High Risk Merchant Accounts for Electronic Cigarettes

Electronic Cigarette Merchant Accounts: Some facts

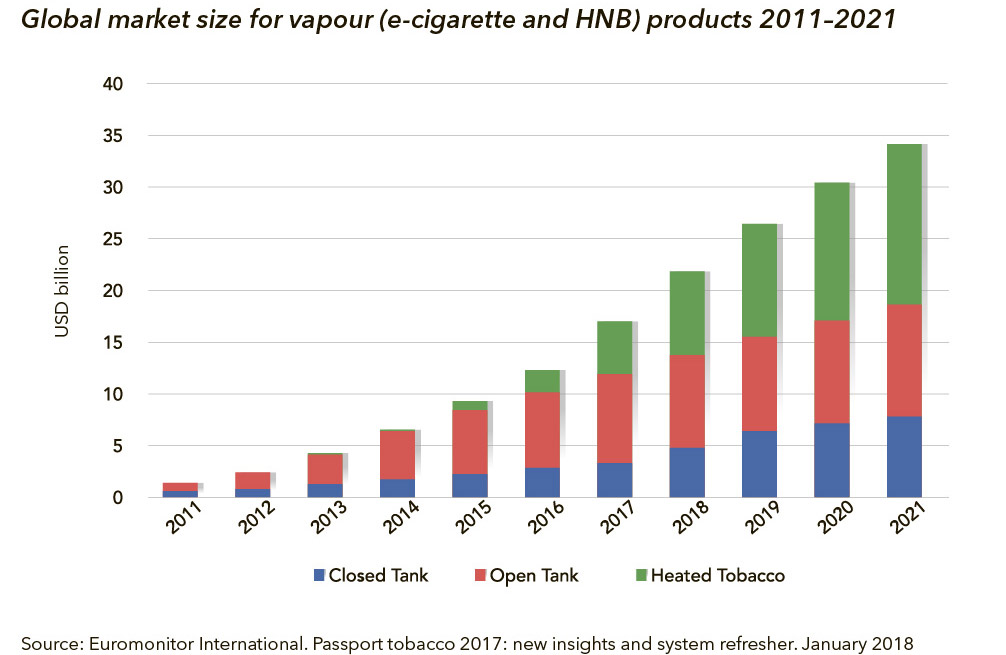

The popularity of traditional cigarettes has given way to e-cigarettes, which is worth $3.5 billion and rising due to the popularity of vaping, hookahs and e-juices. E-cigarettes are considered a healthy alternative to traditional tobacco cigarettes and are more popular with those who have never smoked. An October 2015 study by the National Health Interview Survey revealed that 3.2% of respondents who had never smoked a traditional cigarette have tried e-cigarettes.

Although the e-cigarette and tobacco merchant processing industry is hot, it is deemed a high-risk industry by traditional financial institutions. This makes it difficult to get credit card transactions processed with fair, cost-effective payment solutions. SecureGlobalPay can provide e-cigarette merchants with an alternative.

SecureGlobalPay specializes in offering customized payment processing solutions to companies in high-risk industries. Whether you are a large or small e-cigarette merchant, SecureGlobalPay offers payment solutions with global reach. Apply today to begin the process.

Benefits of an e-cigarette merchant account

E-cigarette merchants, and those with businesses that sell e-cig merchandise, are rarely approved for payment solutions by traditional banks. This is due to the regulatory challenges and typically high chargeback ratios of the industry, thus rendering it ‘high-risk’ in the eyes of banks reluctant to provide traditional solutions.

Merchants in high-risk industries like e-cigarettes need to apply to an online payment solutions provider like SecureGlobalPay if they wish to process sales via credit card. Apply now and get approved in as little as 24-48 hours.

E-cig merchant account vs. a low-risk account

E-cigarette merchant accounts can face challenges not associated with low-risk merchant accounts, including higher costs, a monthly credit card cap, delays in funding and a rolling reserve.

SecureGlobalPay can help eliminate these obstacles within three months for merchants that demonstrate a stable and successful history of processing credit cards.

