Dual Pricing in Credit Card Processing – No Transaction Fees

Rising credit card processing fees have been putting pressure on merchants for a while, and the landscape keeps getting worse. Towards the end of 2023, Wall Street Journal published how Visa and Mastercard plan to increase their rates, costing merchants an additional $502 million annually in processing fees. Learn how dual pricing merchant services and cash discount payment processing solution can help you save thousands of dollars per month on your payment processing services.

A dual pricing strategy offers a solution that benefits both businesses and their customers by providing an incentive for cash payments — thereby reducing and even eliminating the costs associated with credit card transactions.

Let’s see how dual pricing credit card processing works, how it differs from surcharging, and what are the requirements for implementing dual pricing in your business.

What is dual pricing?

Dual pricing, often referred to as cash discounting, is a pricing strategy where businesses offer two distinct prices for their goods or services — one for customers paying with cash and a slightly higher price for those using credit cards.

The premise is simple: by encouraging customers to pay with cash, businesses avoid (or at least reduce) the fees associated with credit card transactions.

Dual pricing is particularly advantageous for businesses that operate on thin margins and/or experience high transaction volumes, such as:

- Retail, grocery, and convenience stores

- Restaurants

- Gas stations

- Service-based industries like salons and automotive services.

By reducing the number of credit card transactions or implementing dual pricing, a business can significantly cut the costs associated with transaction fees. These fees can range from 1.5% to 4.0% per transaction, depending on the card issuer and the terms of the merchant services agreement.

Customers also stand to benefit from dual pricing. Without it, merchants would need to raise prices for all payment methods. This way, those who pay with cash can still enjoy lower prices, increasing their satisfaction and loyalty.

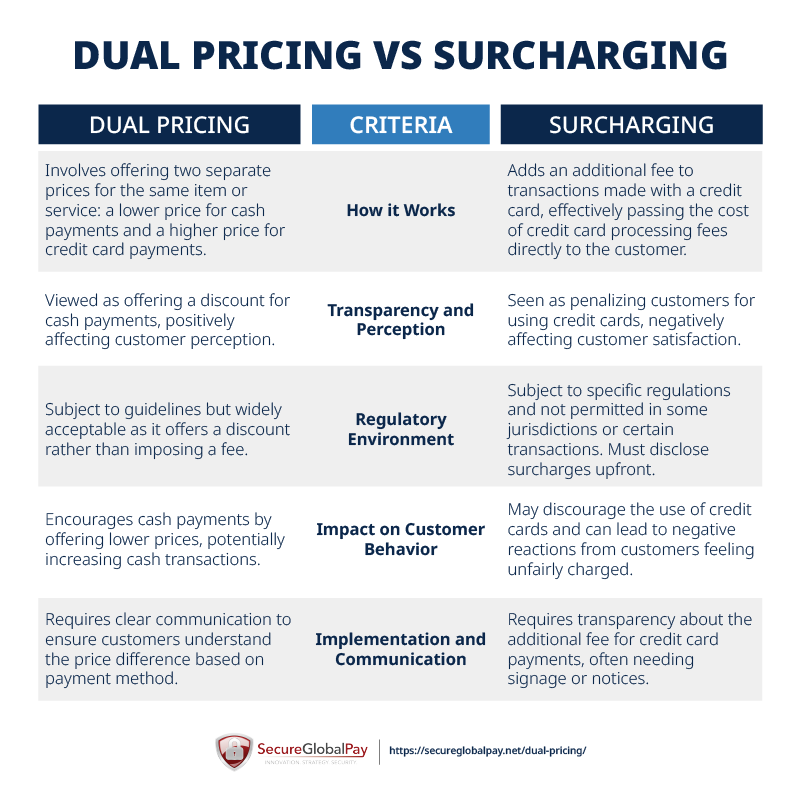

Dual pricing vs surcharging

Both dual pricing and surcharging are strategies businesses use to manage the costs associated with credit card transactions. However, they take opposing approaches, resulting in different pricing and customer experience.

In contrast to dual pricing, surcharging adds an additional fee to transactions made with a credit card, essentially passing the cost of those processing fees directly to the customer. This means the displayed price is the same for all customers, but those who pay with credit cards will see an extra charge added at the point of sale.

