High-Risk Merchant Account Underwriting: A Guide for Merchants

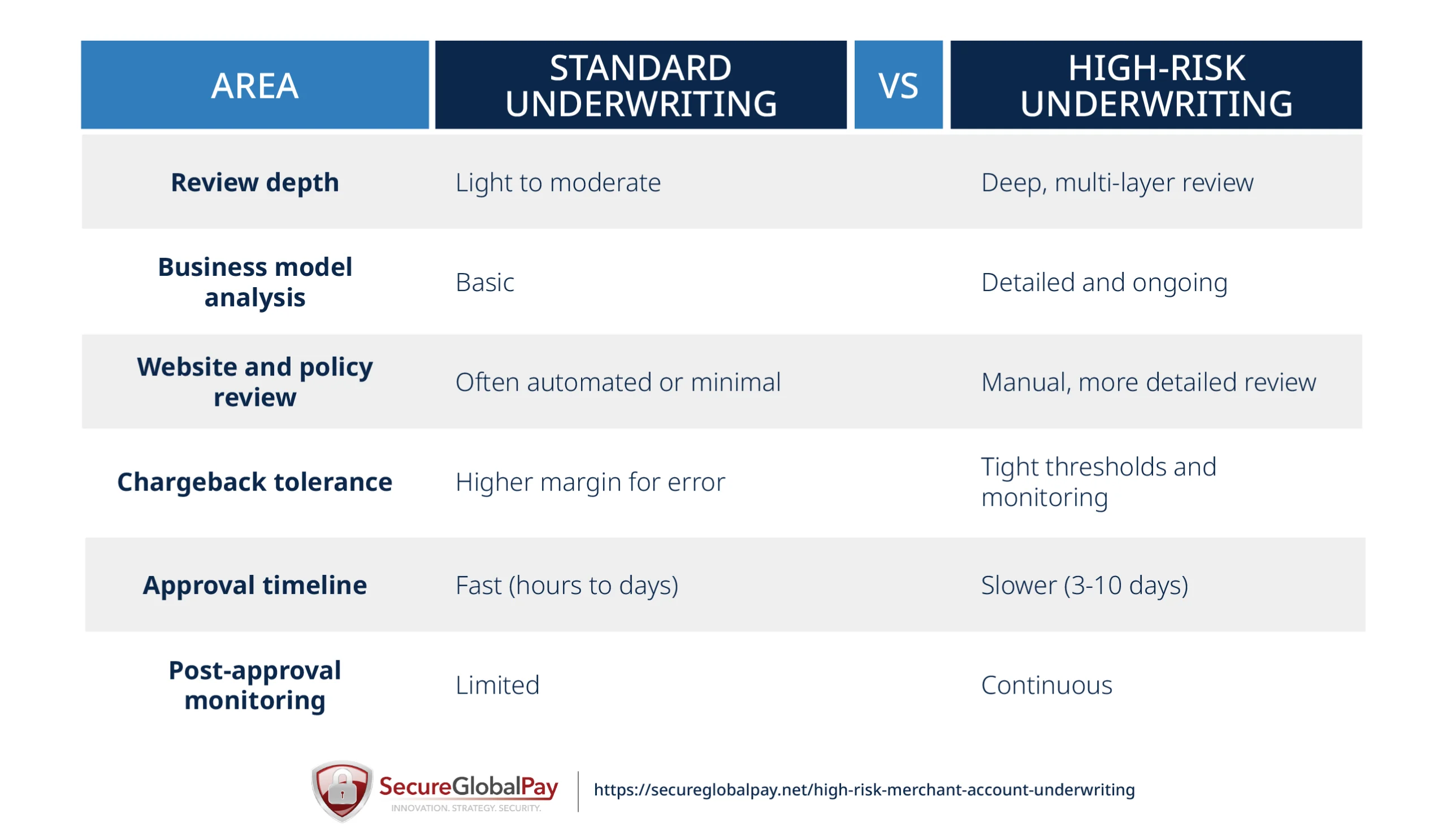

If you apply for a high-risk merchant account, underwriting is unavoidable. It’s the process banks and payment companies use to decide whether they can safely let your business process credit and debit cards — and under what terms.

