Square Deactivated Your Account? 5 Steps to Protect Your Business

Typically, Square notifies merchants of deactivation by email. The message often states that your account has been “deactivated” or “closed due to risk concerns” and may reference a violation of their terms. In some cases, you’ll also see a notice when you log into your dashboard.

The explanation is often vague, which makes the situation even more frustrating.

While this is not a great situation to be in — you do have options.

Let’s break down what might have happened, what it means for you, and what to do next.

QUICK TAKEAWAYS

- If Square deactivated your account, your funds may be held for up to 90 days or more.

- Most Square shutdowns are triggered by chargebacks, sudden volume spikes, or high-risk business models.

- Appeals sometimes work, but permanent closures are rarely reversed.

- High-risk merchants should immediately switch to a high-risk payment processor to avoid repeated holds, freezes, and shutdowns.

What does it mean when your Square account is deactivated?

Here’s what typically happens when Square deactivates your account:

- Payment processing stops immediately. You can’t run new transactions.

- Payouts may be frozen. Any funds in your balance may be placed on hold.

- Account access may be limited. You might still be able to log in and view reports — or you may be locked out entirely.

- Customer disputes still apply. Chargebacks and refunds can continue even after deactivation.

In general, Square holds funds for up to 90 days. This is usually tied to their chargeback window. If Square believes your account poses a higher risk (for example, high chargeback potential), it may extend the hold period.

What happens to the money in your account? The good news is that the funds in your Square balance are not automatically lost. However:

- They may be held in reserve for up to 90 days (or longer if Square estimates a high risk of disputes) to cover chargebacks.

- After the hold period ends, remaining funds are typically released.

- If there are active disputes, Square will deduct chargeback amounts before releasing the remaining funds.

If you have pending payouts at the time of deactivation, those are usually included in the fund hold.

Most common reasons for Square account deactivation

Square (now part of Block, Inc.) rarely provides detailed explanations when it deactivates an account. In many cases, you’ll receive a general statement referencing “risk concerns” or a violation of their terms of service.

Why so vague? Probably due to the costs and resources needed to implement a better system. Plus, if they revealed too many details, bad actors could more easily work around them. As a result, legitimate merchants often get caught in automated reviews with little clarity.

Here are the most common reasons Square accounts get shut down:

- High chargeback rate: If too many customers dispute transactions, Square sees your account as a financial liability. Even a short spike in chargebacks can trigger an automated shutdown.

- Selling restricted or prohibited products: There is a wide range of businesses and products that Square doesn’t support — like marijuna-derived products, adult content, MOTO payments for age-restricted products, etc.

- Sudden spike in sales volume: A large increase in transaction size or daily volume can look suspicious, especially for newer accounts.

- High-risk business model: Subscription billing, pre-orders, crowdfunding-style sales, and long fulfillment times increase the risk of disputes. Even if your business is legitimate, the structure may be considered risky.

- Mismatched business information: If your website, product descriptions, or processing activity don’t clearly match what you stated during signup, it can trigger a review and deactivation.

- Excessive refunds or suspicious transaction patterns: Large numbers of refunds, repeated declined transactions, or irregular processing behavior can signal potential fraud or instability.

- Operating in a restricted location: Processing payments for customers or business operations in unsupported countries can violate Square’s terms.

