Getting a High-Risk Merchant Account and Gateway for Shopify Merchants

Selling high-risk products on Shopify can be tricky. While Shopify makes it easy for most businesses to start selling online, its in-house payment solution, Shopify Payments, doesn’t support every type of business. If your store falls into a “high-risk” category, you might find your account suddenly on hold — or worse, terminated.

To avoid that, you should partner with a third-party high-risk payment processor for Shopify, like SecureGlobalPay. We provide both a high-risk merchant account and a Shopify-compatible payment gateway. Ensure you can continue processing payments without interruption.

HIGH-RISK SHOPIFY MERCHANT ACCOUNT & GATEWAY

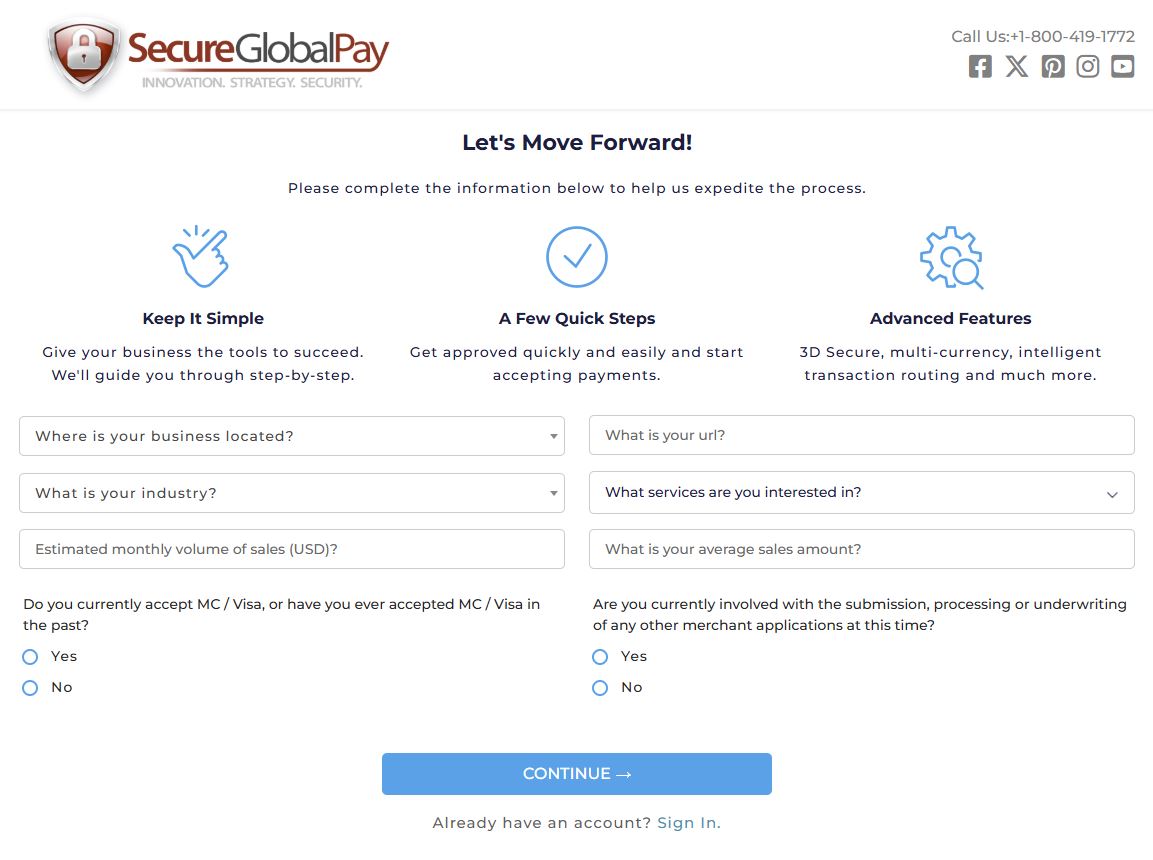

Quick and easy online application!

If you want to learn more, in this quick guide, we’ll explain how to set up payment processing as a high-risk Shopify merchant.

Which Shopify merchants need a high-risk merchant account?

Shopify keeps a tight lid on what it considers “acceptable risk.” In general, if your business has a higher chance of chargebacks, legal issues, or regulatory scrutiny, Shopify Payments won’t support it.

According to Shopify Payments eligibility and Terms of Service, these restrictions apply to:

- Products with legal or regulatory limitations, like CBD, cannabis paraphernalia, or tobacco products

- Adult-oriented content or services

- Supplements and nutraceuticals, especially those making medical claims

- Firearms, weapons, or ammunition

- Online gaming, gambling, or fantasy sports

- Subscription-based services with high chargeback potential

- E-cigarettes and vaping products

- Counterfeit products or services that infringe on intellectual property rights

- Travel, ticketing, and event-related businesses with variable delivery risks.