For “high-risk” businesses, this process is more detailed and more demanding. That’s because certain industries and business models are more prone to fraud, chargebacks, regulatory issues, or reputational risk.

This guide explains how high-risk merchant account underwriting actually works, what underwriters look for, and where merchants often run into trouble. You’ll learn how to prepare for underwriting and speed up the approval process.

QUICK TAKEAWAYS

- High-risk merchant underwriting is a detailed risk assessment designed to protect banks, card networks, merchants, and customers.

- Most underwriting delays and declines come from missing documentation, website and checkout issues, or misaligned business disclosures.

- Chargebacks, refunds, and customer transparency matter just as much after approval as they do during onboarding.

- Merchants who prepare in advance and communicate proactively are more likely to be approved (and get better terms).

The purpose of merchant account underwriting

Merchant account underwriting is a risk assessment performed by a payment processor or acquiring bank. Its purpose is to evaluate the business, its owners, the products or services being sold, and expected transaction behavior before allowing card payments to flow.

The main goals of high-risk merchant account underwriting are to:

- Prevent fraud and financial losses: Assess the likelihood of chargebacks, refunds, disputes, and potential merchant default that could leave banks or card networks liable.

- Ensure legal and regulatory compliance: Meet KYC/KYB, AML, and card network requirements, and confirm the business is not involved in prohibited or restricted activities.

- Confirm the business model is accurately represented: Identify misrepresentation, hidden risk, or transaction laundering before approval.

- Protect the broader payment ecosystem: Safeguard cardholders, card networks, acquiring banks, processors, and consumers from abusive or fraudulent behavior.

Key players in the underwriting process

Opening a high-risk merchant account can’t be done overnight. It’s a coordinated process involving multiple parties, each with a different responsibility in managing risk and compliance.

Here are the key players and their roles:

- Merchant (you): Provides accurate business information, documentation, and ongoing transparency. Your operations, marketing, and customer experience directly impact underwriting decisions and ongoing monitoring.

- Payment facilitator/processor/ISO: Acts as the front-end onboarding partner. Collects applications and documents, performs initial risk checks, communicates underwriting feedback, and manages the day-to-day merchant relationship. SecureGlobalPay fulfils this role.

- Acquiring bank: Often the ultimate risk holder. The acquiring bank sponsors the merchant account, settles funds, and is financially liable to the card networks if losses occur.

- Card networks (like Visa and Mastercard): They set the rules for acceptable risk, chargeback thresholds, monitoring programs, and prohibited activities. While they don’t underwrite individual merchants directly, their requirements heavily influence underwriting decisions.

- Third-party risk and compliance tools: Support underwriting and monitoring through identity verification, sanctions screening, fraud detection, chargeback analytics, and transaction monitoring.