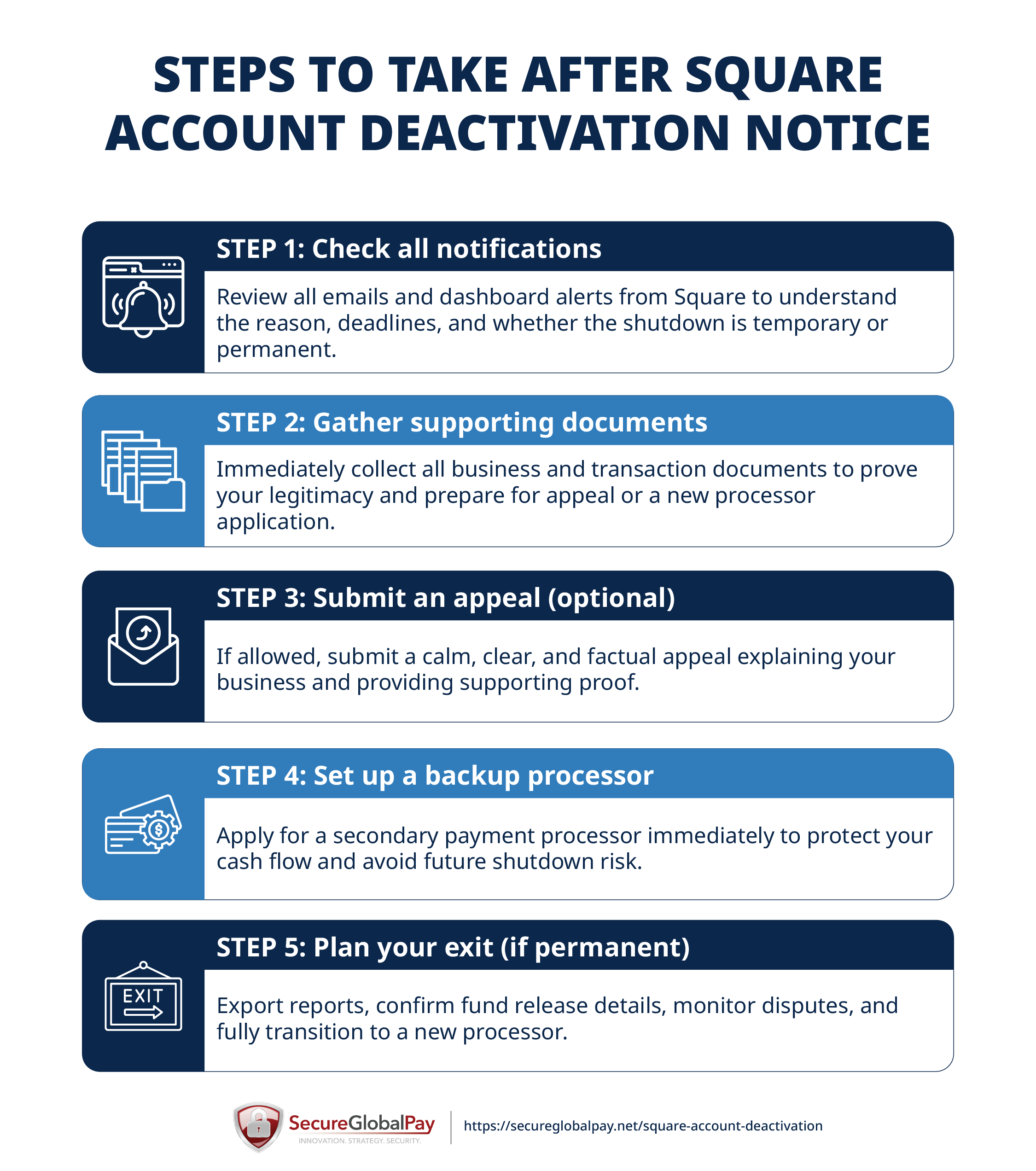

Immediate steps to take after your realize your account has been deactivated

The faster you understand what happened and respond correctly, the better your chances of protecting your funds (and possibly your account). Start with clarity, then move quickly and strategically.

Step 1: Check all notifications

Before you assume the worst, carefully review every recent message from Square.

Start with your email inbox — and don’t forget your spam or junk folder. Read the deactivation email closely. Look for:

- Any stated reason for the shutdown.

- Deadlines to respond.

- Instructions for appeal or verification.

- A list of requested documents.

Next, log in to your Square dashboard (if you still have access). Check for account alerts or review notices that may provide additional details.

Finally, confirm your account status:

- Are payments fully disabled?

- Are funds currently on hold?

- Is this a temporary review or a permanent closure?

You should know exactly what you’re dealing with before taking the next step.

Step 2: Gather supporting documents immediately

If your account is under review, assume Square will want proof — and gather it right away. Delays in providing documentation can hurt your chances of reinstatement.

Common documents to prepare include:

- Government-issued ID (driver’s license or passport).

- Business license or formation documents (LLC, corporation, etc.).

- EIN confirmation letter from the IRS.

- Recent bank statements.

- Supplier invoices or proof of inventory.

- Shipping confirmations and tracking information.

- Customer contracts or service agreements.

- Refund and return policy screenshots from your website.

