How to Manage and Prevent Merchant Account Holds and Freezes

Nothing slows a business down faster than a sudden hold or freeze on your merchant account. When this happens, your cash flow is disrupted, daily operations take a hit, and customers can quickly lose trust if payments can’t be processed.

This article will help you understand the difference between a merchant account hold and a freeze, what steps to take if you ever find yourself in this situation, and how to prevent it from happening in the first place.

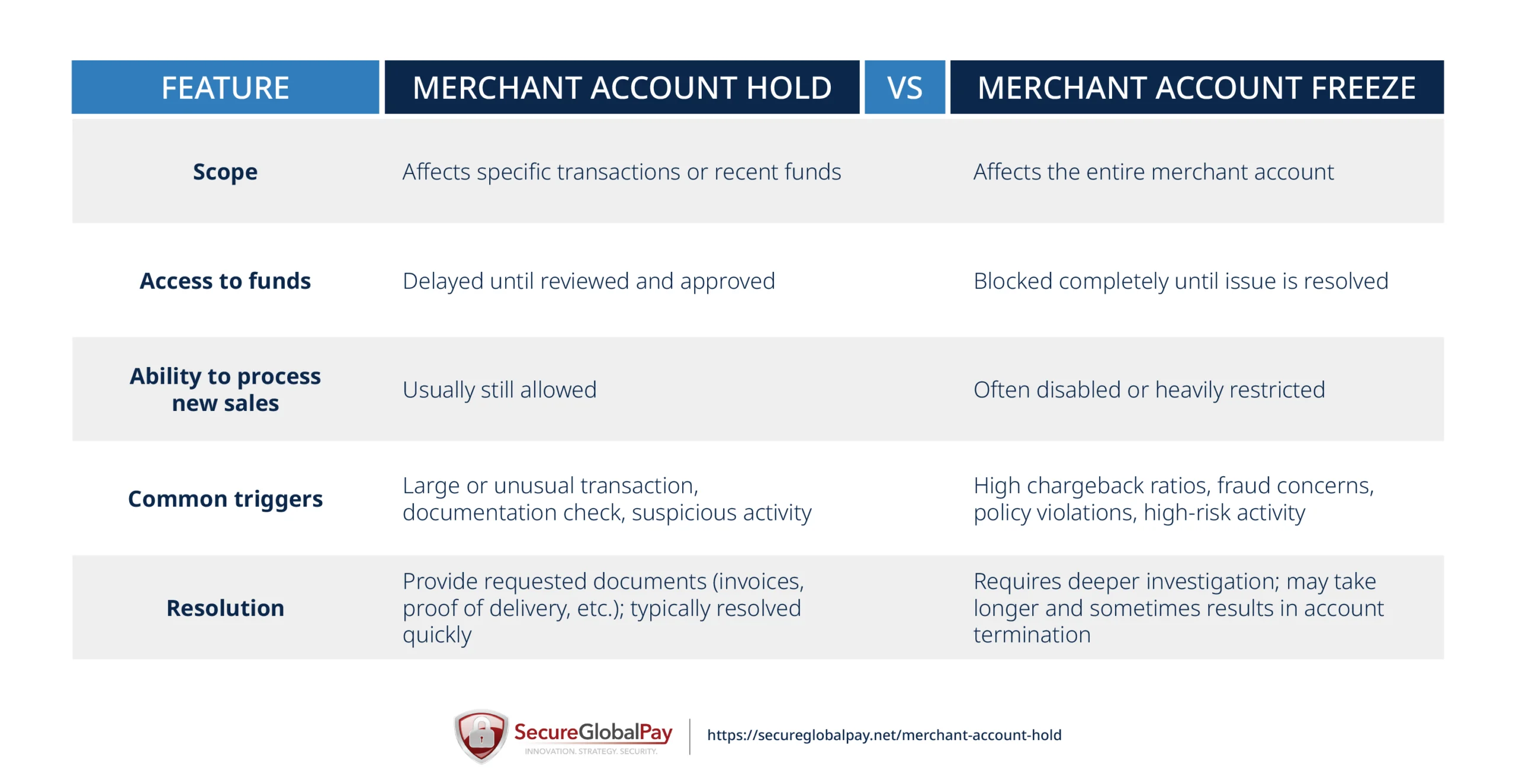

Merchant credit hold vs frozen merchant account

When something looks unusual with your transactions, your payment processor might step in to protect both you and your customers.