The typical high-risk merchant account underwriting process

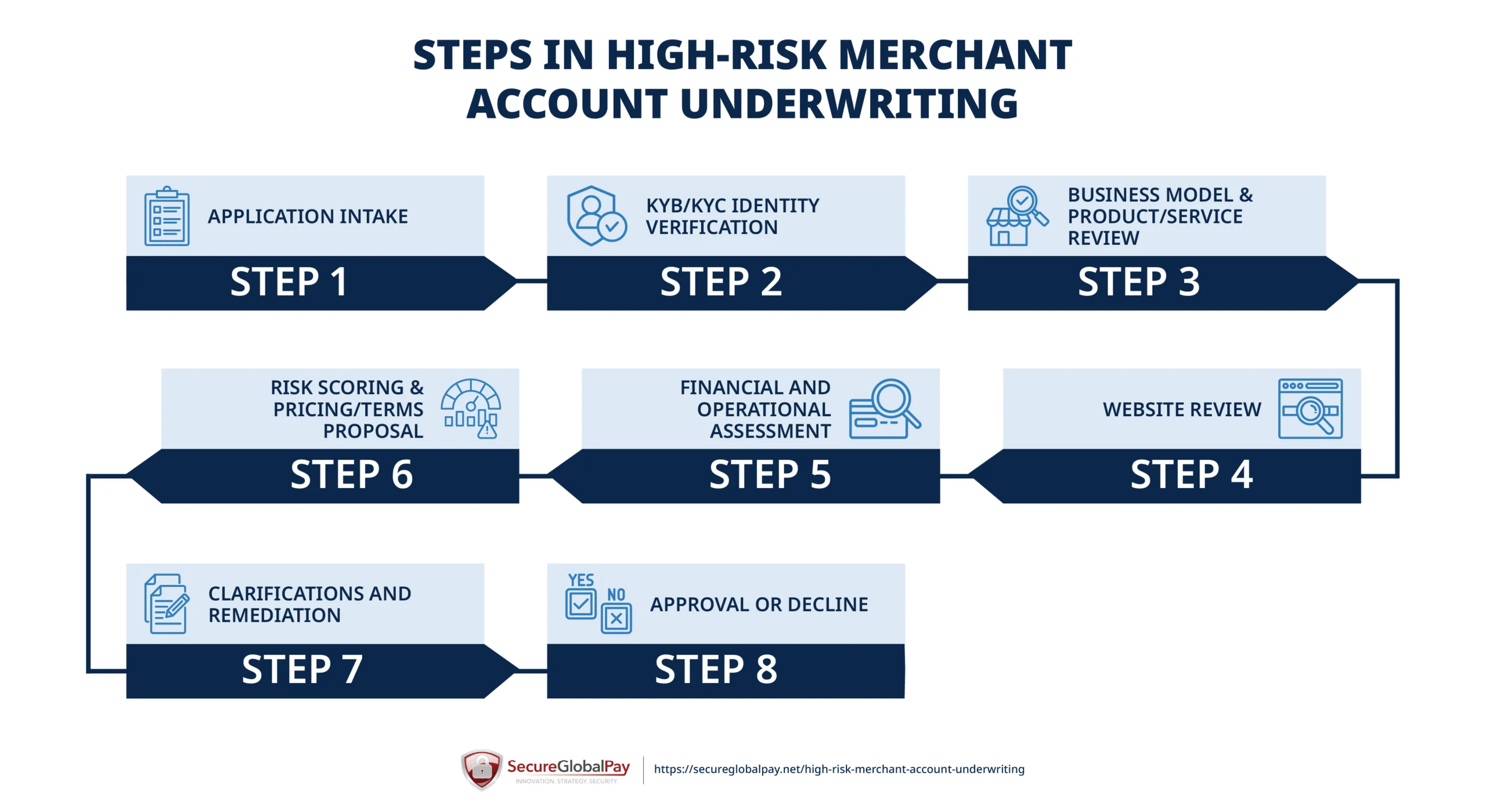

High-risk merchant underwriting follows a structured, step-by-step process designed to identify risk early and set appropriate terms. While timelines vary by industry and complexity, most high-risk reviews follow a similar path.

The typical underwriting process for high-risk merchants:

- Application intake: The merchant submits an application with business details, ownership information, expected volumes, and any prior processing history. Incomplete or inconsistent applications are a common cause of delays.

- KYB/KYC identity verification: The legal existence of the business and the identity of owners and controllers are verified through KYB and KYC checks.

- Business model & product/service review: Underwriters evaluate what you sell, how you sell it, pricing structure, refund policies, and whether the activity is permitted under the card network and bank rules.

- Website review: Websites are reviewed for transparency, customer disclosures, terms and conditions, privacy policies, checkout process, refund policies, and general compliance.

- Financial and operational assessment: Bank statements, processing history, chargeback ratios, fulfillment timelines, and operational readiness are assessed.

- Risk scoring & pricing/terms proposal: Based on the risk profile, pricing, reserves, volume caps, settlement delays, and other conditions are determined.

- Clarifications and remediation: Merchants may be asked to explain anomalies, provide additional documentation, or make website or operational changes.

