Document Preparation Merchant Accounts – A Comprehensive Guide

The document preparation business is a rapidly growing industry as more individuals and businesses require professional assistance in completing complex paperwork, such as legal forms, tax documents, and loan applications. As a document preparation service provider, it is crucial to have a reliable payment processing system in place. Document preparation merchant accounts are considered high risk and finding a reliable document preparation payment processing solution is key to a merchants success.

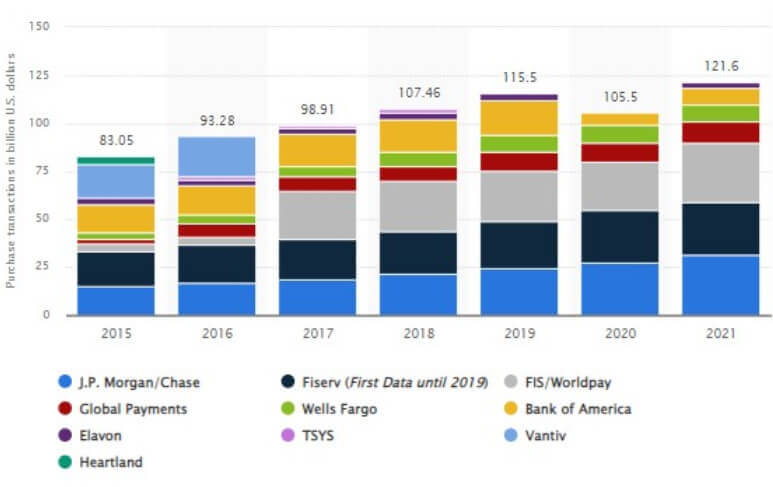

Image: US Merchant Acquirers (Statista.com)

This blog post will delve into the importance of document preparation merchant accounts and answer some frequently asked questions. We will also provide tips for finding the right merchant account provider via some high risk merchant providers reviews.

What is a Document Preparation Merchant Account?

A doc prep merchant account is an online payment gateway explicitly designed for the needs of document preparation service providers. It lets customers pay quickly and securely using their debit/credit cards or digital wallets such as Venmo, Apple Pay, and Google Pay.

Why Do You Need a Document Preparation Merchant Account?

A document preparation merchant account can significantly benefit your business by streamlining payment processes, enhancing client satisfaction, and providing a foundation for growth.

Diverse payment options

A document prep merchant account enables your business to accept various payment methods, including credit cards, debit cards, and online transactions. Offering diverse payment options makes it convenient for your clients to pay for your services and increases the likelihood of repeat business.

Improved cash flow

By accepting electronic and credit card payments through your merchant account, you can shorten the credit card processing time and enhance your business’s cash flow. Faster payment processing means you’ll have quicker access to funds, which can be critical for meeting operational expenses and investing in your business’s growth.

Enhanced security

Credit card processing account providers offer advanced security features to protect sensitive financial information and reduce the risk of fraud. By using a document preparation merchant account, you can assure your clients that their financial data is secure, which builds trust and credibility for your business.

Better customer experiences

A seamless and secure payment process is essential for providing a positive customer experience. With a document preparation merchant account, you can offer your clients a hassle-free payment process, making it more likely that they’ll recommend your services to others.

Access to high-risk merchant services

As a document preparation business, you may be classified as high-risk due to the potential for chargebacks and fraud. By partnering with a provider specializing in high-risk merchant accounts, you gain access to tailored services, tools, and support designed to address the unique challenges associated with high-risk industries.

Detailed reporting and analytics

A document preparation merchant account often comes with comprehensive reporting and analytics tools that allow you to monitor your business’s financial performance. Analyzing these reports allows you to identify trends, track revenue, and make informed decisions to grow your business.

Scalability

As your document preparation business expands, your merchant account can adapt to accommodate your growing needs. Whether you need multiple merchant accounts payment processing, increased transaction volume for your high volume merchant account, or plan on expanding to new markets, a flexible merchant account will support your business’s growth.

What Supporting Documents are Required for a Document Preparation Merchant Account?

