Is Your Business Considered High Risk? The List of High-Risk Business Industries

Being a high-risk merchant does not have to be challenging. To start accepting payments, high-risk industries, and business types need to get a high-risk merchant account. A high-risk merchant account does not always mean higher processing fees and more stringent contract terms by payment processors. If you are curious about what particular business verticals are considered high-risk industries, review our high-risk industries list below!

Additionally, the high-risk category in itself is loosely defined, leading to different payment processors using different criteria to evaluate how risky your business is.

To help you solve that complexity, this article is going to cover three major points:

- Discuss the factors that determine if your business falls into the high risk category

- Provide an exhaustive list of high-risk business industries

- Show if there is anything you can do to avoid being labeled as high risk

Let’s dive straight in.

How to determine if your business is considered high risk

While increasingly rare, there can be a situation where two merchant account providers come to different conclusions: one considers your business as high risk, the other one doesn’t.

So, the most surefire way to determine if your business is considered high-risk is to talk with different merchant services providers and get their evaluation.

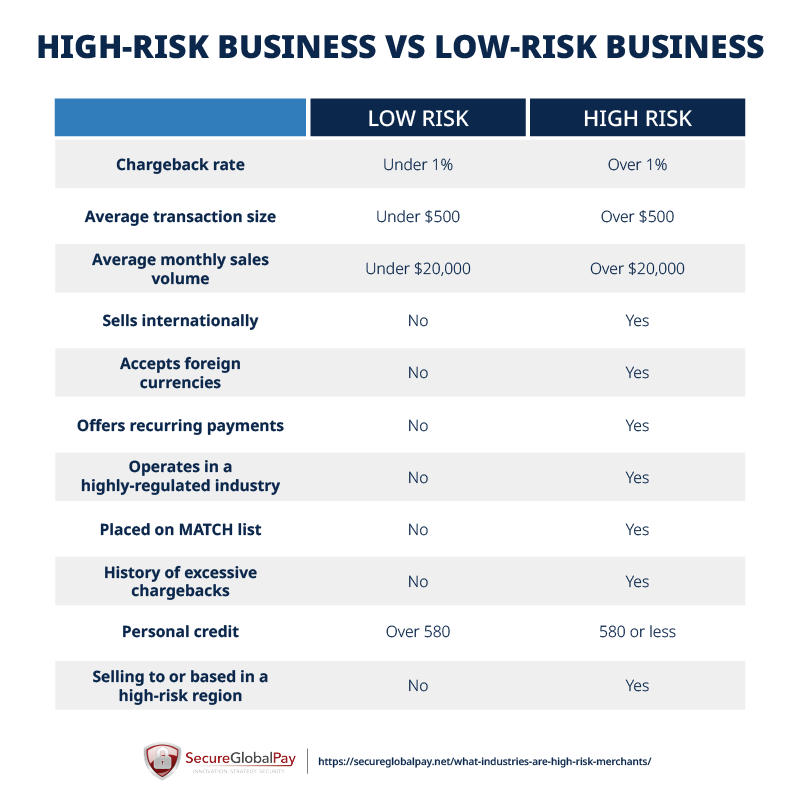

Below, you will find the most common factors that credit card processors use to evaluate merchant applications.

1. Industry reputation

Certain business types are continuously added to the high risk industries list, due to a variety of reasons like:

- Regulatory issues

- High chargeback rates

- Greater likelihood of fraud or legal disputes

- Selling “questionable” products or services

Examples of these industries include adult entertainment, e-cigarettes and vaping products, gambling and casinos, and nutraceuticals.

Simply put, when an industry is known for legal complexities or financial unpredictability, merchant account providers start viewing it with more caution.

2. Business model

Your business model directly impacts how merchant services providers assess your risk level.

Here are some innovative and non-traditional business models that might be considered problematic by some payment processors:

- Heavy reliance on recurring payments, subscription services, or operating on a ‘free trial’ basis. These models often experience higher chargeback rates due to customer disputes over recurring charges and cancellation processes.

- Affiliate marketing and drop shipping may encounter skepticism due to the layers of complexity and reduced control over product quality and delivery.

To navigate this scrutiny, clarity in your business operations, transparent customer communication, and robust dispute resolution mechanisms are essential.

3. Chargeback rates

High chargeback rates are a big red flag for merchant services providers, directly influencing their assessment of your business as high-risk. Chargebacks occur when customers dispute a charge on their credit cards, often due to dissatisfaction with a product or service, unrecognized transactions, or fraud.

Industries and business models prone to high levels of customer disputes or returns tend to have higher chargeback rates, which can complicate securing and maintaining merchant accounts.

4. Financial stability and processing history

While evaluating your financial stability, merchant services providers will look at your processing history, bank statement activity, and overall financial health.

A strong processing history with consistent transaction volumes suggests reliability, while your bank statements can offer insights into your cash flow and financial management practices.

Businesses that show signs of financial distress, such as inconsistent revenues, frequent overdrafts, or a high debt-to-income ratio, may be deemed high risk. Poor personal or business credit scores also contribute to this assessment, as they reflect on your ability to manage finances responsibly.

For new businesses or those without a long processing history, the owner’s personal credit score becomes even more significant. It often stands in for the business’s creditworthiness during the initial assessment phase.

5. Payment acceptance methods

The risk assessment of your business by merchant services providers is also influenced by your payment acceptance methods, particularly distinguishing between card-present and card-not-present transactions.

Card-present transactions, where the customer physically swipes, inserts, or taps their card, are generally considered low risk, due to the lower incidence of fraud in face-to-face transactions.

