How to Implement a Merchant Surcharge Program

In 2022 alone, US merchants paid a record 161 billion in processing fees. As the number of credit card purchases continues to increase, it’s unsurprising to see more and more merchants implementing surcharge programs in an effort to lower their processing costs.

Currently, it is estimated that 5-10% of US businesses who already accept credit cards have a merchant surcharge program, and about 15% of new merchants are starting with a surcharge policy out of the gate.

If you are considering implementing a surcharge program yourself, here is everything you need to know to get started.

What is a surcharge program?

A surcharge program is a way for merchants to pass along credit card processing fees to their customers. When a customer opts to pay with a credit card, a surcharge, typically ranging between 1% and 4% (based on the cost of processing the payment), is added to the total purchase amount.

Surcharges are not universally applicable. You can only add it to purchases made with a credit card — it is illegal to add an extra charge to debit card, cash, or check transactions to cover processing costs. Furthermore, the application of surcharges also depends on local laws and the regulations set by credit card companies, which can stipulate when and how merchants can apply these additional charges.

In general, businesses with high transaction volumes or higher average transaction amounts stand to benefit the most from implementing a merchant surcharge program:

- Retail stores: Especially those with slim margins where credit card fees can eat into profits.

- Service providers: Like legal and medical practices, where services often carry higher price tags.

- Hospitality and food services: Restaurants, bars, and hotels, where the added surcharge can be a small percentage of the overall bill while helping combat thin margins.

- E-commerce platforms: Online stores can use surcharges to offset the high costs of digital payment processing fees.

- High-risk merchants: Businesses that are considered high risk will have higher processing costs, making the surcharging a very appealing option.

It’s crucial for any business considering a surcharge program to weigh the potential impact on customer satisfaction. Transparent communication about why surcharges are applied and providing alternative payment options can help mitigate any negative perceptions.

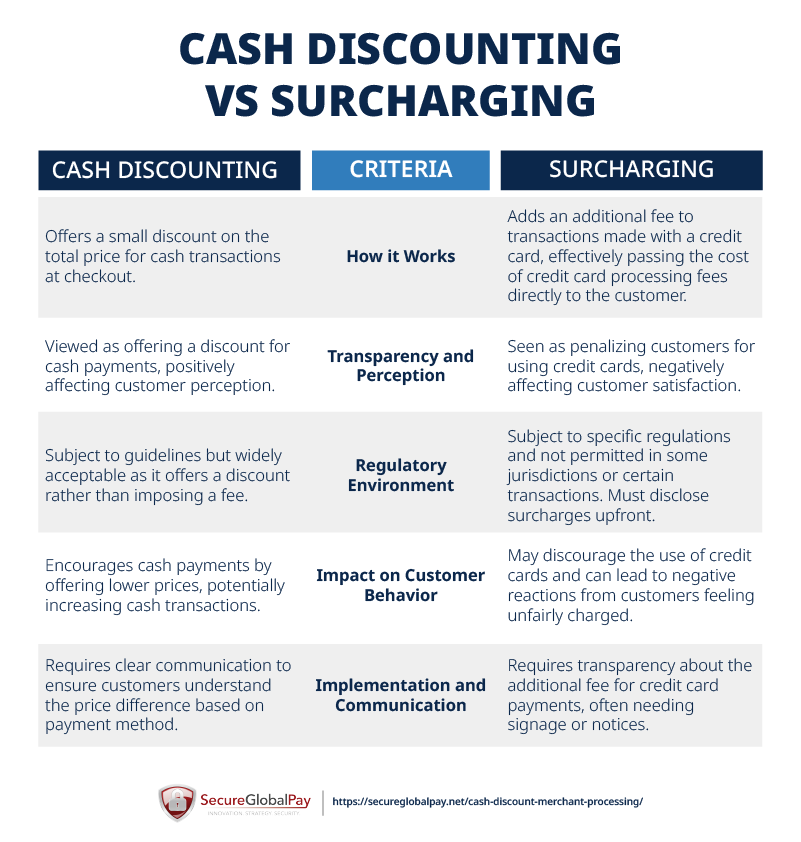

The difference between surcharging and cash discounting

While both surcharging and cash discounting help merchants lower card processing costs, they operate on fundamentally different principles. Understanding these differences is key to choosing the right approach for your business:

- Surcharging: Ads an additional fee to transactions when customers choose to pay with a credit card. The surcharge, typically a percentage of the sale amount, directly covers the cost of credit card processing fees.

- Cash discounting: Rewards customers for paying with cash or check instead of a credit card. Here, the listed prices assume a card payment, and a discount is applied for non-card payments.