- Approval or decline: The account is approved outright, approved with conditions, or declined if the risk cannot be sufficiently mitigated.

A full approval allows the merchant to process under standard monitoring with agreed-upon terms. A conditional approval permits processing but includes specific requirements — such as reserves, volume limits, or operational changes — that must be maintained to keep the account active.

QUICK & EASY ONLINE APPLICATION

We specialize in getting high-risk merchants approved and processing!

What do underwriters check for (+ red flags)

Underwriters assess how your business operates in the real world: how customers experience your brand, how money flows through your account, and how risk could materialize after you start processing.

Below are the most common areas underwriters review, along with the red flags that frequently trigger delays, conditions, or declines.

1. Business identity and legitimacy (KYB/KYC)

Underwriters look at:

- Legal business name, registration, and good standing.

- Physical address and operating jurisdiction.

- Ownership and control structure (beneficial owners, directors).

- Identity documents for owners and authorized signers.

- Business bank account details and account history.

- Consistency across documents, website, and application.

Common red flags include:

- Recently formed entities with no operating history.

- Mismatched names, addresses, or ownership information.

- Use of virtual offices or mail drops without disclosure.

- Owners with prior account terminations or excessive chargebacks.

- Incomplete, altered, or unverifiable identity documents.

2. Industry type and prohibited/restricted activity

Underwriters look at:

- The primary industry and sub-industry classification.

- Whether products or services are allowed, restricted, or prohibited under the card network and bank rules.

- Licensing or regulatory requirements specific to the industry — money services licensing, supplement manufacturing compliance, gaming or gambling permits, etc.

- How closely the actual business activity matches what’s stated in the application.

- Jurisdictions where products or services are offered.

Common red flags include:

- Selling products or services on the card network prohibited lists.

- Operating in regulated industries without required licenses or approvals.

- Vague or misleading descriptions of what the business actually does.

- Offering higher-risk products under a lower-risk business category — like applying as an “eCommerce retail” store while actually selling supplements.

- Cross-border sales into restricted or sanctioned countries.

3. Processing history and chargebacks

Underwriters look at:

- Prior merchant account history, if any.

- Historical chargeback ratios and dispute reason codes.

- Refund and return rates relative to sales volume.

- Transaction volumes, average ticket size, and growth patterns.

- Previous account terminations, monitoring program enrollments, or blacklisting.

Common red flags include:

- Chargeback ratios approaching or exceeding card network thresholds. Broadly speaking, anything above ~1.00% increases the likelihood of rolling reserves and processing thresholds.

- Excessive “fraud” or “no authorization” dispute reason codes.

- High refund-to-sales ratios, as they indicate customer dissatisfaction.

- Sudden spikes or drops in processing volume without explanation.

- Previous merchant account closures due to fraud, chargebacks, or policy violations.

4. Website, marketing, and customer transparency

Underwriters look at:

- Clear and accurate description of products or services.

- Visible contact information — business name, address, email, and support channels.

- Published Terms & Conditions that clearly define the customer–merchant relationship.

- A visible Privacy Policy explaining how customer data is collected, used, and protected.

- Refund, return, and cancellation policies that are easy to find and understand.

- Marketing claims and advertising language used on the site and in ads.

- Consistency between the website, checkout flow, and merchant application.

Common red flags include:

- Missing, generic, or hard-to-find Terms & Conditions or Privacy Policy pages.

- Exaggerated, misleading, or non-compliant marketing claims.

- Refund or cancellation terms buried deep in the site or written unclearly.

- No visible customer support contact information.

- Messaging that contradicts what was disclosed during underwriting.

- Use of pre-checkout upsells or negative-option language without clear disclosure.

5. Checkout flow and descriptor clarity

Underwriters look at:

- The checkout flow, from product selection to payment.

- Full price disclosure, including taxes, shipping, and recurring charges.

- Explicit customer consent for subscriptions, trials, or continuity billing.

- Whether billing descriptors clearly identify the business on cardholder statements.

