Echeck vs ACH vs Wire Transfer: Comparing Cost, Speed, Limits, and Use Cases

Choosing the right way to move money can save your business time, fees, and a lot of headaches. ACH payments, eChecks, and wire transfers all let you send funds electronically, but each one works differently and is better suited for certain situations.

QUICK TAKEAWAYS

- ACH and eChecks are the most affordable options for recurring billing, invoicing, and everyday business payments.

- Wire transfers are the fastest and most final method (hard to reverse), making them ideal for urgent or high-value transactions.

- SecureGlobalPay helps businesses — especially high-risk ones — add ACH and eCheck processing to reduce costs and support high-ticket payments.

In this quick comparison guide, we’ll break down how each method works, its pros and cons, and when to use it.

These are all electronic fund transfers (EFTs)

EChecks, ACH payments, and wire transfers all fall under the broader category of electronic fund transfers (EFTs). An EFT is simply any transfer of money that happens electronically rather than through paper checks or cash. The difference lies in how each transfer is processed, how fast the funds move, the cost involved, and the level of security or reversibility.

EChecks and ACH payments both move through the ACH Network, while wire transfers move through banks or specialized wire systems. Understanding their differences helps you choose the right method for each business need.

How does an eCheck work?

An eCheck (electronic check) is the digital version of a paper check. Instead of writing and depositing a physical check, the customer authorizes payment electronically, and your payment processor pulls the funds directly from their checking account.

How eChecks work:

- The customer provides bank routing and account numbers.

- They authorize the transaction (online form, signed agreement, phone authorization, etc.).

- Your processor submits the payment through the ACH Network.

- The funds clear and settle — usually in 3–5 business days.

Popular use cases: Memberships and subscriptions, rent payments, professional services (legal, consulting, healthcare), high-ticket purchases where credit card fees would be too expensive, B2B invoices.

Advantages of using eChecks:

- Lower processing costs compared to credit cards.

- Good for recurring payments, memberships, and invoicing.

- Easy to authorize and collect remotely.

- Works well for high-ticket transactions.

Disadvantages of using eChecks:

- Slower processing compared to wire transfers.

- Transfers can be reversed due to insufficient funds or disputes.

- Not ideal for urgent or time-sensitive payments.

How do ACH payments work?

ACH payments move money through the ACH Network, the same system used for eChecks. The difference is that ACH is the broader category — and eChecks are just one specific type of ACH transaction.

With ACH, funds move in batches rather than individually. Banks send and receive these batches several times per business day. This makes ACH efficient and inexpensive, especially for recurring or predictable payments.

How ACH transfers work:

- The sender authorizes the payment (business or consumer).

- The bank or payment processor submits the transaction to the ACH Network.

- The receiving bank accepts the funds.

- Settlement typically occurs in 3-5 business days, depending on the type of ACH transfer used (debit, credit, or same-day/next-day ACH).

Popular use cases: Payroll and direct deposit, business bill payments, B2B vendor payments, online purchases, continuity subscriptions, government benefits, and tax refunds.

Advantages of using ACH:

- Very low transaction fees compared to cards and wires.

- Fast enough for everyday business payments.

- Supports recurring billing for subscriptions and invoices.

- Highly reliable and widely supported by U.S. banks.

Disadvantages of using ACH:

- Not instant — settlement still takes 3-5 days.

- Transactions can be reversed due to insufficient funds, errors, or disputes.

- Primarily used domestically, within the United States.

How does a wire transfer work?

A wire transfer moves funds directly from one bank to another. Because wires are handled one at a time and verified by each institution, they’re typically used for large, time-sensitive, or high-security transactions.

Wire transfers can be sent domestically or internationally, and funds often arrive the same day (sometimes within minutes), depending on cutoff times and the banks involved.

How wire transfers work:

- The sender provides the recipient’s bank information (routing number, account number, or SWIFT code for international wires).

- The sending bank verifies funds and initiates the transfer.

- Funds are sent directly to the receiving bank through a wire network.

- The receiving bank releases the money — often the same day for domestic wires.

Popular use cases: Real estate closings, urgent or high-value B2B payments, international payments, large one-time purchases, financial transactions that must settle the same day.

Advantages of using wire transfers:

- Fastest transfer method for large or urgent payments.

- Funds are typically final once received.

- Works globally, unlike ACH and eChecks.

- Suitable for high-value transactions.

Disadvantages of using wire transfers:

- Higher fees for both the sender and sometimes the receiver.