Imagine you own a bookstore. The sticker price on a book is $20, which includes the cost you incur for credit card processing.

- With surcharging: A customer choosing to pay with a credit card would be charged an additional fee, say 2%, making their total $20.40.

With cash discounting: The sticker price remains at $20 for credit card users, but a customer paying with cash gets a 2% discount, paying $19.60 for the same book.

While both methods essentially have the same goal, they send different messages. Surcharging can be seen as a way to pass processing fees to those who choose the convenience of credit cards, while cash discounting appears as a reward for those who pay with cash.

To learn more about the latter, check our full guide on implementing a cash discount program.

Rules and regulations around surcharging

Implementing a surcharge program isn’t as straightforward as deciding to add extra fees to credit card transactions. Various rules, regulations, and legal considerations must be navigated to ensure that your surcharge program is compliant and fair.

Legality

The legality of surcharging varies significantly depending on where your business is located. The practice is legal in most of the US, with the following exceptions:

- Connecticut

- Maine

- Massachusetts

- Puerto Rico

- New York (as currently interpreted)

The rules can change so it’s crucial to check your state’s current regulations before proceeding. Additionally, keep in mind that international laws can differ, with some countries having stricter rules around surcharging.

Credit card surcharge program rules and fees

Credit card networks like Visa, MasterCard, Discover, and American Express have specific guidelines for merchants who wish to implement surcharges. Common rules across these networks include:

- Notification: Merchants must notify the credit card network and their payment processor at least 30 days before beginning to surcharge.

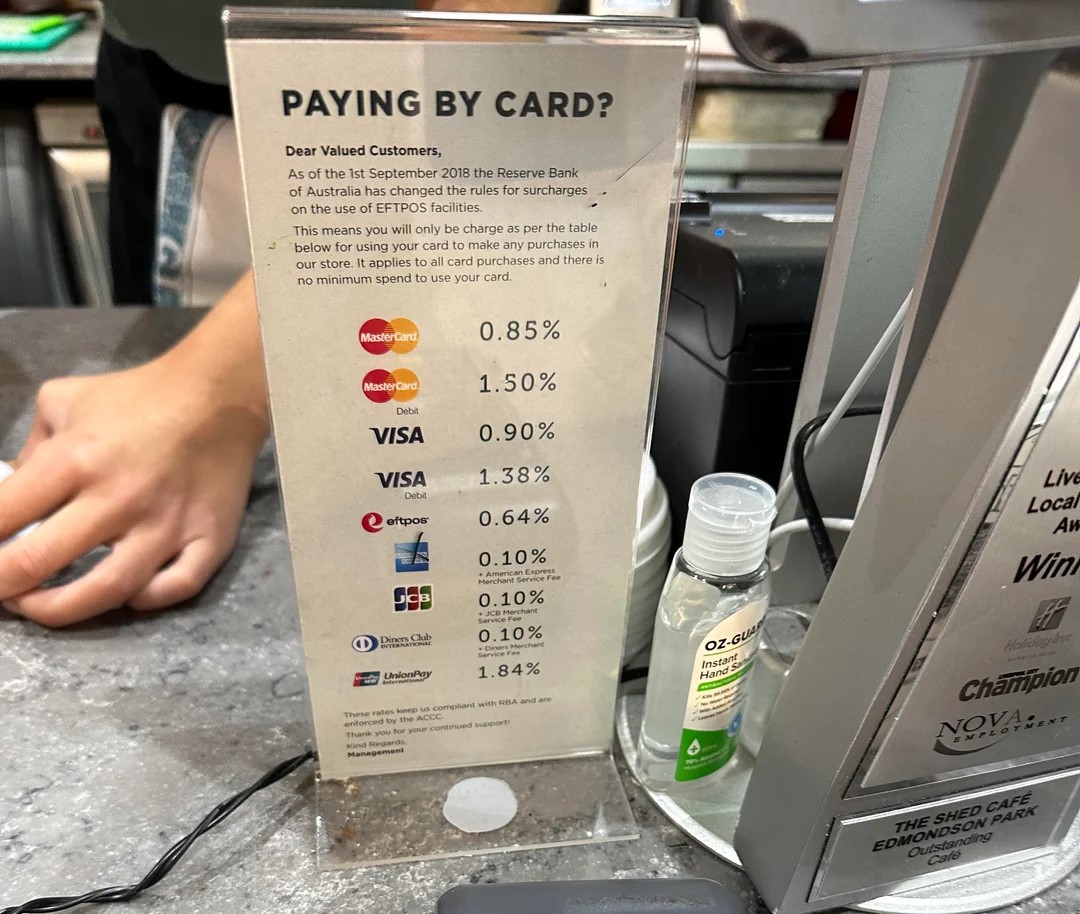

- Transparency: Surcharges must be clearly communicated to customers both at the point of entry and at the point of sale.