It is not hard to see why dual pricing is seen as a more consumer-friendly option. This is also the reason why dual pricing is accepted nationwide, while surcharging is prohibited in some states and works under stricter regulations.

Businesses should consider their customer base, regulatory environment, and the potential impact on customer experience when choosing between these two approaches.

How does dual pricing credit card processing work in practice?

Imagine you own a coffee shop. A cup of coffee in your shop costs $2.00 for customers who pay in cash. However, for customers who choose to pay with a credit card, the price is $2.10.

Here’s how dual pricing works in this scenario:

- Pricing structure setup: You determine the cost of your goods or services based on the cash payment. For the cup of coffee, that’s $2.00. Then, you calculate the additional amount needed to cover credit card processing fees, which, in this example, is an additional $0.10, making the credit card price $2.10.

- Point of Sale (POS) system configuration: Your POS system must be configured to support dual pricing, allowing it to automatically present the correct pricing based on the customer’s chosen payment method.

- Transaction completion: The transaction is processed as usual, with the only difference being the amount charged based on the payment method.

What are the requirements to offer dual pricing at your location?

Transitioning to this model is a smart move, but one that requires planning and adherence to specific requirements to ensure compliance.

Partnership with the right merchant services provider

It’s crucial to work with a provider like SecureGlobalPay who understands dual pricing and can offer tailored solutions that fit your business model.

Your merchant services provider should offer a flat rate percentage fee that aligns with your dual pricing program and specific needs. This helps ensure consistency and predictability in your transaction costs and overall checkout process.

A compatible POS system

Your Point of Sale (POS) system plays a critical role in implementing dual pricing. It must be capable of supporting the dual pricing model, which includes displaying both a cash and a credit card price for each product or service.

The system should automatically apply the correct pricing based on the payment method chosen by the customer, ensuring accuracy and efficiency in every transaction.

Clear signage and communication

Transparency is key. Clear signage must be placed at each of the merchant’s POS terminals, as well as other visible areas within the business location, notifying customers of the cash and credit card prices.

This signage should explain the price difference in a straightforward manner, helping to manage customer expectations and prevent confusion or dissatisfaction at the point of sale.

Legal compliance and disclosure

Beyond the operational requirements, it’s important to ensure that your dual pricing strategy complies with all applicable laws and regulations. This includes adhering to guidelines set forth by credit card networks, state laws, and federal regulations regarding pricing transparency and consumer protection.

In most cases, legal compliance comes down to disclosing the dual pricing policy clearly in your marketing materials, website, and receipts — ensuring that customers are fully informed about your pricing structure.

Employee training

Your staff should be well-informed about the dual pricing model and trained on how to communicate it effectively to customers. They should understand the rationale behind dual pricing, how it benefits the customer, and how to address any questions or concerns that may arise.

Implement dual pricing merchant services with SecureGlobalPay

SecureGlobalPay provides an all-in-one solution for businesses looking to implement dual pricing:

- A dual pricing merchant account

- Multiple POS hardware options at no cost that specialize in the dual pricing model

- No long-term contracts, commitments, or closure fees

- High security and encryption standards, ensuring all transactions comply with the applicable laws and card brand rules

- You get access to zero fee merchant processing

On top of that, all of our merchants get fast payment funding and access to world class customer support that will guide you through the whole process.

Learn more by sending a question to partners@secureglobalpay.net or fill out our online application form:

Frequently asked questions about dual pricing

What is the difference between dual pricing and cash discount?

The terms “dual pricing” and “cash discount” are often used interchangeably, but they are slightly different.

Dual pricing explicitly presents two prices for the same item or service. On the other hand, a cash discount is generally applied at the point of sale as a reduction from the standard price, specifically for customers who pay with cash. In this scenario, the posted or advertised price is typically the credit card price, and the discount is offered as an incentive for customers who choose to pay with cash.

The focus here is on the discount given for cash payments rather than the difference between two set prices for cash and credit.

Is dual pricing legal?

Yes, proper, compliant dual pricing is legal. That said, the practice is new and still must align with the principles of fairness and non-discrimination as mandated by consumer protection laws.

The legality and acceptance of dual pricing is legal in all 50 states. However, it’s up to both the merchant service provider, and the merchant to properly adhere to the policies set by the card brands and networks.

Businesses are encouraged to consult with merchant service experts to help ensure legal compliance with their dual pricing models while also adhering to applicable local laws and regulations.