How to Get a UK High-Risk Merchant Account and Payment Gateway

Payment processors tend to place merchants in categories based on the risks their business model and industry pose. High-risk merchants that want to have a UK account need to apply with one of the UK high-risk merchant account providers in order to accept and process credit card payments.

If you are looking for that (or a high-risk payment gateway), we’ve got you covered. Start the process by clicking on the image below and filling out our merchant pre-application form:

For those who just want to learn more, let’s review the process of setting up a high-risk merchant account in the UK, who needs one, and how this all connects to a payment gateway.

Which businesses need a UK high-risk merchant account?

A high-risk merchant account is a type of bank account designed for businesses considered to pose a higher risk of fraud and chargebacks according to credit card processors and sponsoring banks.

Industries often categorized under this label include adult entertainment, travel, gambling, telemarketing, certain types of e-commerce, pharmaceuticals, and many more. These businesses may face difficulties in securing merchant services through conventional channels due to their perceived risk.

Generally, there are two main reasons why businesses open a high-risk merchant account in the UK:

- Any UK-based business operating within industries known for high chargeback rates or regulatory scrutiny might require a high-risk merchant account in the UK.

- You are an international merchant who wants to open a high-risk offshore merchant account in the UK.

While being flagged as high-risk comes with glaring downsides, it does offer some benefits as well.

Cons of being a high-risk merchant:

- Higher fees and charges: One of the downsides to high-risk accounts can be the cost. Providers charge higher fees to offset the risk they take on. This can include setup fees, higher monthly fees, and higher transaction fees.

- Longer settlement periods: Funds from sales may not be available immediately and can often be held for longer periods to manage risk.

- Stringent contract terms: High-risk accounts often come with stricter terms and conditions, which might include automatic renewal clauses, early termination fees, and more.

Pros of having a high-risk merchant account:

- Broader business opportunities: Access to a high-risk account allows businesses to operate freely in industries otherwise restricted by standard merchant accounts.

- Increased security measures: Providers of high-risk accounts typically offer advanced fraud protection tools that can safeguard the business from fraudulent transactions and chargebacks.

Global market access: These accounts often support transactions in multiple currencies, helping businesses expand their reach beyond the UK.

Understanding these factors helps you know what to expect from high-risk merchant services.

How are businesses assessed by high-risk merchant providers in the UK?

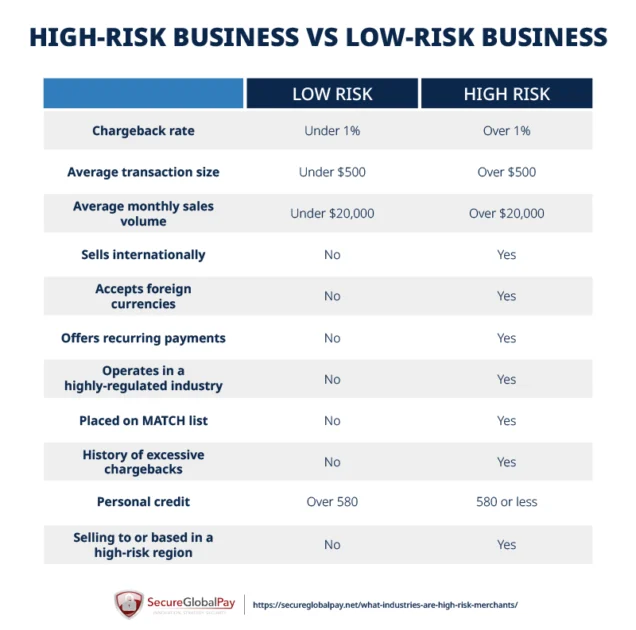

US and UK merchant account providers and underwriters use a fairly similar process to assess if your business is considered high-risk.

They will look at the factors like:

- Your business model: Subscription models, recurring payments, affiliate businesses, drop shipping, massive number of “free trials” — they often see higher chargeback rates and as such are considered more risky.

- Industry type: Adult, gambling, casino, firearms, and marijuana-related products and services are almost by default considered high-risk due to their sensitive nature and heavy regulations.

- Chargeback rates, average transaction sizes, and monthly sales volumes.

- Financial stability: The company’s financial records and how many years they have been in business says a lot about its stability. This is one of the reasons why banks are not excited about providing standard merchant accounts to start-ups.