Typically, you need to submit the following documents when applying for a document preparation merchant account:

- A completed application form

- Business license or registration

- Proof of identity (e.g., driver’s license or passport)

- Proof of address (e.g., utility bill)

- Business bank account details

- Processing statements (if applicable)

- Business plan or description of services

- Credit history

- Credit score

Who is the Best Document Preparation Merchant Account Provider?

There is no one-size-fits-all answer to this question, as the best provider depends on your specific business requirements, such as the types of transactions you process, the size of your business, and your target audience. It’s essential to research and compare different providers to determine which offers your business the best combination of services, fees, and customer support.

Are Document Preparation Merchant Accounts Considered High-Risk?

Yes, a document preparation business is often classified as high-risk due to the nature of the services provided and the potential for chargebacks or fraud. This classification may result in higher processing fees, more stringent merchant account underwriting requirements, and the need for a high-risk merchant account.

Despite the diverse nature of services and markets within the high-risk merchant account document preparation sector, traditional financial institutions and payment processors often perceive the industry as high-risk. Several factors contribute to this classification of document preparation businesses as high-risk by payment processors:

Predominantly online operations

Numerous document preparation companies operate primarily online, with remote teams and minimal physical presence. Traditional payment processors view online businesses as riskier due to the challenges in tracing business owners when faced with unwarranted financial risks.

Vulnerability to cyberattacks and data breaches

The increasing prevalence of online hacking and data breaches have made the conventional credit card processor more cautious about partnering with digital businesses, including document preparation. You may be entrusted with clients’ personal and sensitive data as a document preparation company. If you store this information online, you are legally and financially accountable for data breaches or hacking incidents.

Elevated chargeback and dispute rates

Depending on your document preparation business’s target markets, you might face a higher likelihood of chargebacks and payment disputes for your services. The document preparation industry is notorious for having chargeback rates that exceed the standard. This higher incidence of chargebacks and disputes has prompted major payment processors, such as PayPal, Stripe, and Square, to refrain from working with businesses in the document preparation sector. Understanding credit card chargebacks and fraud is of utmost importance.

Document Preparation Merchant Accounts FAQs

What is document preparation payment processing?

Document preparation payment processing refers to accepting credit card payments and managing client payments for document preparation services. This involves setting up a merchant account for various payment methods, such as credit card transactions or electronic funds transfers.

Where do I apply for document preparation merchant processing?

You can apply for document preparation merchant account services through various providers, such as banks, payment processors, or specialized high-risk merchant account providers. Be sure to compare the services, fees, and requirements of different providers before making a decision.

How do I get approved for a merchant account for document preparation?

To get approved for a merchant account, you must submit a complete application along with the required supporting documents. It’s essential to have a solid business plan, a clean processing history (if applicable), and strong financials to increase your chances of approval.

What is considered document preparation merchant services?

Document preparation merchant services include payment processing solutions, customer support, fraud prevention tools, and reporting tools designed specifically for document preparation businesses. These services enable your business to accept and manage payments securely and efficiently.

Do I need a high-risk merchant account for document preparation?

Yes, document preparation businesses are typically considered high-risk, so you may need a high-risk merchant account to process payments. High-risk merchant accounts often come with specialized services and support to address the unique challenges associated with high-risk industries.

How do I become a document preparation merchant?

To become a document preparation merchant, you will need to:

- Establish your business by obtaining the necessary licenses and registrations

- Set up a business bank account

- Create a business plan and define your target audience

- Apply for a document preparation merchant account and submit the required documentation

- Develop a website and marketing strategy to promote your services

- Ensure compliance with all relevant regulations and industry standards

- Build a strong reputation by delivering high-quality, professional document preparation services to your client’s

Final Words – SecureGlobalPay

Setting up a document preparation merchant account is crucial for any business in this industry. It enables you to accept various payment methods and helps establish credibility and trust with your clients. To become a successful document preparation merchant, it’s essential to research and select the right payment processing provider, maintain compliance with industry regulations, and focus on delivering excellent service to your clients. Following the steps outlined in this blog post can lay a strong foundation for a thriving document preparation business.

At SecureGlobalPay, we understand the unique challenges of document preparation merchants and are here to help. We offer a range of payment processing solutions tailored specifically for document preparation businesses, with advanced fraud prevention tools, reliable customer support, and competitive pricing. Contact us today to learn more about our services. We look forward to working with you!