- Not ideal for recurring payments.

- Limited reversibility — once a wire is sent, it’s usually final.

- As banks only process wire transfers during certain hours of the business day, cutoff times can affect same-day processing.

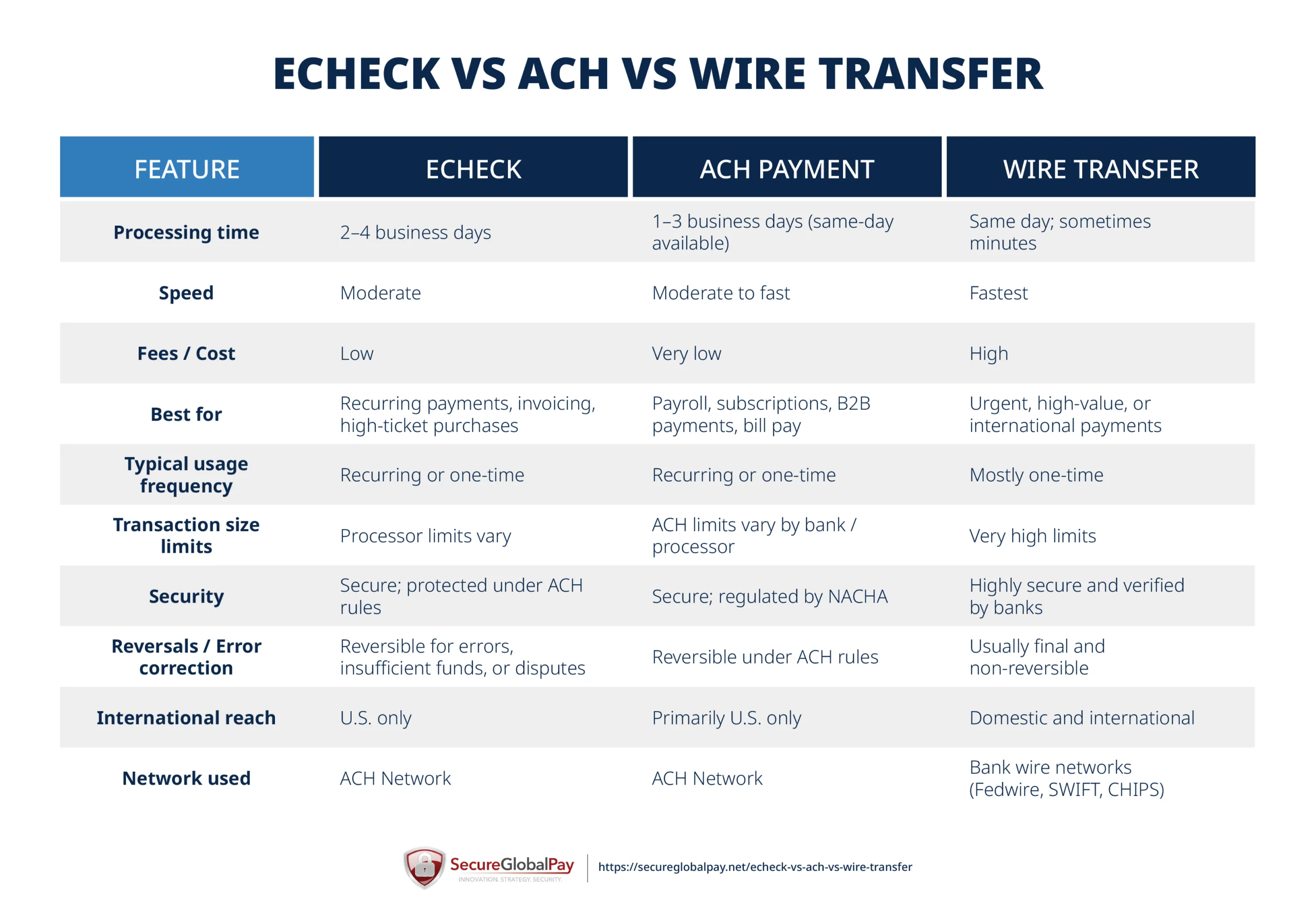

Echeck vs ACH vs wire transfer: Side-by-side comparison

All three methods move money electronically, but they’re built for different needs. ACH payments and eChecks are great for everyday business transactions — especially recurring or high-volume payments — while wire transfers are best for large, urgent, or international transfers.