This can result in either a credit hold or a frozen account. While the two sound similar, they’re very different in terms of severity and what they mean for your business.

What does merchant credit hold for review mean?

A merchant credit hold for review happens when your processor temporarily holds funds from one or more transactions instead of immediately depositing them into your bank account. This doesn’t mean your whole account is shut down — it just means the processor wants to take a closer look before releasing the money.

This is usually triggered when a transaction looks out of the ordinary, such as a large purchase, a customer from a high-risk location, or an activity that doesn’t match your usual sales pattern.

What to do if this happens:

- Don’t panic — a hold doesn’t always signal a major issue.

- Respond quickly to any requests from your payment processor. They may ask for invoices, shipping details, or other proof that the sale is legitimate.

- Keep records organized and easy to access so you can resolve the review faster.

What is a frozen merchant account?

A frozen merchant account is more serious than a hold. In this case, your payment processor completely stops the flow of funds. You won’t be able to access money from past transactions, and in many cases, you won’t be able to process new sales either.

Freezes are usually triggered when the processor suspects major risk — like a high number of chargebacks, evidence of fraud, or possible violations of their terms of service.

What to do if this happens:

- Contact your processor right away to understand the reason for the freeze.

- Provide any documents they request — such as invoices, shipping confirmations, or updated business licenses — as quickly as possible.

- If the freeze is due to chargebacks, start reviewing your refund and customer service processes to show the processor you’re taking corrective action.

- Be prepared for the process to take time. Unlike a simple hold, a freeze will last until the processor feels confident your account is safe to reinstate.

If you’re in a high-risk industry, consider switching merchant services and working with a payment processor that specializes in high-risk merchant accounts, like SecureGlobalPay.

QUICK AND EASY ONLINE APPLICATION

Start Accepting High Risk Payments Now!

Common triggers for holds and freezes

Processors don’t put accounts on hold or freeze them without reason. Usually, something in your account activity raises a red flag. Some of the most common triggers include:

- High chargeback ratios: Too many customers disputing charges signals risk.

- Excessive refunds or reversals: If you’re processing a lot of refunds, it can look like customers are unhappy or sales aren’t legitimate.

- Sudden spikes in sales volume: A big jump in transactions without warning can look suspicious.

- Suspicious transactions: These include large or unusual orders, international payments, or mismatched billing details.

- Selling a new product not approved by the processor: If you start selling something outside your original application (e.g., a regulated or high-risk item), it could violate your agreement.

- Violations of terms of service: This includes prohibited items, misleading business practices, or restricted industries.

- Incomplete or outdated business documentation: Expired licenses, old banking information, or missing legal documents can all be the trigger for a review.

- Mismatch between business type and transaction activity: For example, if you applied as a low-risk retail store but your sales activity looks more like a subscription or travel business, processors may flag it.

Tips to avoid merchant account holds and freezes

The best way to deal with holds and freezes is to prevent them from happening in the first place. Here are some ways to protect your account and ability to process payments.

1. Maintain accurate and up-to-date documentation

One of the simplest ways to avoid unnecessary holds is to keep your business paperwork current. Processors need accurate information to verify who you are and how your business operates.

Make sure you regularly update things like:

- Business licenses

- Banking information

- Legal entity details (ownership, address, tax ID, etc.).

Whenever something changes, notify your payment processor right away. Keeping them in the loop shows you’re running a legitimate, transparent operation.

2. Manage chargebacks proactively

Chargebacks are one of the fastest ways to land on your processor’s radar. Too many can make you look high-risk, even if the disputes aren’t your fault. The key is to stop them before they happen and respond quickly when they do.