Applying for an e-cigarette merchant account

Underwriters seek to verify that merchants are operating a legitimate business responsibly. Merchants who can provide valid data in the form of disclosures and restrictions to support that claim can help maximize their chances of approval.

Underwriters reviewing applications for vendors of e-cigarettes or accessories seek to ensure the merchant is following all applicable laws and not marketing questionable or illegal substances such as marijuana or marijuana related products like CBD Oils and tinctures.

Underwriters examine bank statements, credit card processing history, merchant credit scores and its website. A history of late payments, unpaid bills, high chargeback rates or a bank account with a negative balance will all count against the approval of an application. Websites with a secure SSL, and with the merchant’s privacy and refund policies explicitly stated thereon, will help improve chances of a successful application.

Merchants preparing for an underwriter interview should take steps to ensure they have money in the bank, no outstanding debts and an applicant with an exemplary personal credit history. Meeting these targets will improve a merchant’s chances of approval by demonstrating that they are a trustworthy and legitimate business. Such merchants are more likely to obtain electronic payment processing solutions without limits like a high volume processing cap or a lowered rolling reserve.

Applying for an e-cigarette merchant account

Apply today for a SecureGlobalPay e-cigarette merchant account by filling out our online application form. To speed the process, have the following ready when you apply:

- A valid, government-issued photo ID (e.g., driver’s license, state/provincial ID, etc.)

- A bank attestation or void check

- Bank statements (3 months worth)

- Processing statements (3 months worth)

- SSN (Social Security Number) or EIN (Employer Identification Number)

- The URL to your secure, fully-operational website

- A chargeback history of less than 2%

You must also have a secure and operational company website.

Merchants who meet these criteria can receive approval in less than 24-48 hours.

Regarding chargeback ratios

Merchants in high-risk industries like e-cigarettes, vaping and smoking accessories run an increased risk of chargebacks. Chargebacks happen when a customer disputes a transaction. A quick response is necessary in order to fight chargeback claims, and this depends on an e-payment solutions provider committed to ensuring its clients are informed of chargebacks in a timely manner.

The online e-cigarette business is relatively new. A great many small companies operate online. A lack of distinct name recognition means that customers may not recognize charges of these companies when they appear on their credit card statements.

Chargebacks are common in the industry as online e-cigarette merchants rely on third parties to ship orders to customers. Through no fault of their own, online e-cigarette merchants can end up absorbing the consequences of backorders and delivery issues that are the fault of third parties.

Fraud is also common in the industry due to the number of small outlets, many of which are unaware of the necessary precautions to protect against scams. SecureGlobalPay can help small merchants to avoid fraud and chargebacks before they fall victim to them.

Chargebacks: the consequences

Many smaller businesses are reluctant to issue refunds in an effort to maintain capital. This can lead to chargebacks which are ultimately detrimental to an online business. Credit card processors routinely terminate merchant accounts that have a 3%+ chargeback ratio. Once terminated, merchant accounts can be very difficult to regain a second time.

Chargebacks: the processors’ POV

Chargebacks are viewed as red flags by payment service providers because they usually signal that a business has problems with customer service. Businesses unable to settle dispute transactions, pay refunds or ones that generate chargebacks are often short of cash. Merchant account providers know this means the funds in question could end up being their responsibility.

Merchant account providers face risks of their own. High chargeback merchants on a provider’s customer list can endanger the provider’s relationship with sponsoring banks and credit card companies and card brands. Continuing to process transactions for businesses with high chargeback ratios can lead to fines.

Reducing chargebacks

Good customer service and utilizing a chargeback protection system are key to avoiding damaging chargebacks.

Communication is the basis of good customer service. Ensuring that customer receipts contain detailed information about items purchased, prices, vendor names, contact information and expected date of delivery will decrease chances of miscommunication. Transparency in the form of receipts containing this information plus shipping and tracking details is invaluable.

Most chargebacks occur within four days of purchase. Maintaining contact with a customer for one week following purchase reduces the likelihood of chargebacks. Thank you e-mails, customer satisfaction surveys and final copies of receipts are good ways to show the customer that you value their business.

SecureGlobalPay partners with Verifi and its new Cardholder Dispute Resolution Network (CDRN) as well as Ethoca and its alert system. This allows SGP to provide an elite alert and chargeback prevention system for its customers, including storefront and online e-cigarette merchants.

