Rolling Reserve Explained: How High-Risk Merchant Account Reserves Work

A rolling reserve can show up under various names like merchant account reserve, merchant holdback, or fund hold. All of these terms point to the same basic idea: a portion of your card sales is temporarily withheld by your payment processor rather than paid out immediately.

Rolling reserves are far more common for high-risk merchants. Banks and processors use them to offset the increased risk of working with such businesses.

Today, we will explain how different types of merchant account reserves work. This will help you understand what’s happening to your money — and how to regain control of your cash flow.

QUICK TAKEAWAYS

- A rolling reserve is a percentage of your sales that a payment processor temporarily withholds to protect against chargebacks, refunds, and fraud.

- High-risk merchants are far more likely to face rolling reserves because of higher dispute exposure, large transaction sizes, or recurring billing models.

- There are different types of merchant account reserves, differing in how the reserve is funded, capped, and released.

- With the right processor, strong chargeback control, and a consistent processing history, rolling reserve terms can often be reduced or removed within a short period.

What is a rolling reserve?

A rolling reserve is a risk management tool used by payment processors and acquiring banks.

Instead of paying out 100% of your daily card sales, the processor withholds a small percentage — often between 5% and 10% — and holds it for a set period of time (commonly 90 to 180 days). After that holding period passes, the funds are released back to the merchant on a rolling basis.

The purpose is to protect the processor and bank from losses caused by chargebacks, refunds, fraud, or sudden business closure. Because disputes can occur weeks or months after a sale is processed, the reserve acts as a safety net.

For high-risk merchants, rolling reserves come with trade-offs.

- The upside: A rolling reserve helps high-risk businesses get approved when they otherwise wouldn’t. It can also create stability with acquirers and, over time, help demonstrate good processing behavior that leads to better terms.

- The downside: Reserves tie up cash flow. Funds you’ve already earned aren’t immediately available to cover inventory, marketing, payroll, or growth. This can feel quite restrictive for fast-scaling businesses and high-volume merchant accounts.

Common types of merchant account reserves

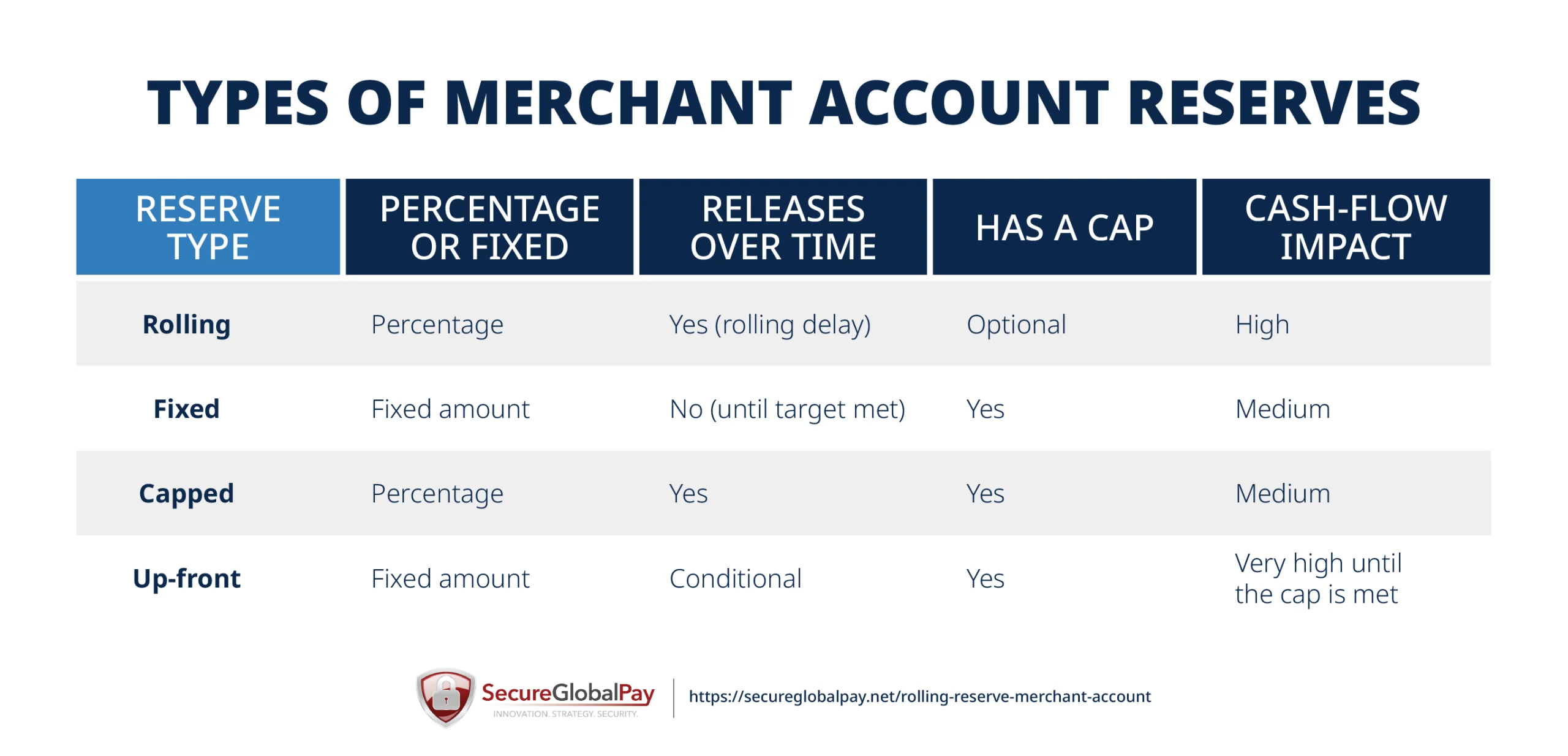

Not all merchant account reserves work the same way. Processors use different reserve structures depending on your risk profile, processing history, and business model. The most common ones include rolling, fixed, capped, and up-front reserves.

You’ll often see processors use some of these terms interchangeably. That can be confusing, but here’s the key point: the name matters less than the release mechanics. What really affects your cash flow — and what you should pay attention to — is :

- How the reserve is funded.

- How long the funds are held.

- When (or if) it’s released back to you.

An example of a rolling reserve

A rolling reserve withholds a percentage of each day’s card sales and holds those funds for a fixed period of time — most often 90, 120, or 180 days. Each day, a new portion is withheld, and each day, the oldest portion (from the end of the holding period) is released. That’s why it’s called “rolling.”

Key traits of rolling reserves:

- Grows and shrinks dynamically with sales.

- High-impact on long-term cash flow.

- Common for high-risk or newer merchants.

Example: A subscription-based nutraceutical company processes $100,000 per month with a 10% rolling reserve held for 180 days. Each month, $10,000 is set aside. In month seven, the $10,000 withheld in month one is released, while a new $10,000 is withheld. The reserve never stops — it just cycles.

An example of a fixed reserve

A fixed reserve requires the merchant to maintain a set dollar amount in reserve at all times. A portion of the funds is withheld until the agreed-upon reserve balance is fully funded. Once that amount is reached, no additional funds are withheld from daily processing — as long as the reserve balance remains intact.

Key traits of fixed reserves:

- Predictable ceiling, which you can plan around.

- Faster normalization once the target is hit.

- Often paired with rolling or capped reserves.

Example: A high-volume, high-risk online electronics retailer is required to maintain a $50,000 fixed reserve. During the first few months of processing, the processor withholds a larger portion of daily settlements until the full $50,000 is collected. After that point, the merchant receives normal payouts. If a spike in chargebacks later reduces the reserve to $42,000, the processor begins withholding again until the balance is restored to $50,000.

An example of a capped reserve

A capped reserve is essentially a rolling reserve with a maximum limit. The processor withholds a percentage of each transaction — just like a rolling reserve — but only until the reserve reaches a predetermined dollar amount. Once that cap is met, no additional funds are withheld, even though the reserve may still be subject to a holding period.

Key traits of capped reserves:

- Predictability helps with cash flow planning.

- A merchant-friendly version of a rolling reserve.

- Very common for high-risk merchants.

Example: A high-ticket coaching business processes $250,000 per month and is placed on a 5% rolling reserve capped at $25,000 with a 180-day hold. For the first six months, 5% of each month’s volume is withheld until the reserve balance reaches $25,000. At that point, withholdings stop. After the 180-day holding period passes, funds begin to release unless a new risk prompts the processor to reapply the reserve.

An example of an up-front reserve

An up-front reserve is collected at the start of the merchant relationship rather than over time. The processor requires a set dollar amount to be funded immediately, often through an initial lump-sum deposit.

Unlike rolling or capped reserves, an up-front reserve does not reduce every future payout once it’s fully funded. The funds simply sit in reserve and are released after the agreed holding period, assuming the account remains in good standing.

Key traits of up-front reserves:

- Immediate protection for the processor.

- Often required for travel, ticketing, subscriptions, or very high chargeback exposure.

- Fund release is conditional, not guaranteed.

Example: A new international SaaS company with limited processing history is required to post a $25,000 up-front reserve held for 180 days. The company pays 15,000 upfront, and the processor withholds an additional $10,000 in settlements during the initial weeks of processing. After that, the merchant receives full payouts going forward. At the six-month mark, the reserve is released, provided chargebacks and refunds stay within acceptable limits.

Businesses that need a rolling reserve merchant account

Rolling reserves aren’t random or punitive — they’re typically applied when a processor sees higher financial or chargeback risk. If your business falls into one or more of the categories below, a reserve is more likely to be required as a condition of approval:

- High-risk industries: Businesses in verticals like supplements, adult, CBD, online gaming, travel, or digital services tend to have higher dispute rates or regulatory exposure.

- High-volume or high-ticket businesses: Merchant accounts with large monthly volumes or expensive individual transactions create bigger potential losses if refunds or chargebacks occur, making reserves more likely.

- New businesses: Merchants without processing history haven’t yet proven stability, so processors use reserves as a safeguard during the early months.

- Seasonal businesses: Businesses with sharp spikes followed by long slow periods (like holiday sales or event-based services) may struggle to cover post-season chargebacks.

- International or cross-border businesses: Cross-border transactions carry higher fraud and dispute rates, especially when selling into regions with weaker cardholder verification.

- Subscriptionor recurring billing models: Customers can dispute charges long after the initial sale, especially if cancellations or billing terms aren’t clear.

- Businesses with poor credit or financial history: Prior merchant account closures, excessive chargebacks, or weak financials signal higher risk to banks.

How does SecureGlobalPay handle account reserves?

SecureGlobalPay is an experienced high-risk merchant services provider that works with hard-to-place businesses. Our focus is on structuring reserves in a way that protects the bank without unnecessarily choking cash flow for merchants.

Here’s how SecureGlobalPay helps high-risk merchants manage reserves:

- Matching your business with the right acquirers: Different acquiring banks specialize in different risk profiles. SecureGlobalPay places merchants with acquirers that understand their industry, which can lead to lower or no reserve percentages, capped reserves, or shorter holding periods.

- Using modern tools and technology to control risk: Merchants get access to a modern payment gateway with AI-powered fraud detection and integrations with leading chargeback management tools.

- Proactive account monitoring and expert guidance: Instead of waiting for problems to surface, our team actively monitors accounts and provides advice on billing practices, descriptor optimization, refund timing, and dispute responses — helping merchants stay compliant and within acceptable thresholds.

- A clear path toward reserve reduction or release: With consistent processing history and controlled chargeback ratios, SecureGlobalPay works with acquirers to renegotiate reserve terms over time, including reductions, caps, or full removal when possible.

Sign up with SecureGlobalPay — and let us help you get approved, stay approved, and improve your processing terms!

FAQs about merchant account reserves

No. While reserves are very common for high-risk merchants, they are not mandatory. Factors like processing history, chargeback ratios, ticket size, and business longevity all influence whether a reserve is required and how strict it will be.

Most rolling reserves fall between 5% and 10% of monthly processing volume, though higher-risk accounts may see 15% or more. Lower percentages are often available once a merchant establishes stable processing history.

Holding periods are usually 90, 120, or 180 days. Funds are released on a rolling basis after the hold time passes, assuming the account remains in good standing.

The three most common types are rolling reserves (a percentage held over time), fixed or static reserves (a set balance that must be maintained), and up-front reserves (a lump sum collected at the beginning of the relationship).

PayPal applies rolling reserves to accounts it considers higher risk, typically holding a percentage of each transaction for up to 90 days. These reserves are automated, less negotiable, and governed entirely by PayPal’s internal risk models.

Rolling reserves apply to most credit card transactions (though they are less common for debit cards and card-present transactions). Other payment methods, like ACH or crypto, are typically handled under separate risk and settlement rules.

Yes. Many reserves are reviewable after 3–6 months of clean processing. Lower chargebacks, consistent volume, and good financials improve your chances of reducing the percentage, adding a cap, or removing the reserve entirely.

Yes. SecureGlobalPay works with risk-tolerant acquirers, monitors account performance, and helps merchants improve dispute metrics — often leading to lower reserve amounts or shorter holding periods over time.

Yes. Many retail merchants, as well as established high-risk merchants with strong processing history, qualify for reserve-free accounts. However, high-risk start-ups and newer, higher-risk businesses typically need to start with some form of reserve before earning those terms.