The goal is to prove that your transactions are legitimate and that customers are receiving what they paid for.

(Optional) Step 3: Submit an appeal or verification response

If Square gives you the option to appeal or respond to a review, use only their official channel — typically the reply link in the email or the notification inside your dashboard. Don’t try to bypass the system with multiple tickets or social media messages.

When you respond, keep it calm, factual, and concise.

Your appeal should clearly explain:

- What your business does: Be specific. Describe your products or services, how customers find you, and how fulfillment works.

- Why your transactions are legitimate: Reference invoices, shipping confirmations, signed agreements, or delivery proof.

- What steps you’ve taken to reduce risk: For example, clearer refund policies, fraud filters, better customer communication, or adjusted billing practices.

Remember: the person reviewing your case is looking for risk signals. Your goal is to reduce uncertainty, not escalate tension.

Step 4: Set up a backup payment processor

Do this immediately — even if you believe your account will be reinstated.

PayFacs like Stripe, PayPal, and Square can shut down accounts with little notice. Relying on just one provider puts your entire cash flow at risk. While you’re waiting for a response, you should already be applying elsewhere.

If your business operates in a higher-risk category, don’t apply to another “aggregator” like Square. Instead, look for a specialized merchant account providers that underwrite your business upfront.

When reviewing high-risk merchant services providers, look for:

- Transparent pricing: Most merchants prefer an interchange-plus pricing model with a clear breakdown of all monthly fees involved.

- Chargeback and fraud tools: You’ll want real-time alerts, AI fraud prevention, and integration with leading chargeback management tools and services.

- Rolling reserve transparency: If they require a rolling reserve, it should be disclosed clearly.

- Experience with high-risk merchants: Ask directly what industries they specialize in.

The goal is stability. You want a processor that understands your business model — not one that may shut you down the moment your volume increases.

Free Template for Comparing Merchant Service Providers

Our Google Sheet template arms you with 13 critical questions you should ask each provider to catch red flags and cut through the sales talk — with SecureGlobalPay’s answers already filled in for comparison.

Step 5: If permanently deactivated, plan your exit

If Square confirms that your account is permanently closed, it’s time to shift from appeal mode to exit mode.

Here’s what to do next:

- Download all reports and transaction history: If you still have dashboard access, export sales reports, customer data, tax documents, and chargeback records. You may need these for accounting or disputes later.

- Confirm your final fund release timeline: Ask when remaining funds will be released and whether any reserves will be held longer. Get this in writing if possible.

- Monitor chargebacks during the hold period: Even after closure, customers can still file disputes. Stay on top of notifications so you can respond if allowed.

- Update your website and invoices: Replace checkout links, payment buttons, recurring billing setups, and any saved invoices with your new processor immediately.

Once a processor makes a final risk decision, appeals rarely overturn it. Your energy is better spent securing a different, long-term payment solution.

Switch to SecureGlobalPay

If your business has been flagged as “high risk,” moving to another basic payment aggregator may only lead to another shutdown. That’s where SecureGlobalPay can help.

SecureGlobalPay is a merchant services provider that works with retail businesses and high-risk merchants — with a strong focus on the latter.

With SecureGlobalPay, you receive:

- A dedicated high-risk merchant account.

- A state-of-the-art payment gateway with a multi-MID setup, able to process a wide range of payment methods in multiple currencies.

- Free POS solutions for businesses that qualify.

- Access to cost-cutting programs like cash discounting and dual pricing.

Apply with SecureGlobalPay today and secure a stable payment processing solution built for your business model.

FAQs

To recover a deactivated account, review Square’s notifications carefully and submit an appeal through their official channel. Provide all requested documents, clearly explain your business model, and demonstrate how your transactions are legitimate. Keep in mind that permanent closures are rarely reversed.

Yes. When you agree to Square’s terms of service, you authorize them to place holds or reserves if they believe your account poses financial risk, such as potential chargebacks or fraud.

In many cases, Square holds funds for up to 90 days to cover the chargeback window. In higher-risk situations, funds may be held longer depending on dispute activity.

High-risk businesses are often better served by dedicated merchant account providers that underwrite accounts upfront. Look for high-risk providers like SecureGlobalPay that offer transparent pricing and reserve policies, advanced fraud and chargeback tools, and capable support.