How to Negotiate a Better Merchant Services Rate and Agreement

Many merchants — especially high-risk businesses — assume their processing costs are fixed simply because providers frame them that way. In reality, only part of what you’re paying is truly set in stone.

Let’s be clear upfront: this guide won’t promise miracle savings or claim you can negotiate interchange rates set by card brands. That’s not how the system works. What it will do is show you where real leverage exists, what fees are negotiable, and how to approach conversations with processors from a position of confidence.

At SecureGlobalPay, we review merchant statements daily across industries, risk profiles, and volume levels. We see where merchants overpay and where there is room for negotiation.

QUICK TAKEAWAYS

- Most savings come from negotiating processor markup — not interchange or card network fees.

- Understanding your monthly statements and merchant processing agreement (MPA) is the foundation of any successful rate negotiation.

- High-volume merchants with low chargebacks typically have more leverage than they realize.

- Transparent pricing, flexible contract, and capable customer support often matter more than chasing the lowest possible fees.

Let’s start at the ground floor: understanding your current processing costs.

Understanding what you’re currently paying for

Your processing costs aren’t a single number. They’re made up of multiple layers, and only some of those layers are negotiable. You need to understand which is which.

The three buckets of merchant processing costs

Recurring costs tied to your merchant account can be split into 3 categories:

- Interchange fees: These are set by the card brands and paid to the issuing banks. Interchange varies by card type, transaction method, and risk factors — but it is not negotiable with your processor.

- Card network & assessment fees: These are fees charged by the card networks themselves (like Visa or Mastercard) for using their rails. Like interchange, these fees are fixed and apply to all processors.

- Processor markup: This is where your provider makes money — and where negotiation actually happens. Markup can include basis points, per-transaction fees, monthly fees, and assorted “service” charges.