- Payment acceptance methods: Card-not-present transactions like online purchases, mobile payments, mail/telephone sales, or any situation where the physical card isn’t used directly, pose a higher risk.

This is not a complete list, but it covers the most common reasons why businesses get classified as high-risk. For a more detailed breakdown, take a look at our guide on high-risk industries.

Can high-risk UK businesses get instant approval for their merchant account?

High-risk merchant account instant approval in the UK does not exist. As a matter of fact, be it the UK, the US, or any other western country, banks and merchant services providers need to do their due diligence before approving any account.

Big payment processors like Stripe or Paypal will often allow you to just sign up and create an account. However, as soon as they realize you are high-risk, they will terminate it and freeze your funds.In our experience, it takes 3 to 7 business days to approve high-risk merchant accounts. The image below shows several ways in which you can speed up and ensure a smooth approval process.

What are the fees and pricing involved for high-risk merchant accounts in the UK?

Different merchant account providers offer different fees and pricing. We always recommend merchants to shop around to find the one that best fits your business and budget.

Here’s a quick cost overview:

- Setup and registration fees: Fees can vary widely depending on the service provider and the business’s specific risk level. Some high-risk merchant service providers, like SecureGlobalPay, do not charge setup fees.

- Transaction fees: For a high-risk business, this is about 2% over cost plus a fixed transaction fee of $0.25 to $0.35 per transaction depending on the pricing structure.

- Refund fees: Some providers also charge a fee for processing refunds, separate from the transaction fees are typically around $0.25 to $0.35 per refund.

- Rolling reserves: Depending on the business type and risks involved, these can vary between 5% and 15% of the transaction volume and can be held for three months or up to one year, depending on the scenario.

- Chargeback fees: They can be significant, generally around $25.00 to $50.00 per chargeback. These fees are in addition to the actual chargeback amount.

- Termination fees: These can be pretty steep if you are in a long term contract. Make sure and discuss these before entering into an agreement.

Apart from these fees, there might be costs related to compliance and additional security measures (think fraud prevention tools).

Carefully review and negotiate your merchant agreements to ensure transparency and avoid unexpected expenses!

We at SecureGlobalPay work extra hard to have simple transparent pricing — but many merchant services providers do not.

What is the best high-risk payment gateway in the UK?

A payment gateway is a technology used by merchants to accept debit or credit card purchases from customers. It acts as an intermediary between the merchant’s website (or other point of sale) and the payment processor. The gateway ensures that customer data is processed securely and efficiently.

SecureGlobalPay has one of the best high-risk payment gateways in the UK:

- Notable for: Its flexibility in working with a wide variety of high-risk businesses and its excellent track record in securing stable merchant accounts.

- Features: Offers a range of payment solutions including eCommerce payment processing, text to pay services, ACH transactions, mobile payments, robust fraud prevention systems, fast settlements, multi-currency support and seamless integrations. Known for its competitive pricing and personalized customer service.

When evaluating high-risk payment gateways (in or outside of UK), pay close attention to:

- Security features: Robust fraud detection and prevention tools are essential to minimize the risk of chargebacks and fraud.

- Integration capabilities: The ease with which the gateway can integrate with existing systems is crucial for seamless operations.

- Customer support: Effective and responsive customer support ensures issues can be addressed promptly, reducing potential disruptions.

- Compliance: Adherence to payment industry standards and regulations, such as PCI DSS, is critical for maintaining secure operations.

If needed, consult with payment experts to ensure you choose a gateway that best fits your operational requirements and budget constraints.

Set up a UK high-risk merchant account and payment gateway with SecureGlobalPay

Whether you are based in the UK or want to open an offshore account, SecureGlobalPay can quickly set you up with a UK high-risk merchant account.

Here’s a few benefits of choosing us as your payment processor:

- We have or own secure payment gateway which safe and secure (PCI-DSS compliant), and can be set up based on your needs

- You get free fraud prevention tools

- You can implement a wide variety of payment methods

- Our dedicated account managers have 15+ years of industry experience each and will help you guide through the whole approval process and account setup

- We don’t tie you with long-term contracts nor have any termination fees

- We offer transparent and fair pricing with no hidden fees

Learn more by sending a question to partners@secureglobalpay.net or get started immediately by filling out our online application form: