Zero Fee & No Fee Credit Card Processing Explained

As businesses rely more on accepting credit card payments, they need reliable and affordable payment processing. No fee credit card processing, also know as zero fee merchant processing is a solution designed to assist compliant merchants in minimizing fees when accepting debit and credit card payments.

In this post, we will explain everything you need to know about zero fee processing, including how it works, its benefits, legal issues, and how to find the right merchant account provider for this payment model.

What is zero fee processing?

Zero fee credit card processing, also known as no fee payment processing, is a payment model designed to eliminate the processing fees associated with credit card transactions.

In traditional credit card processing, merchants are charged a fee for each transaction, which can significantly cut into their profits. Zero fee payment processing shifts these costs away from the merchant and typically onto the customer.

Under this model, businesses use a special payment processing system that adds a service charge or surcharge to the total amount of the customer’s purchase when they choose to pay with a credit card.

This surcharge is intended to cover the costs associated with credit card processing, including interchange fees, assessment fees, and the payment processor’s markup. As a result, the merchant receives the full amount of the sale without having to pay the usual processing fees.

Is no fee merchant processing the same as surcharging?

No fee merchant processing and surcharging are closely related concepts but they are not exactly the same. No fee merchant processing is a broader term that encompasses various methods businesses use to avoid paying credit card processing fees.

Surcharging involves adding an extra fee to transactions when customers choose to pay with a credit card, effectively passing the cost of credit card processing fees directly to the customer. Surcharges are typically a percentage of the transaction amount and must be clearly disclosed to the customer before the transaction is completed.

No fee payment processing, on the other hand, can include other strategies beyond surcharging. For example, some businesses might opt for a cash discount program or dual pricing, avoiding processing fees altogether by incentivizing cash payments.

How does no fee credit card processing work

With zero fee merchant services, the merchant partners with a payment processing company like SecureGlobalPay, which offers the zero fee merchant processing model. The payment processing company provides the merchant with the necessary equipment and software to process credit card payments.

When a customer pays with a credit card, the payment processing company adds a surcharge, convenience fee, or cash discount merchant processing to the transaction amount.

Here’s an example.

Imagine you own a small bookstore. To combat rising credit card processing fees, you partner with a payment processing company offering a zero fee model. When a customer decides to purchase a new novel priced at $20 with a credit card, the system automatically applies a 3% surcharge to the transaction, making the total $20.60. The additional 60 cents cover the credit card processing fees.

As a result, your bookstore receives the full $20 from the sale, while the customer is informed of and pays the slight surcharge, ensuring transparency and compliance.

Legal considerations around zero fee payment processing

Over the last decade, there were many court cases concerning surcharging practices. The good news for merchants is this practice is now legal in all states except Massachusetts, Maine and Connecticut. Please remember that surcharging and dual pricing are very different pricing models.

However, it being legal doesn’t mean that there are no constraints. Many states have strict surcharging rules, requiring merchants to be highly transparent about their payment processing model and capping the surcharge fee at a specific percentage.

Even if your state has banned surcharging, you’re not left stranded. You can still use a no-cost credit card processing solution by offering a cash discount program. Staying conscious and up to date with local regulations is essential — luckily, there are great online resources about surcharging rules that you can follow.

Additionally, here at SecureGlobalPay, we help every merchant in ensuring compliance with legal and credit card regulations, so you don’t have to worry about anything.

Types of businesses that are a good fit for no fee merchant services

Zero fee merchant processing has become a popular cost-saving measure among businesses of all sizes. They are particularly advantageous for certain types of businesses where the transaction volume is high, the profit margins are thin, or where the average transaction value is substantial.

Here are some sectors and business types that often find no fee merchant services to be a good fit:

- Retail stores: Retail businesses, especially those with high credit card transaction volumes, can benefit from no fee services.

- Restaurants and cafés: With thin margins being a common challenge, restaurants and cafés can use no fee processing to maintain profitability.