CDRN operates with banks and credit card companies to give merchants control over resolution of credit card disputes. By being directly involved in the process, merchants who keep an eye on alerts can reduce their chargeback ratio by 25%.

Chargebacks can cost a company its business. Taking a proactive approach to chargebacks can help you avoid being placed in a vulnerable position.

E-cig: industry categories

Four-digit numeric codes known as Standard Industrial Classification (SIC) codes are common in the United States and many other countries for identifying businesses and their primary purposes. A similar classification system known as NAICS (the Northern American Classification System) is a list of six-digit codes used by federal statistical agencies to classify business establishments. The classification system aims to gather, analyze, and publish statistical information about similar types of businesses and what their impacts are on the U.S. economy.

E-cigarettes, e-juices, vaping and smoking accessories usually fall into section 5194 of the Tobacco and Tobacco Products SIC Code. Some merchants, however, can fall into different categories.

- 5993: Tobacco Stores and Stands

- 5199: Nondurable Goods, Not Elsewhere Classified

- 7389: Business Services, Not Elsewhere Categorized

A complete SIC list is available via the US Department of Labor website.

Vape shops as well as providers of e-cigarettes and e-juices usually fall under section 453991: Tobacco Stores NAICS code. Another common code is 424940: Tobacco and Tobacco Product Merchant Wholesalers NAICS code.

Visit the United States Census Bureau to view the complete NAICS code list.

The popularity of e-cigarettes

According to a 2014 US Census Bureau study, approximately 9 million Americans (3.7% of adults) routinely use e-cigarettes. The same survey revealed that one in six traditional cigarette smokers and one in four ex-smokers recently used e-cigarettes. Why?

E-cigarettes are viewed as a safe alternative to traditional tobacco cigarettes, which include carcinogens like arsenic and vinyl chloride. Despite this, the UK’s Ministry of Health, executive agency, labeled them safer than e-cigarettes.

The British medical establishment has given its seal of approval to e-cigarettes, with Public Health England declaring in 2016 that e-cigarettes are 95% safer than ordinary cigarettes and the Royal College of Physicians urging tobacco smokers to switch to vaping. Canadian researchers have announced similar findings, indicating that e-cigarettes contain only one-fourth of the toxins in normal cigarettes and none of the tar. According to these same researchers, e-cigarettes reduce the risk of second-hand smoke. US medical professionals have indicated a similar preference for vaping over normal cigarettes but have stopped short of pronouncing the practice harmless.

What is vaping?

Vapers use a battery-powered inhaler or vaporizer to heat liquid (e-juice) into vapor which is then inhaled. The liquid itself can contain varying amounts of nicotine. Users inhaling vapor experience the same rush of adrenaline and boost of dopamine euphoria as cigarette smokers.

As e-juice liquid cartridges contain no tobacco, public health officials view vaping as a useful intermediary step for people quitting smoking. Vaping similarly cuts down on second-hand smoke, decreasing the risk of many types of cancer, stroke and heart disease.

Electronic Cigarette

E-cigarettes, like vaping, provide a safer alternative to tobacco. Users draw on a cartridge called a cartomizer, which activates an LED that lights up.

SecureGlobalPay can help you find the right merchant account for your new cigarette shop. Complete our easy, free online application form and be approved to begin accepting credit card transactions within 72 hours.

E-Cigarette Merchant Accounts

A lack of full federal research on and regulation of e-cigarettes, as demonstrated in the Family Smoking Prevention and Tobacco Control Act of 2009, cause payment processors some hesitation where it comes to processing online payments for e-cigarette providers.

SecureGlobalPay has expertise in providing payment services to traditionally high-risk industries. Apply and let us help you set up your online e-cigarette shop and begin processing credit card payments in as little as 72 hours.

SecureGlobalPay can help you succeed.

SecureGlobalPay can help you get started. If approved, you can begin processing online credit card payments in as little as 72 hours. SecureGlobalPay guarantees:

- No Application Fees

- Competitive rates

- No VISA/MasterCard Required

- Multiple Secure Payment Gateway Options