How to Implement a Cash Discount Program and Lower Your Merchant Processing Fees

A cash discount refers to a reduction in the price paid for goods or services which sellers offer customers in order to incentivize cash payments. It’s a common method merchants use to encourage quick payment, reduce fees associated with credit card processing, and improve their cash flow. When implemented correctly, cash discounts programs are completely legal. They can benefit both the seller, by accelerating cash receipts, and the buyer, through cost savings. Let’s explore how a cash discount program works, how it differs from a surcharge program, and what steps you need to take to implement it in your place of business.

What is a cash discount program?

A cash discount program is a strategic pricing policy adopted by merchants to encourage customers to pay with cash instead of credit cards. By offering a small discount on the total price at checkout for cash transactions, businesses can incentivize the use of cash. More cash payments means fewer credit card payments — and fewer credit card payments means lower merchant processing fees. The allure of a cash discount program extends beyond reduced processing costs. Other compelling benefits include:

- Improved cash flow: Cash payments are immediate, enhancing a business’s cash flow. There’s no waiting period for funds to clear as there is with credit card payments.

- Customer savings: Customers appreciate the opportunity to save money. A cash discount serves as a direct incentive, potentially increasing customer loyalty and satisfaction.

- Simplicity and transparency: Unlike credit card transactions that can involve complex fee structures, cash transactions are straightforward, fostering a transparent pricing model for both merchants and customers.

- Legal and compliant: When implemented correctly, cash discount programs are legal in all 50 U.S. states, provided they comply with the guidelines set by card networks and regulatory bodies.

In essence, cash discount programs represent a smart move for businesses aiming to minimize costs without compromising on service quality or customer satisfaction.

How does a cash discount program work in practice

Imagine you run a boutique retail store specializing in handmade crafts and local artisan products. You’ve decided to implement a cash discount program. The store has price tags that reflect a price inclusive of a surcharge to cover credit card processing fees. For instance, a handcrafted vase is tagged at $105. This price anticipates the cost of card payment processing. With a cash discount program in place, the process would look something like this:

- Announcement and signage: You strategically place signage throughout the store and at the checkout counter that reads: “Enjoy a Cash Discount!” or “Pay less by paying with cash.”

- The transaction: A customer selects the handcrafted vase priced at $105. During checkout, your staff member reminds the customer that a cash discount is available, reducing the price to $100 if they pay in cash.

- Cash payment: Choosing to utilize the cash discount, the customer pays $100 in cash for the vase. The POS system automatically records the transaction with the applied cash discount, allowing the customer to save $5, and the store avoids the credit card processing fee for this sale.

If the customer opted to pay with a credit or debit card, the cash discount would not be applied. The customer would pay the displayed price of $105, which includes the anticipated card processing fee.