- Service providers: Professionals like lawyers, accountants, and consultants, who typically process larger transactions, can also benefit. For these businesses, absorbing credit card fees can be costly, so a no fee model allows them to retain the full value of their invoices.

- Online stores: E-commerce platforms with a high volume of transactions stand to gain from no fee merchant services. Since almost all payments are processed electronically, saving on these fees can lead to significant cost reductions.

- Specialty businesses: Businesses selling high-ticket items or services, such as jewelry stores or high-end electronics, can make no fee processing work in their favor. The cost savings on processing high-value transactions can be substantial.

- Healthcare providers: Dental clinics, private medical practices, and specialty healthcare services, where patient payments are often made via credit card, find no fee processing a way to manage operational costs effectively.

- Nonprofits: Charitable organizations often operate on tight budgets and rely heavily on donations to fund their missions. Implementing no fee merchant services allows them to maximize the amount of donations received.

It’s essential for businesses considering no fee merchant services to assess how the model aligns with their customer base and pricing strategy. Transparency and clear communication with customers about any additional charges are crucial to maintaining trust and satisfaction.

Moreover, businesses should ensure they comply with all applicable laws and regulations related to surcharging or cash discount programs in their jurisdiction.

How “free” is free credit card processing?

While it may sound appealing, in practice, there is no such thing as completely free credit card processing.

Zero cost and no fee services can significantly reduce the direct costs associated with credit card transaction fees — but they don’t eliminate all possible expenses a business might incur:

- Merchants will still have to take care of monthly service fees, fees for PCI compliance, and charges related to chargebacks.

- There are also potential hardware and software expenses. Some payment processors might require merchants to buy or lease POS systems or credit card terminals from them.

- Merchants cannot apply surcharges to debit card payments, regardless of whether the debit card is processed as a credit transaction. This limitation means that businesses will still bear the cost of processing these debit card transactions.

Lastly, the decision to implement a no fee payment processing solution should consider customer satisfaction and the potential impact of surcharges on consumer behavior.

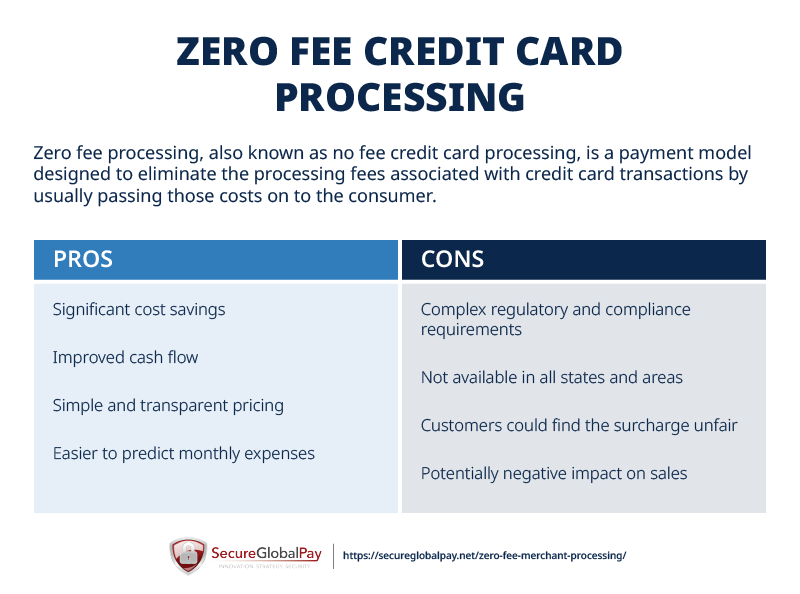

The pros and cons of zero fee credit card processing

Zero fee merchant processing, like any financial strategy, comes with its own set of advantages and challenges. Pros:

- Significant cost savings: By passing processing costs to the customer via surcharges or employing a cash discount program, merchants can preserve their profit margins and improve cash flow.

