch tactics. Integrachge-plus pricing.

- Expert support: You will work with seasoned experts who understand adult businesses and know how to minimize risks.

If you’re ready to set up reliable, adult-friendly payment processing, apply with SecureGlobalPay and get a solution built for your business.

FAQs

OnlyFans uses a combination of payment processors and acquiring banks, including mainstream providers like Stripe alongside adult-friendly processors such as CCBill. Transactions are routed across multiple banking relationships to manage risk and scale.

OnlyFans primarily accepts credit and debit cards, including Visa and Mastercard. Availability of specific card brands and alternative methods can vary by country. Prepaid cards or certain banks may be declined due to adult-content restrictions.

OnlyFans most likely works with multiple acquiring banks, rather than a single institution. The exact relationships aren’t publicly disclosed.

For adult membership sites and subscription platforms, high-risk processors are almost always the best option. Providers like SecureGlobalPay offer proper adult merchant accounts, a secure payment gateway, and recurring billing support, combined with transparent interchange pricing and expert support.