- Confirmation pages and receipts that restate key purchase details.

Common red flags include:

- Hidden fees that only appear after payment is submitted.

- Pre-checked boxes for subscriptions or add-ons.

- Vague or misleading billing descriptors that do not match the business name or website.

- Customers being enrolled in recurring billing without clear consent.

6. Fulfillment, delivery, and dispute exposure

Underwriters look at:

- How and when the product or service is supposed to be delivered.

- Shipping timelines, tracking, and proof of delivery for physical goods.

- Access method and usage tracking for digital goods or services.

- Refund eligibility relative to delivery or consumption.

- Customer support processes for delivery issues and complaints.

Common red flags include:

- Long or undefined fulfillment timelines.

- No tracking, delivery confirmation, or access logs.

- Charging customers well before goods are shipped.

- Digital products with no demonstrable delivery or usage proof.

- High rates of “not received” or “not as described” disputes.

7. Financial stability and cash-flow adequacy

Underwriters look at:

- Business bank statements and average daily balances.

- Cash-flow stability relative to expected processing volume.

- Ability to cover refunds, chargebacks, and reserves.

- Revenue concentration by product, customer, or channel.

- Financial projections for rapid growth or seasonal spikes.

Common red flags include:

- Thin operating balances or frequent overdrafts.

- Reliance on future sales to fund refunds or disputes.

- Large volume increases without corresponding capital.

- Heavy dependence on a single product or traffic source.

- Personal and business finances that are not clearly separated.

8. Business model risks

Underwriters look at:

- Whether the business uses subscriptions, trials, or continuity billing.

- Average order value and exposure per transaction.

- Cross-border sales, currencies, and customer locations.

Common red flags include:

- Free or low-cost trials that convert into high recurring charges.

- High-ticket transactions with limited refund windows.

- Cross-border sales without localized policies or support.

- Subscription cancellation flows that are hard to find or use.

- Chargebacks clustered around renewal or rebill dates.

9. Third-party relationships

Underwriters look at:

- Use of affiliates, lead generators, influencers, or referral partners.

- How third parties are compensated and monitored.

- Control over advertising claims made on the merchant’s behalf.

- Call center scripts, sales practices, and recording availability.

- Whether third parties touch payment data or customer funds.

Common red flags include:

- Affiliates making misleading or non-compliant marketing claims.

- Lack of oversight or contracts governing third-party behavior.

- Call centers using high-pressure or deceptive sales tactics.

- Third parties processing payments or rerouting transactions — like an affiliate running customer payments through your merchant account instead of their own approved account.

10. Transaction laundering and business misrepresentation

Underwriters look at:

- Whether transactions match the approved business model.

- Consistency between processed transactions and the advertised products or services.

- Sudden changes in product mix, pricing, or customer demographics.

- Links between multiple merchant accounts or related entities.

Common red flags include:

- Processing payments for unapproved products or services.

- Allowing another business to use your merchant account.

- Sudden appearance of new products that weren’t underwritten.

- Mismatched billing descriptors or URLs.

- Attempts to hide or rebrand high-risk activity after approval.

Ongoing merchant account monitoring

Businesses grow and evolve. As a result, their risk changes as well. Ongoing monitoring allows payment companies and acquiring banks to manage that risk by periodically re-underwriting accounts.

This also helps detect merchant fraud and questionable behavior, including:

- Transaction laundering: An approved merchant processes payments on behalf of an unapproved business.

- Business model changes: A merchant is approved under a lower-risk model and later adds higher-risk products or billing practices without disclosure.

- Bust-out fraud: A fraudster opens a merchant account, builds trust over time, accesses credit or delayed settlements, and then disappears without repaying obligations.

What payment companies monitor continuously

Payment companies use automated systems and manual reviews to watch for changes that increase risk. These include:

- Chargeback and refund trends, including dispute reason codes.

- Fraud signals such as velocity spikes, IP or geolocation mismatches, and abnormal approval or decline rates.

- Sudden changes in transaction profile — average order value, volume, customer mix, or product mix.