- Simplicity in pricing: For businesses, particularly small ones, navigating the complex landscape of transaction fees, interchange rates, and processing charges can be daunting. Zero fee processing can offer a more straightforward financial setup, making it easier to predict monthly expenses.

Cons:

- Regulatory and compliance hurdles: Businesses need to navigate legal waters carefully, ensuring they comply with all applicable laws and card network rules.

- Limited application: Businesses still face costs when customers use debit cards, and surcharging is not legal in all states.

- Potential impact on sales: The psychological impact of additional fees at checkout can influence consumer behavior. Some customers might abandon their purchase or seek alternatives if they perceive the surcharges as excessive or unfair.

While for some these cons might be a deterrent to implementing such a model, most businesses will find that the benefits far outweigh the drawbacks.

What to look for in a no fee merchant account provider

A zero fee merchant account is a type of account that allows businesses to process credit card payments without paying high processing fees. When choosing a zero fee merchant account provider, businesses should consider the following factors:

Pricing and hidden fees

Although no fee merchant processing eliminates the majority of credit card processing fees for businesses, other fees may be associated with the service.

For example, the payment processing company may charge monthly fees, setup fees, interchange fees, early termination fees, or any other additional fees for their services.

Carefully review the payment processing statement pricing and fee structure of the zero fee merchant account before signing up.

Security features

When choosing a zero fee merchant account, businesses must also review the security features offered by the payment processor. This includes data encryption and fraud detection technologies that help protect customer data and minimize credit card chargebacks the risk of fraudulent transactions.

Ensure your merchant account provider offers strong security features to keep customer information safe.

Point of Sale (POS) system requirements

Some payment processing companies may require businesses to use specific point of sale systems and software to process transactions.

In general, businesses must ensure that their existing POS system is compatible with the zero fee merchant account or be prepared to switch to a new one.

High processing thresholds

Some zero fee merchant accounts may require businesses to reach a certain processing threshold or monthly minimum service fee before the zero fee policy kicks in. This can be problematic for businesses with low processing volumes or those just starting out.

Focus on providers that offer a zero fee policy with no processing thresholds.

Customer support

Look for providers that offer 24/7 customer support and resources such as online help centers or forums to help you troubleshoot any issues that may arise. You should also get a dedicated account representative to guide you through the whole setup process.

Set up zero fee processing with SecureGlobalPay

At SecureGlobalPay, we understand how important it is for businesses to have reliable payment processing services that can help them reduce their costs and maximize their profits. That’s why we provide customers with the best merchant processing solutions, from zero fee merchant processing and cash discount programs to alternative payment methods.

Learn more by sending a question to partners@secureglobalpay.net or get started immediately by filling out our online application form:

FAQ about free credit card processing

How do I accept payment with no fees?

As long as the payer facilitates it, most banks offer ACH transfers with no fees. While credit card payments can never be completely free, you can add a surcharge to pass those processing costs to the consumer.

How do I avoid payment processing fees?

These days, it is almost impossible to bypass merchant fees without foregoing credit cards, debit cards, or ACH transitions. You can only avoid payment processing fees indirectly, by incentivizing cash payments or through surcharging.

What is a zero percent transaction fee?

Typically, credit card processors charge merchants a fee that is a percentage of the transaction amount. In a zero percent model, this fee is either eliminated or shifted elsewhere, such as being passed on to the customer through a surcharge. This model aims to reduce or eliminate the direct costs to the merchant associated with accepting credit card payments.

What is the cheapest way to take card payments?

The most cost-effective method for accepting card payments largely depends on your business’s specific needs, including transaction volume and size. For small businesses or those with lower transaction volumes, utilizing a Payment Service Provider (PSP) like Square, PayPal, or Stripe can be advantageous due to their straightforward, flat-rate pricing and lack of monthly fees.

For businesses with higher transaction volumes, cash discounting, surcharge programs, flat rate programs, and hybrid programs, can be some ways to reduce credit card processing costs.