- Fee limitations: The surcharge amount cannot exceed the merchant’s actual cost of processing the credit card payment, and it is capped at 4%. The exact rate can depend on several factors, including the merchant’s processing agreement and the credit card network’s regulations.

- Equality: Merchants are not allowed to discriminate between different issuers or card types — the same surcharge must apply to all transactions of a similar nature.

We also recommend maintaining detailed records of surcharge practices and amounts for potential review by credit card networks or regulatory bodies.

Pros and cons of starting a surcharge program

If you’ve read the whole article, the benefits of starting a surcharge program are quite obvious:

- Huge cost savings that lead to higher revenue and better cash flow.

- Higher pricing transparency that informs customers about financial realities you face as a merchant.

- Encourages customers to use less costly payment methods — such as cash, debit cards, or ACH transfers — further reducing overall transaction costs.

That said, surcharging comes with real downsides as well:

- Customer pushback: Customers that prefer using credit cards may view surcharges as a penalty, potentially leading dissatisfaction and to a loss of business.

- Competitive disadvantage: If competitors do not implement surcharge programs, they may appear more attractive to price-sensitive customers.

- Regulatory and compliance requirements: Navigating the legal and regulatory requirements of implementing a surcharge program can be complex and time-consuming. Failure to comply with these regulations can result in fines or legal challenges.

- Administrative burden: Implementing a merchant surcharge program requires adjustments to pricing, payment processing systems, and staff training to ensure compliance and effective customer communication. This administrative burden can be significant, especially for small businesses.

Before finalizing your decision take time to consider your specific business model, customer base, and competitive landscape.

Steps for implementing a merchant surcharge program

Implementing a surcharge program requires careful planning, clear communication, and adherence to regulations. Here’s a step-by-step guide to help you set up a surcharge program that complies with legal and credit card network requirements, while also considering your customers’ experience.

Step 1: Understand the legal requirements

Before anything else, verify the legality of surcharging in your jurisdiction. This involves understanding both state laws and regulations in the countries where you operate, as these can significantly impact your ability to add surcharges.

Step 2: Notify your credit card processor and networks

You must inform your credit card processor and the networks of your intent to start surcharging. This typically requires a written notice 30 days before implementing the surcharge. Each credit card network has its own notification process, so you’ll need to contact them individually.

Step 3: Determine the surcharge amount

Decide on the surcharge level, ensuring it does not exceed the maximum allowed by law or the actual cost of processing, whichever is lower. This rate often falls between 1% and 4%. It’s crucial to calculate this carefully to comply with regulations and maintain fairness to customers.

Step 4: Update your payment systems

Modify your payment processing systems to automatically apply the surcharge to credit card transactions. This may involve software updates or changes to your point-of-sale (POS) system to ensure accurate surcharge calculations and clear disclosure on receipts.

Step 5: Train your staff

Your team should understand the surcharge program and be able to explain it to customers. This includes knowing the surcharge amount, why it’s being implemented, and how it will be applied to transactions. Training ensures consistent communication and helps prevent misunderstandings at the point of sale.

Step 6: Communicate with customers

Transparency is key. Clearly communicate your surcharge policy to customers before they make a payment. This can be done through signage at the entrance and at the point of sale, as well as verbally by staff. It’s also a good idea to explain the surcharge on your website and in any pre-purchase materials.

Step 7: Monitor and adjust

After implementing the surcharge, monitor customer feedback and sales data closely. Be prepared to adjust your strategy if you notice a significant impact on customer satisfaction or spending behavior.

You’ll also want to keep up with state laws and credit card network rules to ensure ongoing compliance with potential changes in legislation or network policies.

Start saving today with SecureGlobalPay’s simple surcharge program

If you’ve decided to start a surcharge program, SecureGlobalPay has everything you need to make the implementation as frictionless as possible:

- Dedicated account managers that will guide your throughout the whole process — from equipment and signage setup to talking with card networks

- A free POS equipment that is ready to securely process surcharged transactions

- No long-term contracts or commitments

- The ability to cancel your merchant account without closure fees

We’ve been helping businesses accept and process payments for more than 20 years. Any problems you might encounter, there’s a good chance we’ve already seen it — and helped solve it.

Learn more by sending a question to partners@secureglobalpay.net or go straight to our merchant application form located below.