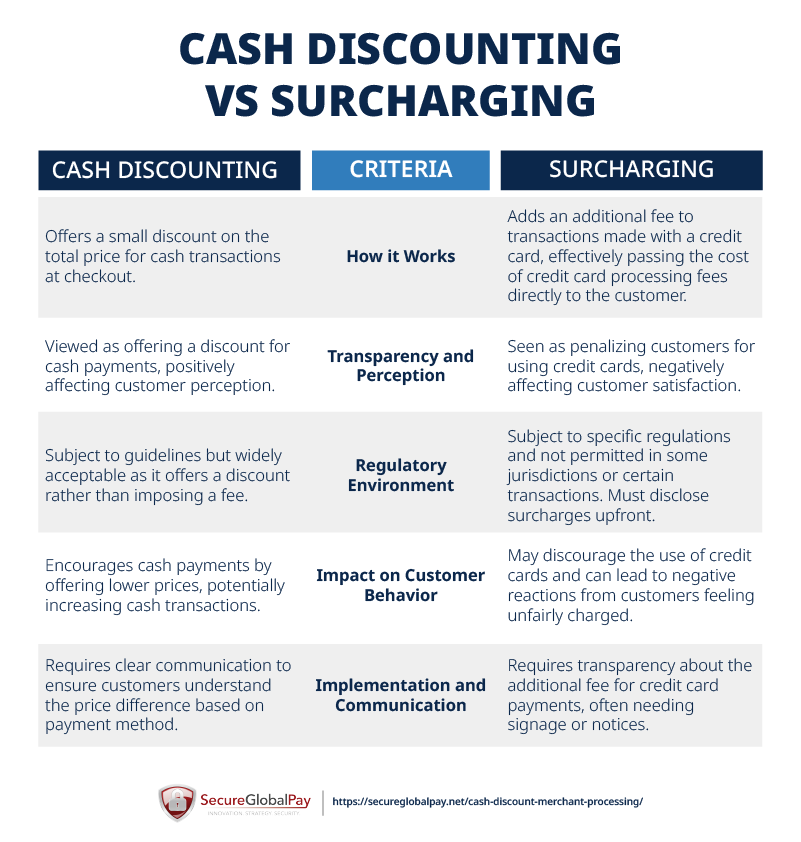

The difference between a cash discount and a surcharge program

In contrast to cash discounts explained above, a surcharge program involves adding an extra fee on transactions made with a credit card. This means the displayed prices are the cash prices, and an additional merchant surcharge is applied if the customer decides to pay with a credit card. This extra fee is meant to cover the card processing costs associated with these transactions. Surcharges are not applied to debit card transactions due to regulatory restrictions. So, the key difference between a cash discount and surcharge program are:

- Incentive vs. penalty: Cash discount programs incentivize customers to pay with cash by offering a discount, making it a positive experience. Surcharge programs, on the other hand, add a fee to credit card payments, which can be perceived as a penalty for not paying with cash.

- Regulatory considerations: Both programs must adhere to legal and card network regulations, which vary by location. Surcharges are not allowed in some states and have specific disclosure requirements, whereas cash discounts are widely accepted if implemented correctly.

If you’ve been researching how to lower credit card transactions fees, you have probably heard about dual pricing. A cash discount and dual pricing are basically the same thing, with the only potential difference being in how they are presented to customers:

If you’ve been researching how to lower credit card transactions fees, you have probably heard about dual pricing. A cash discount and dual pricing are basically the same thing, with the only potential difference being in how they are presented to customers:

- Cash discount programs typically advertise or display the credit card price and then offer a discount for cash payments at the point of sale.

- Dual pricing explicitly lists both prices together, making the differences in payment methods transparent before the decision to purchase is made.

We recently wrote a comprehensive guide on dual pricing in case you want to learn more.

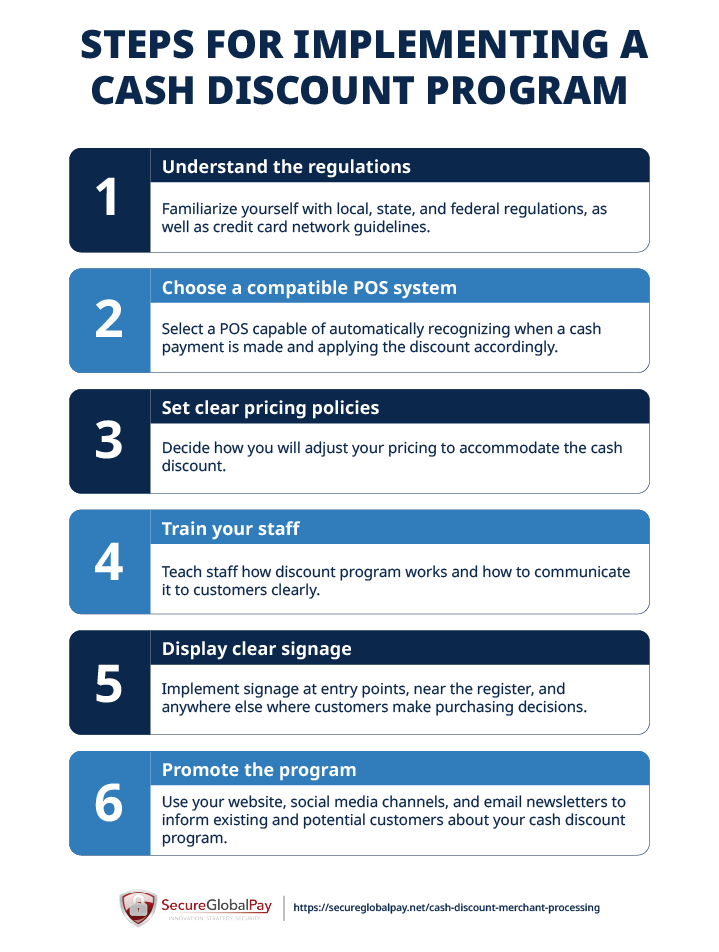

Steps for implementing a cash discount program

Implementing a cash discount program can be a strategic move for businesses looking to reduce credit card processing fees and encourage cash payments. Here are the steps to implement such a program effectively.

1. Understand the regulations

Before implementing a cash discount program, familiarize yourself with local, state, and federal regulations, as well as the guidelines set by credit card networks. Ensuring your program complies with these regulations will help avoid legal issues and maintain good standing with card processors.