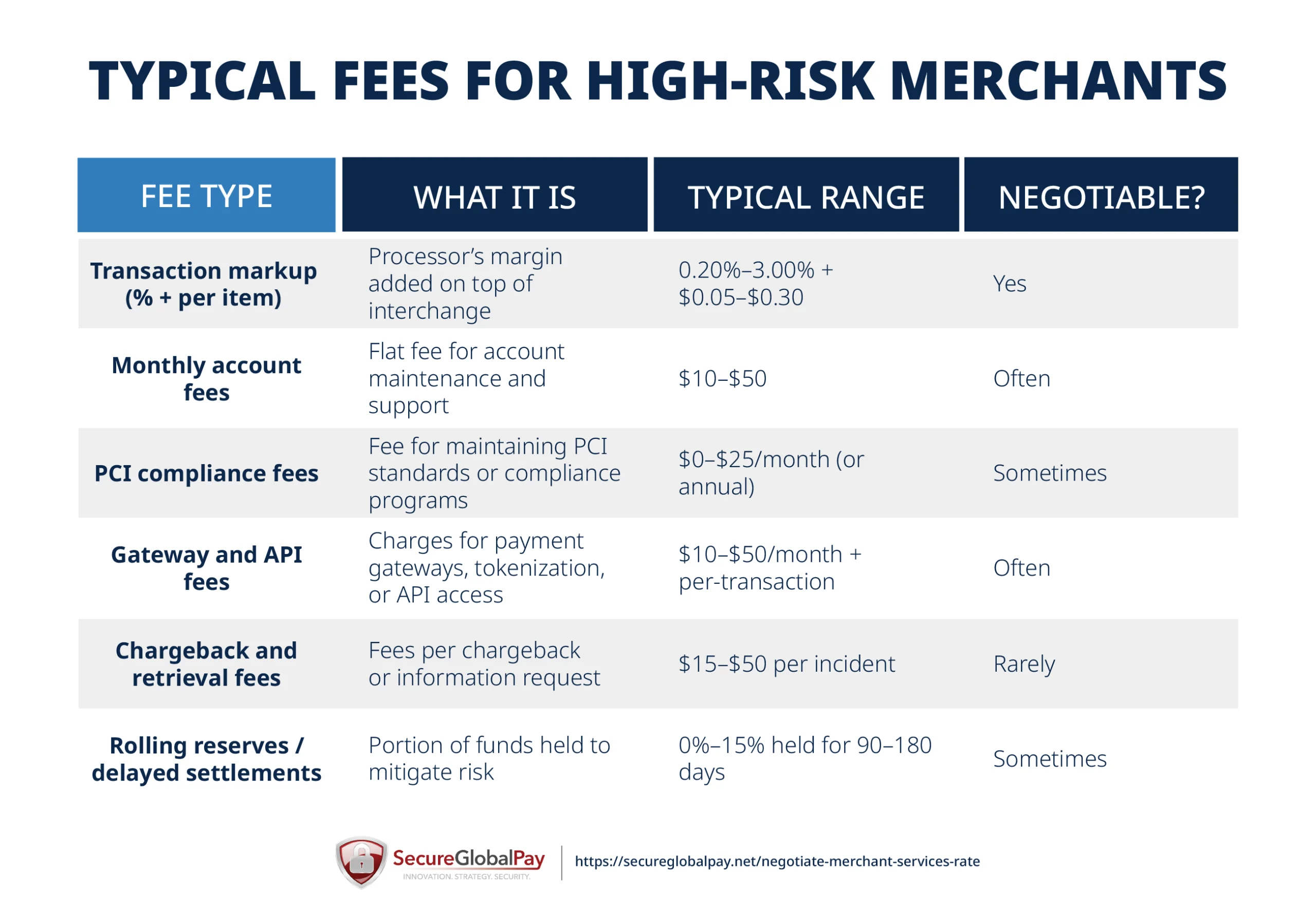

Common fees faced by high-risk and high-volume merchants

Processors price risk based on two broad factors:

- Industry-level risk: Certain industries statistically carry higher fraud, refund, or chargeback rates. That baseline risk often leads to higher starting markups.

- Merchant-specific risk: Your actual performance matters just as much. Volume consistency, average ticket size, refund ratios, chargeback history, and operational maturity all affect pricing.

This is why high-risk and high-volume merchants tend to see more line items on their monthly statements compared to low-risk businesses. Most of these costs are justified, but many of them are negotiable.

You’ll typically find these fees in two places: your merchant service agreement and your monthly processing statements.

For a more detailed breakdown, check out our guide on high-risk merchant account fees and rates.

Red flags that signal you’re overpaying

If you spot one or more of the red flags below, it doesn’t automatically mean your provider is acting in bad faith. But it does mean you should take a closer look before renewing, renegotiating, or increasing volume.

Pricing red flags

The following pricing-related issues often indicate that a merchant is paying more than necessary or lacks full visibility into how their rates are calculated:

- Tiered pricing with vague rate ranges: Transactions are grouped into categories like “qualified mid” or “non-qualified” without clear rules. This makes it difficult to predict true costs and often results in higher effective rates over time.

- Non-disclosed markups: When a processor can’t clearly separate interchange, network fees, and their own markup, it becomes nearly impossible to verify whether you’re being charged fairly.

- Excessive per-transaction fees at scale: Flat per-item fees that remain high as volume increases can quietly erode margins, especially for merchants processing thousands of transactions per month.

- Sudden mid-contract rate increases: Unexpected fee or markup increases without performance-based justification or advance notice are a strong indicator of misaligned incentives.

Merchant service agreement red flags

Good contract terms can be just as important as processing rates. Watch out for:

- Long-term processing agreements with auto-renewals: Multi-year agreements that renew automatically can trap merchants in outdated pricing even after risk decreases or volume improves.

- Large early termination fees: High cancellation penalties discourage merchants from exploring better options and are often used to compensate for uncompetitive pricing.

- No dedicated account manager: Without a clear point of contact, pricing questions and operational issues tend to go unresolved. If you get hit with a merchant account hold, and your provider is unresponsive, it can devastate your bottom line.

- Slow or evasive responses to pricing questions: Delays or vague explanations when asking about fees often indicate a lack of transparency rather than complexity.

Knowing your leverage as a merchant

Processors price risk and effort just like merchants price their own products. The stronger your profile looks on paper, the more flexibility merchant service providers have.

Factors that strengthen your position

The following factors signal lower risk, higher value, or long-term stability to a processor, making them more willing to adjust pricing and terms:

- High processing volume: It’s simple — the more you process, the more room a processor has to lower markups or reduce per-transaction fees.

- Consistent processing history: Stable month-over-month volume demonstrates operational maturity and lowers the perceived risk of sudden spikes or account issues.

- Low chargeback ratios: Fewer disputes reduce operational overhead and financial risk, strengthening your case for lower risk-based pricing.

- Strong refund and customer service practices: Clear refund policies and responsive support reduce disputes before they become chargebacks, which processors view favorably.

- Multi-year operating history: Longevity signals business stability and lowers concerns about sudden closures or volume volatility.

Factors that weaken your leverage

On the other hand, these issues can limit a processor’s willingness to negotiate:

- Spikes in chargebacks: Sudden increases in disputes raise immediate red flags and often result in tighter controls rather than rate reductions.

- Poor documentation: Incomplete business information, unclear product descriptions, or outdated policies increase perceived risk.

- Unstable volume: Large swings in transaction volume make revenue less predictable and increase exposure for the processor.

- Lack of alternative offers: Without competitive quotes or viable backup options, you have less practical leverage in pricing discussions.