The table below breaks down the main differences.

Can high-risk merchants use eChecks, ACH, and wire transfers?

While high-risk merchants can use all three payment methods, banks and processors manage these accounts more carefully.

Because high-risk business industries see more chargebacks, higher average ticket sizes, and more fraud attempts, providers usually start merchants with lower transaction limits and increase them as they build a solid processing history.

eChecks for high-risk merchants

High-risk eChecks are often the most flexible option for high-risk industries because they have lower fees than credit cards and support larger invoice amounts.

Typical starting limits:

- $500–$5,000 per transaction

- Daily caps between $2,500–$10,000

After a stable processing history, limits may increase to $10,000–$50,000+ per transaction.

ACH for high-risk merchants

High-risk ACH processing is possible, but providers watch these accounts closely because ACH debits can be reversed if a customer disputes the payment or has insufficient funds.

Typical starting limits:

- $2,000–$10,000 per transaction

- Lower limits for ACH debits, higher for ACH credits

- Same-Day ACH still has a network cap of $1 million, but high-risk merchants rarely start near it.

Again, as merchants maintain low return rates, processors may gradually increase their limits.

Wire transfers for high-risk merchants

Wire transfers have the highest limits and are the easiest to access because wires are fast, secure, and generally final once sent.

Typical ranges:

- $50,000–$500,000+ per wire, depending on the bank

- Multi-million-dollar wires are possible with additional verification

- Domestic and international wires are both supported.

Processors like SecureGlobalPay specialize in onboarding high-risk merchants and helping them access these — and many other payment methods — safely and cost-effectively.

Accept and process ACH and eChecks with SecureGlobalPay

SecureGlobalPay (SGP) is a full-service merchant services provider that helps businesses — including high-risk merchants — seamlessly and securely accept low-cost, bank-based payments like eChecks and ACH transfers.

Here’s what SecureGlobalPay provides:

- Fast onboarding for both standard and high-risk merchants.

- Low ACH and eCheck processing fees that reduce overall payment costs.

- Flexible transaction limits that can grow as your business scales.

- Recurring billing tools for subscriptions, memberships, and invoicing.

- A modern payment gateway with robust risk management that helps keep returns and disputes under control.

- Over 200 integrations with popular shopping carts, ecommerce platforms, CRMs, billing platforms, and chargeback management tools.

- Ability to combine ACH/eCheck with domestic and international card processing under one provider.

- U.S.-based support from industry veterans who understand complex merchant categories.

Merchants that want to streamline payments and reduce processing costs can start by completing our simple online application.

FAQs

No. An eCheck is not a wire transfer. Both are electronic, but they work through completely different systems. An eCheck is processed through the ACH Network, while a wire transfer moves money directly from bank to bank.

An eCheck is actually a type of ACH payment. Think of ACH as the broader category — the entire network that moves bank-to-bank transfers. An eCheck is simply a digital version of a paper check that gets processed through that network.

An ACH transfer moves money through the Automated Clearing House Network, where transactions are batched and processed several times throughout the day. This makes ACH slower but very cost-effective, with settlement usually taking 1–3 business days. ACH transfers can also be reversed in certain situations, such as errors, disputes, or insufficient funds.

A wire transfer, on the other hand, sends money directly from one bank to another in real time, which is why wires usually arrive the same day and are considered final once sent. They cost more, but they’re ideal for urgent, high-value, or international payments where speed and payment certainty matter.

A wire transfer is faster than an ACH payment. Wires are processed individually and typically arrive the same day — sometimes within hours — depending on bank cutoff times. ACH generally takes 1–3 business days to settle, unless you use Same-Day ACH, which is still slower than a wire.

Not exactly. ACH is the network that moves many types of bank-to-bank payments. An eCheck is the digital version of a paper check and is processed through the ACH Network, but ACH itself covers much more than check-style payments.

Both methods are secure, but in different ways. eChecks are protected under NACHA rules, bank-level encryption, and strict authorization requirements — but they can still be reversed if there’s an error or if the customer disputes the charge.

In contrast, wire transfers are generally final once sent. This reduces the risk of chargebacks, but you might not be able to get your money back if you accidentally send it to the wrong recipient.

SecureGlobalPay supports a wide range of EFT options, including eChecks, ACH payments, and traditional credit and debit card processing. Merchants can accept one-time or recurring ACH debits, process eChecks for high-ticket invoices, and combine bank-based payments with card payments under a single provider.