2. Choose a compatible POS system

Your point-of-sale (POS) system plays a pivotal role in the smooth operation of a cash discount program. It should be capable of automatically recognizing when a cash payment is made and applying the discount accordingly. Some systems may require an update or a new software module to handle these functions seamlessly.

3. Set clear pricing policies

Decide how you will adjust your pricing to accommodate the cash discount. You may opt to increase your standard prices slightly to cover card processing fees, then offer a discount for cash payments that brings the price down to your original rate. Transparency with your customers about this pricing structure is key.

4. Train your staff

Your staff should be well-informed about how the cash discount program works and be able to explain it to customers clearly. They’ll need to understand how to process transactions under this program and communicate the benefits to customers effectively.

5. Display clear signage

Inform your customers about the cash discount program through clear and visible signage at entry points, near the register, and anywhere else where customers make purchasing decisions. Transparency about how customers can benefit from paying with cash is essential for the program’s success.

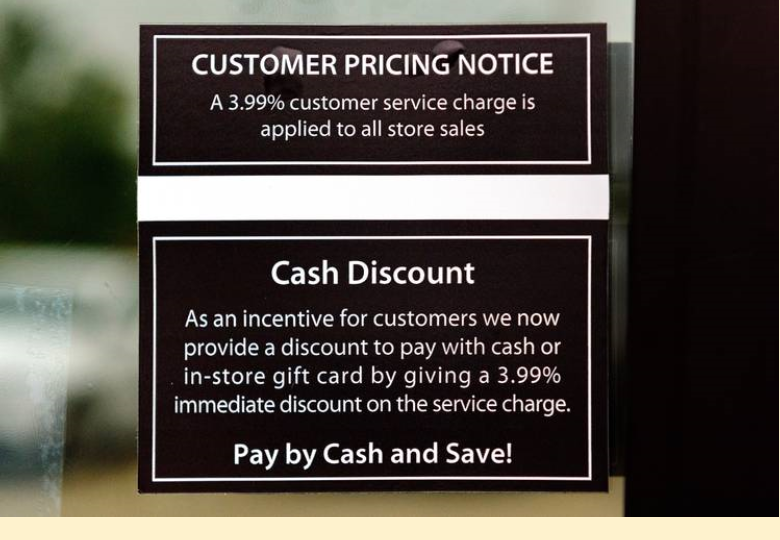

Cash discount sign example. Source: LinkedIn Pulse article

Cash discount sign example. Source: LinkedIn Pulse article

6. Promote the program

In addition to in-store signage, whenever possible, use your website, social media channels, and email newsletters to inform existing and potential customers about your cash discount program. Highlighting the benefits of paying with cash can attract more customers who prefer this payment method and appreciate the savings.

Implement cash discount merchant processing with SecureGlobalPay

Implementing a cash discount program becomes remarkably straightforward with merchant services providers like SecureGlobalPay, thanks to our advanced payment terminals and software that seamlessly integrate into your checkout process. Our all-in-one solution includes:

- A cash discount merchant account

- FREE POS hardware that supports cash discount model

- No long-term contracts or closure fees

- High security and encryption standards, ensuring all transactions comply with the applicable laws and card brand rules

- Seasoned account experts who will guide you every step of the way

Take the first step towards implementing a cash discount program by reaching out to partners@secureglobalpay.net or filling out our online application form:

FAQ about cash discounting

Is a cash discount program legal?

Yes, cash discount programs are legal in all 50 states when implemented in compliance with state and federal laws, as well as credit card network regulations. Regular review and compliance checks are recommended to ensure ongoing adherence to legal requirements.

What is an example of a cash discount?

An example of a cash discount would be a retail store displaying a price of $100 for an item when paying with a credit card, but offering the same item for $95 to customers who pay in cash. This means that customers who choose to pay with cash receive a $5 discount, incentivizing cash payments and allowing the store to save on credit card processing fees.

Are there any downsides to cash discount credit card processing?

The variation in pricing between cash and card payments might not sit well with customers who prefer to use credit cards. Clear communication is essential to prevent misunderstandings, but there’s still a risk that some customers may perceive the program negatively. Moreover, implementing such a program requires careful planning and adjustments in pricing strategies, point-of-sale systems, and employee training. Ensuring compliance with legal and regulatory requirements can add another layer of complexity to the process.

Is cash discount an expense?

No, a cash discount isn’t classified as an expense. Instead, it’s considered a reduction in revenue. When you offer a cash discount, you’re essentially lowering the selling price for customers who pay in cash. This reduction is directly reflected in the sales revenue, rather than being recorded as a separate expense in your accounting records.