Negotiating a better merchant services rate and processing agreement

Your payment processor or high-risk merchant service provider should be your partner. As such, these negotiations should not be about ultimatums or threats — they should focus on presenting a clear business case and asking for specific improvements based on performance, volume, and risk profile.

Step 1: Gather the right documents

Before you try to lower your processing rate, make sure you’re working with real data. Having the right documentation shows preparation, credibility, and seriousness.

At a minimum, you should have:

- 3–6 months of recent processing statements: These show actual volume, effective rates, and fee patterns that matter in negotiations.

- Current contract terms: Including pricing schedules, reserve requirements, renewal clauses, and termination fees.

- Chargeback and refund metrics: Clear numbers help demonstrate improved performance or stable risk levels.

- Business profile updates: Any growth, operational improvements, compliance upgrades, or process changes that reduce risk or increase volume.

Step 2: Know exactly what you’re asking for

Asking to “lower your rate” gives the provider too much room to deflect, reframe, or offer changes that don’t actually move the needle.

Try to be clear and specific. Depending on your business and risk profile, your ask might include:

- Lower markup (basis points): A direct reduction in the processor’s percentage on top of interchange, which has the biggest long-term impact on costs.

- Reduced per-transaction fees: Especially important for high-volume merchants where small per-item charges add up quickly.

- Fee eliminations or consolidations: Removing duplicate, outdated, or low-value monthly and annual fees.

- Reserve reductions or release timelines: Lowering reserve percentages or shortening hold periods as performance improves.

- Contract flexibility: Shorter terms, removal of auto-renewals, or reduced termination penalties.

- A combination of the above: Many successful negotiations involve trade-offs rather than a single change.

Step 3: Start the conversation

How you frame the conversation matters just as much as what you ask for. Leading with threats or comparisons usually puts providers on the defensive and slows everything down.

A strong opening focuses on performance and growth:

- Position it as a review: Make it clear you’re reassessing pricing based on volume, history, and current business needs.

- Reference volume growth and performance improvements: Point to increases in processing volume, reduced chargebacks, or improved refund practices since the account was approved.

- Signal that you understand pricing mechanics: Acknowledge that interchange and network fees are fixed and focus the conversation on markup, per-transaction fees, reserves, or contract terms.

Processors are far more willing to negotiate when they see that you understand how pricing works and that your request is rooted in measurable improvements — not emotion or pressure.

Do not fall into the trap of “best rate merchant services”

Getting a good merchant service rate matters, but it shouldn’t be the only thing you evaluate. A provider can offer “the best rate” on paper while falling short where it actually counts — limited payment options, unreliable integrations, slow support, or rigid merchant processing agreements that make it hard to adapt as your business grows.

In practice, these gaps cost more than a slightly higher processing fee. Downtime, delayed settlements, unresolved chargebacks, and constant back-and-forth with support teams drain time, cash flow, and mental energy.

Instead of chasing the lowest advertised rate, look for a long-term partner: transparent pricing, responsive support, flexible contracts, and systems that work reliably as your volume and complexity increase.

How SecureGlobalPay approaches pricing for merchant services

Our philosophy is built on a few core principles:

- Transparency over sales tactics: We clearly separate interchange, network fees, and markup so merchants understand exactly what they’re paying for.

- Risk-based pricing that evolves: Pricing is based on actual merchant performance and adjusted over time.

- Willingness to negotiate when it makes sense: High-volume merchants and businesses showing clear improvement and growth have real opportunities to reduce costs.

- Long-term partnership mindset: We focus on stability, flexibility, and alignment rather than short-term contracts or artificial lock-ins.

- Cost reduction beyond rates: We help each merchant avoid disruptions, reduce chargebacks, and proactively look for issues and cost-saving opportunities.

If you’re reviewing your current merchant service rates — or feel your provider isn’t aligned with your business anymore — we welcome merchants who want clarity, flexibility, and a partner that grows with them.

Fill out our simple online application to get a personalized quote. It’s completely free.

FAQs

Yes — many merchant fees are negotiable, especially processor markup, per-transaction fees, monthly fees, and reserve terms. Interchange and card network fees are set by the card brands and are not negotiable, so most real savings come from negotiating the processor’s margin.

Start by understanding your current pricing and identifying what’s negotiable. Come prepared with recent statements, performance metrics, competitors’ quotes, and specific requests (such as lower markup or reduced fees). Frame the discussion as a pricing review rather than a threat. Clear data and specific requests lead to better outcomes.

A merchant rate is the total cost a business pays to process card transactions, typically expressed as a percentage plus a per-transaction fee. It includes interchange fees, card network assessments, and the processor’s markup.

There’s no single “good” rate — it depends on your industry, volume, risk profile, and transaction mix. In general, a good rate is one that reflects your actual risk and performance, is fully transparent, and comes with a fair contract and reliable support — not just the lowest advertised percentage.