- Website changes, new domains, or checkout flow updates.

- Affiliate traffic spikes and complaint patterns.

What triggers an account review or funds hold

Various events trigger deeper reviews or immediate risk controls (including merchant account holds and freezes). Common triggers include:

- Crossing chargeback thresholds or abrupt increases in volume.

- High refund-to-sales ratios.

- Surges in customer complaints or negative reviews.

- Policy violations involving prohibited products or misleading advertising.

- AML or financial crime red flags.

Underwriting preparation checklist for high-risk merchants

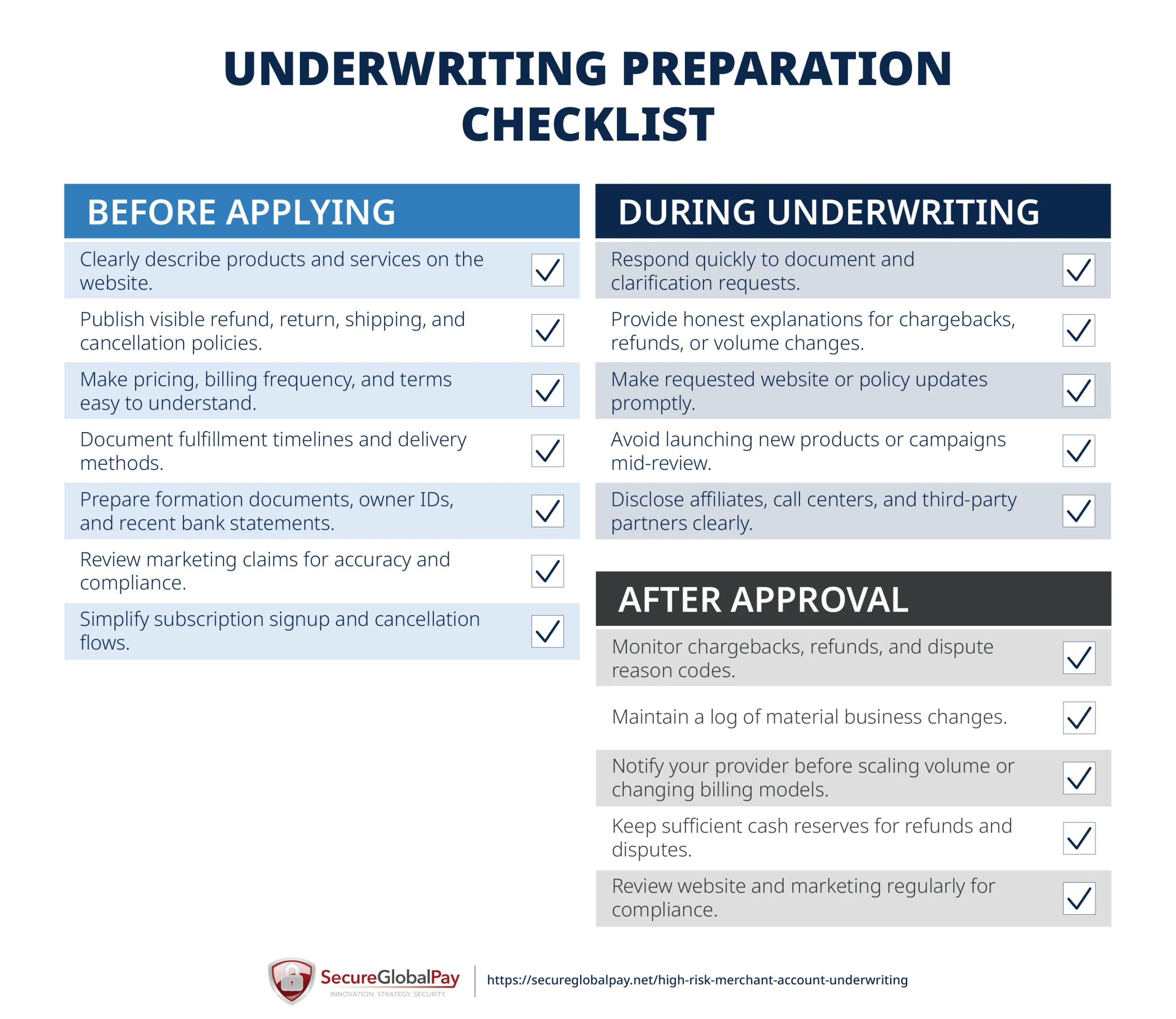

Before applying for a high-risk merchant account, merchants should take time to prepare. A polished website, clear customer disclosures, documented fulfillment flows, and well-defined refund and cancellation processes can significantly reduce underwriting friction and speed up approvals.

During underwriting, responsiveness and transparency matter. Merchants that reply quickly to document requests, proactively explain anomalies in processing history, and make requested changes without resistance are far more likely to receive approval — and better terms.

After approval, the work doesn’t stop. Merchants should actively monitor chargebacks and refunds, keep a log of material business changes, and notify their provider before launching new products, changing billing models, or scaling volume rapidly.

How SecureGlobalPay helps high-risk merchants get (and stay) approved

SecureGlobalPay is a merchant services provider offering comprehensive payment processing solutions for high-risk merchants. You get a merchant account, high-risk payment gateway, payment processing equipment — and most importantly — a long-term partner that always has your back.

If that wasn’t enough, here’s how SecureGlobalPat streamlines the approval and underwriting process:

- We request the right documentation upfront to reduce back-and-forth delays.

- Match merchants with acquiring banks that support their industry and business model.

- Set realistic expectations on pricing, reserves, and volume limits.

- Provide guidance during underwriting to explain anomalies and mitigate risk.

- Proactively monitor account health after approval and flag potential issues before they escalate.

- Support merchants through growth, product launches, and business model changes.

With the right preparation and the right partner, even high-risk merchants can build stable and scalable payment-processing relationships.