Even if your store is perfectly legitimate, Shopify Payments’ risk algorithms can still flag you based on transaction patterns, customer disputes, or even your product keywords. Once that happens, they might hold your funds or disable payments altogether.

“In short:” If your business is considered high-risk, get a high-risk merchant account and payment gateway from a specialized provider before you start selling on Shopify.

Steps to take if Shopify Payments refuses to work with you

If Shopify Payments suddenly freezes your account or refuses to approve your application, don’t panic — it’s a common situation for merchants in high-risk industries. The good news is you can still keep your store running with the right setup.

Here’s what to do next:

- Confirm the reason for the suspension: Check your Shopify admin or email for a notice from Shopify Payments. They’ll usually mention the reason — like prohibited products, excessive chargebacks, or risk classification.

- Keep your store active: Don’t close your Shopify account. Most liklely, you can still use the platform; you just need a different payment processor.

- Apply for a high-risk merchant account. Reach out to a processor that specializes in high-risk industries, such as SecureGlobalPay, to get a merchant account and gateway that fits your business model.

- Integrate a high-risk payment gateway: Once approved, connect your new payment gateway to Shopify so you can resume accepting payments.

- Inform your customers: If payments were temporarily disabled, post a quick notice or email customers once you’re back up to reassure them that checkout is working again.

With these steps, you can usually get back to processing payments in just a few days (without having to switch platforms or rebuild your Shopify store from scratch).

Recommended reading #1: How to Choose a Merchant Service Provider? 13 Key Evaluation Questions

Recommended reading #2: How to Cancel Merchant Services and Switch to a New Provider

What do you need as a high-risk merchant selling on Shopify?

Once you know Shopify Payments won’t work with your business, it’s time to set up a proper payment solution that supports high-risk industries.

Apply for a Shopify high-risk merchant account

A high-risk merchant account is a special type of account designed for businesses that traditional payment processors avoid. It allows you to safely accept and process payments, even if your products, services, or chargeback rates fall outside Shopify’s comfort zone.

Here’s why you need one:

- It ensures your business stays online and processing payments legally.

- It reduces the risk of sudden holds or frozen funds.

- It’s tailored to your industry, taking into account chargeback ratios, customer profiles, and transaction volume.

To apply, you’ll need to contact a provider like SecureGlobalPay, which specializes in underwriting high-risk merchants. These days, the application process is simple and can often be completed using an online form.

During the application process, you’ll have to submit specific documents. The exact information required will depend on your industry and the type of products you are selling. In general, you will be asked to provide:

- Business license or incorporation documents

- Valid government-issued ID

- Recent bank statements (usually the last 3 months, depending on your business type)

- Previous processing history (if available)

- A voided business check or proof of bank account

Once approved, we will set up your merchant account and provide you with the credentials to connect it to Shopify.

Connect your store with a Shopify high-risk payment gateway

Once your merchant account is approved, the next step is to connect the payment gateway to your Shopify store. The gateway is what securely transfers payment data between your Shopify checkout, your customers’ banks, and your new high-risk merchant account.

A robust gateway ensures that transactions are processed safely, chargebacks are managed correctly, and your checkout stays smooth for all customers.

Here’s how to connect a third-party gateway to Shopify:

- Choose your gateway provider: Pick a high-risk payment gateway that supports your business type and integrates directly with Shopify.

- Get your credentials: Once your account is set up, your provider will give you an API key or gateway login details.

- Log in to Shopify Admin: Go to Settings → Payments → Add Payment Method → Third-Party Providers.

- Select your provider. Choose the gateway you were approved for, then paste in your credentials.

- Test your checkout. Always run a few test transactions to confirm that payments are flowing correctly.

Why use SecureGlobalPay as your main high-risk payment processor for Shopify

When you’re running a high-risk business, stability and reliability matter more than anything. SecureGlobalPay specializes in high-risk payment processing and provides a modern, Shopify-compatible payment gateway that helps merchants stay online and get paid.

Getting both your merchant account and gateway from the same provider means faster onboarding and approvals. You don’t have to juggle multiple providers or integrations — SecureGlobalPay handles the entire setup.

Mini Case Study:

Over the last few years, we have onboarded dozens of Shopify merchants — all with the same story. Shopify auto-approves them on sign-up. They set up their Shopify store and start selling. Shortly after, when Shopify is done post-underwriting the account for one reason or another, they wake up to a notification that their account has been terminated due to their business type. Businesses that sell prohibited or regulated products (such as paraphernalia, firearms, ammunition, accessories, tobacco, certain Nutra, and adult novelties are not permitted.

It is a stressful situation that can be easily avoided by working with a high-risk provider from the start.

If you’re running a high-risk Shopify store and want reliable payment processing, SecureGlobalPay is built for you.

👉 Apply today using our online application or reach out to partners@secureglobalpay.com if you have any questions about setup or eligibility.