Practical ways to reduce chargebacks:

- Have clear refund and return policies that are easy for customers to find.

- Use fraud prevention tools like AVS (Address Verification System), CVV checks, and 3D Secure authentication.

- Take advantage of chargeback management tools offered by your processor or third-party providers.

- Offer responsive customer service — many disputes can be avoided if a customer can easily reach you for a resolution.

- Even if everything is going well, from time to time, it’s worth double-checking that your refund and chargeback procedures are being handled correctly.

You can find more detailed explanations in our chargeback management guide.

3. Monitor transaction patterns

Processors get nervous when your sales activity looks unusual. A sudden spike in volume or an unexpected shift in customer behavior can trigger a review, even if everything is legitimate.

If you expect a surge — like during a product launch, big promotion, or seasonal rush — notify your processor in advance.

Aside from that, you can also try to keep an eye on your daily and monthly transaction reports so you can spot unusual activity even before your processor does.

4. Have a robust and secure payment gateway

Your payment gateway is the front line of defense against fraud and failed transactions. Using a weak or outdated system can increase your risk of chargebacks, disputes, and processor reviews.

What to look for in a gateway:

- PCI-compliance with all the standard fraud prevention measures.

- Built-in fraud detection tools and chargeback management features.

- Easy integration with third-party fraud prevention and chargeback software like Chargeback 911, Kount, DisputeBee, etc.

- If you are a high-risk business, you’ll want a high-risk payment gateway that can provide that extra protection.

5. Stay compliant with payment processor policies

Every processor has its own rules, and breaking them — intentionally or not — can get your account flagged. Even minor violations may lead to a merchant hold or freeze.

To stay compliant:

- Get familiar with your processor’s terms of service. When they update it, take a moment to see what changed.

- Avoid selling prohibited or restricted items that aren’t covered in your original agreement.

- If you expand into a new product line or business model, confirm with your processor that it’s allowed.

Staying transparent and proactive about compliance helps build trust and reduces the risk of unexpected payment processing interruptions.

Avoid merchant holds and freezes with SecureGlobalPay

SecureGlobalPay is a merchant services provider that specializes in working with businesses standard processors might consider “too risky.” Whether you’re in a high-risk industry, have experienced account freezes in the past, or are just looking for a partner who understands the challenges merchants face, SecureGlobalPay can help.

We don’t just get you a merchant account — we guide you through the process, provide and set up the gateway and processing equipment, and offer proactive support so you can keep processing without unnecessary interruptions.

If you want a reliable partner who can save you from processing headaches, use this online application to sign up with SecureGlobalPay.

FAQs about merchant account holds and freezes

Under credit review, a merchant account can experience either a transaction hold or a funds hold. A transaction hold means the processor delays a specific payment until it verifies the details. A funds hold is broader — it sets aside a portion of your recent sales for review before releasing them to your bank account.

Both are temporary and usually resolved once the processor confirms the transactions are legitimate.

A hold typically lasts anywhere from a few hours to several business days, depending on how quickly you provide the documents your processor requests.

Account freezes, on the other hand, can last much longer — sometimes weeks or even months — because they involve deeper investigations. In some cases, a freeze may not be lifted at all if the processor decides to terminate your account.

In most cases, yes. A hold usually delays the release of certain funds but doesn’t block you from continuing to process new sales. However, if the processor sees a bigger issue while reviewing the hold, it could escalate into a freeze.

When your account is frozen, you won’t have access to any of the funds until the processor finishes its investigation. Sometimes they’ll release the money after a set period (like 90 or 180 days). In other cases, they may release it in installments to cover potential chargebacks.

Working with a high-risk payment processor can greatly reduce the chances of being frozen since they’re familiar with your industry’s unique challenges. Still, no processor can guarantee zero freezes — you’ll also need to follow best practices around fraud prevention, documentation, and compliance.

Yes, you can appeal by contacting your processor and supplying all the documentation they request, such as invoices, proof of delivery, or updated business licenses. If the appeal fails, your best option is to apply with a high-risk processor that’s better equipped to support your type of business.