Conversely, card-not-present transactions, which include online purchases, mobile payments, mail/telephone sales (MOTO transactions), or any situation where the physical card isn’t used directly, pose a higher risk. These payment channels are inherently riskier so they get more scrutiny.

6. High sales volume and high-ticket sales

Businesses experiencing high sales volumes, typically exceeding $20,000 per month, or those dealing in high-ticket items, where individual transactions are $500 or more, often attract additional scrutiny from merchant services providers.

High sales volumes, while indicative of business success, can elevate the risk profile if growth outstrips the ability to manage transactions securely. Similarly, transactions involving high-ticket items are seen as higher risk due to the increased financial stakes (for both the merchant and the processor) in the event of a dispute or fraudulent activity.

7. Business location and international sales

Operating from regions known for high fraud rates or political instability — like some countries in Africa, Eastern Europe, Middle East, and parts of Latin America and Asia — inherently increases risk for everyone involved.

Similarly, engaging in substantial international sales introduces complexities due to the higher potential for cross-border fraud, currency exchange volatility, and the need to comply with diverse international regulations.

Lastly, accepting payments in foreign currencies, while broadening your market reach, can further complicate transactions and does not work in your favor during risk assessments.

List of high-risk business industries considered unsafe by banks and credit card companies

Below is an extensive list of high risk industries list and higher risk merchants. These are the high-risk business industries that credit card processors try to avoid because of excessive fraud and high chargeback ratios, among other factors we discussed in the previous section.

- Advertising services

- Affiliate marketing

- Airline, lodging, travel

- Alcohol

- Auto sales

- Auto warranties

- Background checks

- Beauty, skin & hair care

- Business opportunities

- Cannabis

- CBD Oil

- Charities

- Coins and collectables (antiques)

- Computer sales

- Credit repair and monitoring

- Cryptocurrencies

- Dating app merchant payments

- Debt collection and debt management

- Domain registration

- Drugs and drug products (including prescriptions)

- Events and Tickets

- E-wallets

- Fantasy sports

- File sharing

- Firearm sales

- Foreign exchange (Forex)

- Furniture sales

- Gambling

- Government grants

- Health

- High ticket coaching merchant account

- Insurance

- ISPs and web hosting

- Jewelry

- Male enhancement

- Marketing

- Merchant Aggregators

- Money transfer

- Monthly membership

- Moving services

- Nutritional supplements (nutraceuticals)

- Merchant processing for online auctions

- Pawn shops

- Pet sales and accessories

- Payday loans

- Penny auctions

- Phone unlocking services

- Prepaid phone cards

- Pyramid selling, network marketing, direct sales

- Self-storage

- Software and apps

- Software downloads

- Subscription boxes

- Tech support

- Ticket brokers

- Timeshares and holiday clubs

- High-risk tobacco merchant processing

- Vape/E-Cigarettes

- VPN services

- Web design and SEO services

Most payment processors will flag businesses operating in these industries as high risk.

Can you avoid being labeled as a high-risk business?

Let’s get one thing straight — high-risk is not inherently a bad label. It doesn’t mean that you’re doing something shady. You might simply be operating in a specific industry or having a business model that incurs higher costs and risks to credit card processors.

Nonetheless, if you are looking to reduce the chance of your business falling into the high risk category, here are a few things you can do:

- Maintain a healthy credit score: Higher personal and business credit scores indicate financial responsibility and stability, which can reassure processors and reduce your risk profile. Regularly monitor and work on improving your credit scores.

- Lower your chargeback ratio: Implement clear refund policies, offer excellent customer service, and implement fraud prevention tools to help keep chargeback ratios low.

- Choose stable markets and business models: Some markets are considered volatile due to legal uncertainties or fluctuating demand. If possible, diversify your offerings or pivot into more stable markets. Also, try to avoid affiliate, subscription, and similar business models that are not viewed favorably by credit card processors.

- Offer secure transactions: Adopt the latest in encryption and security technologies to protect your customers’ data and stay PCI compliant. This not only builds trust among your clientele but also reassures potential merchant account providers of your commitment to minimizing fraud.

- Build a strong processing history: If you’re a new business, this might be challenging. However, having a track record of consistent, reliable transaction volumes can work in your favor.

- Get off the MATCH list: If you find yourself on this list, work on resolving any disputes that led to your listing and demonstrate to processors that you’ve taken steps to address the issues. This might include improving your business practices, settling outstanding debts, or fulfilling any legal requirements.

- Negotiate with multiple processors: Don’t settle for the first merchant account provider you find. Shop around and negotiate terms with several processors. Some may be more lenient or have more experience working with businesses in your industry.

- Consult a high-risk specialist: Consider working with a consultant or a payment processor that specializes in high-risk businesses like SecureGlobalPay. We can offer personalized advice and solutions tailored to your specific situation and needs.

By being proactive, you can improve your standing with current or prospective payment processors. Remember, the key is to demonstrate stability, reliability, and a commitment to mitigating risks associated with your business operations.

Choose a reliable high-risk merchant account provider

Regardless of being low-risk or high-risk, every business needs a reliable merchant account provider with fair pricing options and quality customer support.

While we can work with all industries, SecureGlobalPay specializes in helping high-risk merchants accept and process high-risk credit card transactions quickly and effectively.

As a part of our all-in-one solution to payment processing, merchants get access to:

- ACH processing

- Business funding

- Chargeback dispute resolution and prevention programs

- Instant check processing solutions

- High-volume payment solutions

- Merchant cash advances

- Mail order/Telephone order (MOTO) processing

- Online payment gateways

- Point-of-Sale (POS) solutions

Learn more by sending a question to partners@secureglobalpay.net or jump straight to our online application form below.