Apply for a high-risk merchant account with SecureGlobalPay and get guidance from our experienced payment experts.

FAQs

Payment facilitators (PayFacs) use a streamlined underwriting model that relies heavily on automated checks, predefined risk rules, and ongoing monitoring rather than deep upfront reviews. Most accounts are approved instantly or near-instantly, with underwriting and risk assessment occurring later, often continuously as transactions occur.

For high-risk businesses, this often means approvals can be reversed quickly if chargebacks, fraud, or policy violations appear. Because PayFacs assume operational risk and must protect their sponsoring banks, they are more likely to impose sudden holds, reserves, or account terminations when risk increases.

Businesses are categorized as high-risk based on industry, business model, billing structure, transaction behavior, or regulatory exposure — not because of misconduct. Common triggers include subscriptions, high-ticket sales, cross-border transactions, digital goods, or elevated dispute risk.

High-risk merchant account underwriting typically takes anywhere from 2-10 days, depending on business complexity, industry, and documentation quality. Delays usually come from missing documents, unclear business models, or required website changes.

Not necessarily. However, high-risk accounts can initially have longer settlement times or delayed payouts to reduce exposure to refunds and chargebacks. This can include funding delays, rolling reserves, or split settlements. However, this depends on multiple factors, and standard funding typically takes 2-3 business days.

Yes. International and offshore merchants typically face additional scrutiny due to cross-border risk, regulatory complexity, and higher fraud exposure. Underwriters may require extra documentation, local licensing, or enhanced monitoring. Approval is still possible, but timelines are often longer, and terms may include higher reserves or stricter volume limits.

Transaction underwriting is the ongoing, real-time evaluation of transactions and account behavior after a merchant is live. It looks for fraud patterns, abnormal activity, policy violations, or sudden changes in risk. When thresholds are crossed, merchants face delayed settlements, transaction declines, or account reviews.

Improving chargeback percentages can significantly reduce risk, but it does not necessarily remove a high-risk classification. Consistently low dispute ratios, transparent operations, and stable processing can lead to better terms, reduced reserves, or reclassification during periodic reviews.